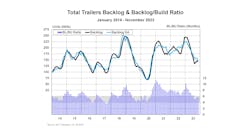

THE concern now isn't whether the trailer market will recover. It's whether trailer manufacturers will be able to keep up with the recovery.

“It's going to be a fun ride, I can tell you that,” FTR Associates president Eric Starks said. “It's already starting to be a fun ride. I'm hearing complaints, but it's a complaint with a grin on your face. People are grumbling because they can't get the product. I think this is a situation we can all take any time of the day, rather than what we were seeing in 2008 and 2009.”

“Can we do 257% growth?” he said. “The increase between 2002 and 2006 was only 110%. We are way above that already. I looked at what they did in the early '80s, because this is a very similar situation, and we saw something in the 150% range — not the 250% range.”

Starks said future demand conditions are starting to show increases, which is putting upward pressure on the trailer forecast.

“The economy is starting to improve, and trucking productivity is being affected by regulatory activity,” he said. “Hours of Service will have the most dramatic impact. The data suggest we will continue to have a deficiency of drivers though 2014. That's problematic. If we look at what happened in 2004, we saw a huge jump in the shortage of drivers. We continued to see problems in 2005, and by 2006 we got back to equilibrium. But this will be a major headache for fleets.

“What does this mean for you? It means more drop-and-hook. And that is a very good thing for this industry because it means fleets will have to buy more equipment. I think we already have seen that some of that has happened. Fleets need to keep drivers productive. The best way is for drivers to drop a load and keep moving. I think the impact of Hours of Service would amount to another 150,000 trucks on the road to move the same amount of freight.”

He said that with the enactment of CSA (Compliance, Safety, Accountability), shippers are looking to protect themselves from lawsuits.

“Shippers are forcing fleets to clean up their systems, to get better drivers, to get rid of questionable drivers, to maintain equipment,” he said. “Fleets are looking to you guys to make sure they have the most up-to-date equipment. I'm going to guess we will see continued acceleration in aftermarket parts because they can't afford to take that hit on their scoring system.

“Electronic on-board recorders will be a big issue over the next three or four years, along with mpg standards. New trucks will need to be more fuel-efficient. The effect of the federal fuel economy standard in 2014 is likely to be fairly muted, with a 10% to 20% reduction in fuel consumption by 2018. The likelihood they can do that without the trailer being part of the solution is not good. They didn't have trailers in the proposal because they said, ‘We don't know trailers. We don't understand trailers.’ For me, it does suggest they have left the door open that they will have trailers as part of the solution.”

Taking a deeper look

He detailed some trucking issues:

-

Many of the publically traded carriers are still showing strong balance sheets.

-

Access to capital continues to be a problem for the small and medium-size fleets. “They're saying, ‘I want to refinance. I'm not willing to buy equipment, yet but I am willing to refinance equipment so I have the opportunity to buy in the future.’ That's something new that's happening in the last several months.”

-

Fleets are concerned about rising costs. “They're going to have to manage their business better than they had to in the previous year.”

-

Carriers are replacing equipment at an accelerated pace, “and that's good.”

He said the FTR Trucking Conditions Index has accelerated, and “this starts to look like a 2004 type of year. 2004 was kind of a pivotal turning point for the industry. Things were very good. We're definitely seeing some positives within this trucking environment over balance of this year.”

“Freight is starting to improve at a modest pace,” he added. “Its' not rip-roaring, but by and large, it's moving the right way. When we look at overall growth over the next several years, we're going to see something in the ballpark of 4% to 5% growth. That's pretty healthy. Is it enough to see us get back from the deep recession of 2009? No, it's not. We don't get back to peak levels that we saw in 2006 until 2013. It's still one of those things where we're not going to get there this year or next year. We have to remember that.”

Starks said the trailer fleet continues to age, moving from 7.1 years in 2006 to 7.4 in 2008 and 8.2 in 2010. Projections are for it to go to an all-time high this year before falling to 7.9 in 2012, 7.7 in 2013 and 7.5 in 2014.

He said the active truck utilization percentage — truck fleet in use versus active trucks available — reached 98% in February, increasing from a low of 75% in February 2009. It should be nearly 100% by November.

“Expect shortages of equipment mid-2011,” he said. “Service levels will be a premium as capacity tightens. Fleets cannot afford down time.

“Tightening active capacity is keeping rates higher. Driver shortages will put additional pressure on rates. We could see a 20% to 25% increase for shippers.”

