Peak order season for heavy-duty trailers opened in September, and although net orders in November continued to show relatively healthy bookings, they were softer than the previous two months, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

Unlike the last few years with challenges “solidly on the supply-side of the pendulum,” trailer industry concerns now rest on the demand-side, the report noted.

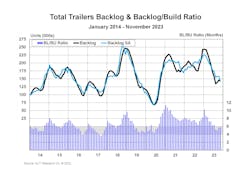

November net orders, at 21,100 units, were 47% lower compared to November 2022 and 14,000 units less than were booked in October.

“With 35% of the year’s orders historically booked in Q4, the quarter’s seasonal factors run roughshod on the nominal data. Seasonally adjusted, November’s orders reduce to 15,700 units. On that basis, orders decreased 40% month-over-month,” said Jennifer McNealy, director–CV market research and publications at ACT Research. “Regarding orders and expectations for 2024, trailer manufacturers reinforced this month what they have been telling us for a while: Negotiations are ongoing, but order placement is at a slower pace than what occurred the past few years.”

As to trailer build, November’s per day build rate decreased 3% to 1,178 from October’s 1,220-unit per day rate, according to ACT Research. Overall, build was more than 12% lower m/m, mostly due to two fewer build days in November.

“Supply-chain issues have essentially normalized, with OEMs reporting smaller, less impactful disruptions,” McNealy said. “Despite being in the third month of the new peak order season, build outpaced orders in November by about 2,500 units. Trailer backlogs contracted 32% against 2022’s supply-chain constrained and pent-up demand heavy environment.”

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.