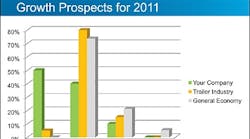

TRAILER manufacturers are very optimistic about the growth prospects for their companies this year. Perhaps too optimistic.

According to a survey conducted in March by RSM McGladrey Inc, 88% are either very optimistic or somewhat optimistic about the growth prospects for their company (49% very optimistic, 39% somewhat). But only 3% are very optimistic about the trailer industry, with 79% being somewhat optimistic.

And things got really fascinating when McGladrey asked those companies how they plan to achieve that growth: 95% are greatly or somewhat relying on the acquisition of new customers.

“How do they get new customers? They're probably taking away the customers of someone else,” said Dale Billet, McGladrey's director of performance improvement consulting.

But hey, at least they're optimistic. When McGladrey conducted the survey a year ago, 8% said they expected a sales decrease. This time around, not one company said it expected a sales decrease. And 89% said they expected a sales increase, compared to 72% a year ago.

In “Looking Back, Moving Forward: Benchmarking and the Economic Outlook for the Trailer Industry,” Billet listed the other ways that companies expect to get a sales increase:

-

85% are greatly or somewhat relying on increased product offerings.

-

90% are greatly or somewhat relying on increased sales to current customers.

-

40% are analyzing customer/product profitability.

-

70% are looking at new geographic markets (including international). “Some are small manufacturers in one geographic region of the US and say they're going to move to another area.”

-

45% are modifying sales strategies.

-

35% are reorganizing or repositioning the sales force on how they sell.

-

35% are reducing the sale price to increase sales and trying to buy market share.

Billet said responses indicated that improved revenue of 30% to 50% was very common in 2010, with many lower end product manufacturers saying 60% to 80%.

Inventory shifts

He said leaner operations continue. Inventory levels are still closely monitored, although levels are increasing.

“That's because prices have gone up,” Billet said. “You may not have any more quantity, but prices have gone up, so you have more dollar value in inventory. And if your product volume has gone up, you probably have to have more inventory to sustain product volume.”

He said employment levels are still depressed because companies don't want to hire anybody unless they know this is sustained upturn and the sales volume is going to stay there.

“The concern there is employee fatigue,” he said. “If you've ever been in an operation that runs overtime consistently, productivity at some point goes down and you end up not getting any more out of them than during a normal work week, because of fatigue.

“Benefits are still closely monitored. Health costs are increasing. 401(k) matches are returning. We've had a number of clients that suspended it and we are now seeing some start to reinstate it.

He said there is no significant push towards “green” products, citing 5% of respondents saying they have experienced increased revenue due to “green” products and 50% saying they do not participate in activities labeled as “green.”

“From what I've experienced out there working with manufacturers, I don't see green having much traction,” he said. “Companies don't understand how they can increase profit by green — it's just more of a politically correct marketing term. We have a number of companies in the Elkhart area that have gotten significant dollars from the government because they're in electric types of products, and they're struggling. One company got a lot of dollars and never even opened their doors.”

In terms of materials sourcing, he said inventory levels increased in 2010, more due to pricing pressures than quantities.

“We're seeing more build-to-order,” Billet said. “Manufacturers are trying to get to more rapid-cycle time and more build-to-order.”

Billet said 58% of respondents have no plans to reduce inventory levels in 2011 (same as 2010) and 42% plan to reduce inventory levels by less than 20% (26% in 2010); no respondents plan to reduce inventory levels by greater than 20% (16% in 2010).

“Prices are going up, production is going up, but over 40% said they still plan to reduce inventory,” he said. “I think this is a lesson learned from the recession — that we can do a better job of managing inventory and sustaining a higher level of production.”

Cost structure matters: Only 10% said they would reduce energy costs; no one expected raw materials to be reduced or stay the same, with 60% expecting an increase of more than 5%; 75% expected operating labor to increase by 1% to 5%; 85% expected an increase in outbound freight; 50% expected no change in administrative costs or inventory-carrying costs.

Workforce plans: Less than 20% expected no change in head count, with 61% saying it will increase by 1% to 9%; 8% are freezing pay, 22% are deferring increases, but no one is reducing pay or benefits, “so that's a change from what we have seen in the past couple of years,” Billet said.

Health-care questions

Health benefits remain a large component of a company's cost structure, with the majority of respondents fully insured and several respondents not offering health benefits. He said 40% of respondents see no change in 2011.

“I saw that and thought, ‘Wow, who are they with? I want that carrier,’” he said. “They may be saying, 'I don't expect an increase because I'm passing that on, so my costs aren't going to increase. It's hard for me to believe 40% of respondents actually said, ‘My health care costs are not going up.’”

He said 30% of respondents see a 5% to 14% increase in 2011, and 30% see a 15% or more increase. Eighteen percent are offering health savings accounts, 12% are offering wellness programs, 18% are changing carriers, 58% are passing it on to employees, and 29% see no change.

In 2010, 32% said their projected gross margin would be between 10% and 19%, but now 47% are expecting that for 2011 and 53% for 2012.

Other results:

- 50% of respondents do not plan to change current operations.

- 15% are planning to consolidate operations.

- 5% are planning to reduce capacity, while 30% are expanding capacity.

- 75% are very or somewhat concerned about health care reform.

- 65% are very or somewhat concerned about the Employee Free Choice Act.

- 70% are very or somewhat concerned about Cap and Trade.

- 85% are very or somewhat concerned about the energy policy and other regulatory matters.

Billet said aluminum prices hit a 27-month high at the end of December. There is a forecasted demand growth of 8% to 10% in 2011, with several industry analysts predicting an aluminum-price increase of 4% to 8%.

Steel-price forecasts for 2011 are not good: a 32% increase by Financial Times (16 industry experts); a 41% increase by Credit Suisse (global company's industry analysts); and a 13% to 25% increase by India's top three steel producers.

Billet said inventory control is typically a problem for most companies. Material typically accounts for 60% of product costs and is the largest portion of the current assets of most companies.

“High inventory levels mask other problems,” he said. “The cost of inventory is much higher than typically understood.”

What is the cost of carrying inventory? He said interest and opportunity cost account for 10% to 15%; handling and storage (people and space), 4-8%; damage and shrinkage, taxes and insurance, and redistribution cost (in the wrong location), 3-6%; transactions (counting, moving, planning, issuing, reconciling), 5-10%; general and administrative staff (managers, planners, physical management), 5-7%.

“The total per year to hold that inventory is 27% to 46%,” he said. “It's staggering to most manufacturers.”

He gave an example of a real-life client: The company had an average inventory of $15 million and five inventory turns. The annual cost of carrying that inventory ranged between $4 million and $6.9 million. If the turns were increased by one, that would be an annual savings of $675,000 to $1.15 million and a one-time cash savings of $2.5 million.

What are the purchasing strategies, policies, and measurements? Do you balance inventory-carrying costs against projected price increases to determine purchase quantity? How do you determine safety stock levels?

He gave an example: You're buying a commodity and the commodity prices are expected to rise 12% during the year, with annual inventory-carrying costs of 24%.

“The typical reaction to rising prices is to purchase larger quantities to hedge against the increase,” he said. “If your inventory-carrying costs are greater than expected price increases, purchase the smallest quantities feasible. You should be buying less.”