Wabash: Q3 ‘difficult’ as material costs, supplier issues spoil record sales

Despite a 30% increase in net sales from this time last year, Wabash National Corporation saw operating income decrease 38% as production challenges and accounting charges took their toll on the bottom line, the publicly traded trailer giant reported Tuesday.

“The third quarter was a difficult quarter for the company as a whole,” said Brent Yeagy, president and CEO. “All three of our reporting segments faced increasing operating pressures which negatively impacted our financial results. Net sales and operating performance metrics were negatively impacted in the quarter by the strong freight demand market impacting shipments and availability of chassis and other components, as well as a higher commodity cost environment and the continued tight labor market in many of the locations we operate.”

Despite these tough operating environments, Wabash generated quarterly net sales of $553 million, the second highest top-line performance in the company’s 33-year history. The year-over-year growth is primarily attributable to the addition of Supreme and strong market demand in all three segments, Yeagy added.

Additionally, the continued strong market demand has driven Wabash backlog to a new record level of $1.3 billion, an increase of 80% compared to the prior year quarter.

“Trailer and truck body demand has remained strong continuing the trend from the previous quarters and supporting our belief in the growing secular demand in e-commerce and home delivery,” Yeagy said. “We continue to take steps to reduce the margin impact of U.S. tariff policy, raw material inflation, supply base disruptions and a very tight labor market on our business for the remainder of 2018 and into 2019.”

Looking ahead, Yeagy anticipates sequential improvement in the fourth quarter operating results as the company manage the various challenges, and as the core trailer business expects stronger pricing and a more favorable sales mix.

Wabash is maintaining previously stated full-year guidance for 2018 new trailer shipments of 60,000 to 62,000 units.

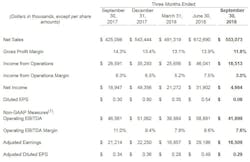

By the numbers, Wabash net income for the third quarter 2018 was $4.7 million, or $0.08 per diluted share, compared to the third quarter 2017 net income of $18.9 million, or $0.30 per diluted share. Third quarter 2018 non-GAAP adjusted earnings were $16.5 million, or $0.29 per diluted share, a $4.7 million decrease compared to the prior year period. Non-GAAP adjusted earnings for the third quarter 2018 excludes a $12 million non-cash impairment charge related to goodwill and long-lived assets in the Diversified Products segment and discrete tax charges incurred related to the deductibility of executive compensation. Non-GAAP adjusted earnings for the third quarter 2017 excludes $8.7 million of one-time acquisition expenses related to the purchase of Supreme and gains realized on the transition of former branch facilities to third-party dealers.

Operating EBITDA, a non-GAAP measure that excludes the effects of certain items, for the third quarter 2018 was $41.9 million, a decrease of $4.7 million compared to operating EBITDA for the prior year period. On a trailing twelve-month basis, net sales totaled $2.2 billion, generating operating EBITDA of $190.8 million, or 8.7 percent of net sales, the company reported.

For additional discussion by Wabash executives and the reaction from investment analysts, see the November print issue of Trailer/Body BUILDERS.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.