OEMs are reporting that their orderboards for 2023 are fully open, with most booked through the end of the year—although a few spots are still available in Q4, according to this quarter’s issue of ACT Research’s Trailer Components & Raw Materials Forecast. And some trailer builders are taking orders into 2024, the report noted.

Still, an array of factors have the attention of manufacturers heading into the second half of the year. These include the tightening labor market, slowing demand into 2024, inflation pressuring consumer spending, business investment pressures on carrier profitability, recession risk, material supply availability and cost, and how all these factors are likely to impact dealer confidence, ACT Research notes.

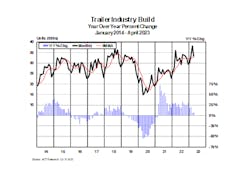

“Build in the last three months (Feb-Apr) of 83,300 units was more than 6% higher than the same three-month period last year, while net orders of 52,600 trailers was about 38% lower for the 2023 period, versus the same three months in 2022,” said Jennifer McNealy, director-CV Market Research & Publications at ACT Research.

Based on the same three-month comparison, backlog of 212,700 units this year was nearly 7% more than the 199,600 units pending production last year, she added.

“During the past six months, trailer manufacturers and major suppliers have largely indicated stable business conditions as compared to each prior month,” McNealy said. “Responses for May, relative to April, were in line with this trend.”

ACT’s US trailer forecasts, as well as its forecast of the components and raw materials needed to manufacture that equipment, is not only based on build, but on an ongoing secular shift and pent-up demand, the market analysis firm states.

“For dry vans, especially, there is a strong case for a secular shift to higher trailer/tractor ratios by big fleets and the creation of trailer pools by mega-brokerages,” Eric Crawford, ACT vice president and senior analyst said. “At its core, this shift stems from a desire to raise productivity and reduce expenses in the brokerage space.”

ACT Research in 2023 forecast elevated build rates and “relatively muted” economic growth will cut into pent-up demand by about 25,000 units, leaving some 32,000 units of pent-up demand entering 2024, he continued.

“That said, we forecast pent-up demand will be more than satiated by year-end 2024, as our 165k dry van build forecast implies an over-build of approximately 13k units,” Crawford said.

ACT Research’s U.S. New Trailer Components & Materials Forecast provides those in the trailer production supply chain, as well as those who invest in said suppliers and commodities, with forecast quantities of components and raw materials required to support the trailer forecast for the coming five years.