Global outlook

Starks said it's a global commodity market, with global demand for freight transportation growing.

“Globally, we are seeing countries like China invest heavily into their infrastructure,” he said. “And they are eating up the natural resources. We will not run out of natural resources, but the way that those resources are starting to get allocated is changing. So if China has resources and they say, ‘I don't want to give it up; I want to keep it locally,’ they will keep it locally. So the ability to go source things overseas is becoming much more difficult.

“Demand for components outside of North America is going to strain the system through this cycle. It's already putting pressure on the pricing. Now we will have to educate our fleets of why the equipment is so much more expensive. The dynamics have changed.”

As positive as the recovery seems to be — with an 80% probability that the economy will grow at or above trend in 2011 — Starks said he did have to present some issues that would risk him being cast as “Mr Negative.”

At the time of his presentation, oil was trading at $112 a barrel — a far cry from the $84-$90 range he said it should be.

“These rapid movements in fuel prices become a tax on the system,” he said. “All of a sudden, businesses are impacted by the increases in oil prices. So what is the first thing they do? They stop hiring, they stop allocating capital for other resources, they have to put this money toward fuel or toward commodities that contain crude oil products. It's very problematic. Then the consumer says, ‘I was planning on spending the money on something else, and now it goes into gasoline.’

“Same thing for the fleets. They all of a sudden have to pay cash out today and try to recoup that cash by charging a tax fuel surcharge tomorrow. Tomorrow can be a month or more before they are getting paid, and all of a sudden it has the potential to be a crisis situation. When we have these rapid increases in fuel cost, especially for the fleets, which are our customers and are now becoming cash-poor. I'm not concerned about the big guys, and they are ordering lots of equipment. I am most concerned about the small to medium companies.”

He said that inflation is a longer-term structural issue from mid-2012 and on out.

“All commodities prices are increasing through the roof,” he said. “You're sitting there saying, ‘I'm concerned about inflation.’ But in reality, it takes a lot for that commodity price increase for you to move all way down to the consumer. Also, structurally when we look at the debt, it's a longer-term issue. The ability to grow starts to go away.”

Manufacturing in February hit its highest level since May 2004 — a 61 on the Institute for Supply Management (ISM) Index. Anything above 50 suggests manufacturing is expanding. The Index had plunged as low as 32 in January 2009.

The manufacturing portion of the Industrial Production Index released by the Federal Reserve hit 91.1 in February after bottoming out at 81 in May 2009.

The Chicago Fed National Activity Index, which Starks said is “very helpful for us to understand underlying pressure in the economy,” shows the economy growing below trend.

“However, recent monthly data suggest growth is now likely above trend,” he said. “The trend is 3% to 3.5% GDP growth. As this continues to accelerate, we want to avoid a number where inflation becomes a problem.

“In the general economy, things are relatively strong and starting to improve. Payroll employment is strengthening — growing 240,000 in February and 230,000 in March — suggesting a continued recovery.

“Remember, employment is a lagging indicator, not a leading indicator,” Starks said. “We are looking for continued growth in the employment sector. We want to see 250,000 to 300,000 jobs per month to suggest we have good fundamentals and can sustain the recovery. We're not where we'd like to be quite yet.”

New orders at factories have not been consistently higher every month, but the trend has been upward since March 2009.

Business inventories are lean, with the inventory/sales ratio at an all-time low of 1.22.

“The lower the sales ratio, the more pressure there is to move freight,” he said.

Retail sales held up well during the holiday season and don't show signs of slowing, reaching an 8.9% year-over-year change in February.

“Consumers are showing signs of life,” he said. “We didn't see that until the end of last year. But when trying to gauge their behavior, disregard consumer sentiment surveys. They are a terrible gauge of what's happening with the consumer. All that type of survey tells us is what we feel. Look at what the real numbers tell us.”

The picture is not nearly as positive with the housing market, which continues to struggle. Housing starts have stagnated since early 2009, and actually have trended downward since March 2010.

“This is one of the areas that have eluded the economy,” he said. “This year is the hope that housing will start to change. There's only way to go — up. It cannot go any lower. What troubles me is that platform fleets already do not have enough equipment, and this is without housing participating. So I'm very bullish about the platform market in the next few years. We are going to have a shortage of equipment, and that's problematic for fleets. It's good for those of you selling the equipment. Once we do see housing pick up, we might see some additional pressure.”