Trailer builders in North America soared in 2018, and times were very good in Europe as well. As in North America, a booming equipment market in the EU was tempered by supplier and labor challenges.

And, again, the outlook sounds familiar as the various national economies downgrade near-term growth forecasts: A slowdown in demand for trailers in the region during 2019 is likely to prove correct, according to Gary Beecroft of Clear International Consulting (CLEAR), a firm that specializes in the automotive and transport markets and regularly updates its outlooks for these sectors around the world.

“The downturn I expect in Western Europe will also affect the main trailer producing regions around the globe including North America and Asia,” Beecroft told Trailer/Body BUILDERS. “In South America, Brazil is just recovering from a serious slump in trailer demand, so it will be out of phase with other regions, as will the Middle East and Africa.”

When the books are officially closed on 2018, CLEAR expects an increase in trailer demand of 2.7%. Although six of the 15 West European countries will see small declines in trailer registrations, the remaining nine will see some growth, with the first half of the year having been much stronger than the second.

Nevertheless, CLEAR still expects a 10% fall in trailer demand in 2019 with a wide variation across the countries in the region from +2% to 20%. Often the size in the decline in 2019 will be in proportion to the increase in the market in 2017-18, the report notes.

CLEAR has forecast a cyclical slowdown (but not a recession) in European economies for some years—and the catch-up demand that has been pushing the trailer market is now over, Beecroft adds.

“The trailer park is fully replenished despite the fact that road transport demand has yet to return to 2006 (pre-global financial crisis) levels,” he says. “Furthermore, it is nine years since the decimation of the trailer market in 2009 and the market has never gone 10 years without a slowdown or worse.”

CLEAR also believes it is likely that trailer demand fell in the fourth quarter of 2018 compared with 4Q2017, heralding lower sales in 2019 as a whole. Nine out of 15 markets are currently forecasting lower to close 2018. This scenario is supported by weakening heavy truck demand at the end of 2018.

Beecroft notes, however, that trailer demand reached a very high level in 2018, only rivalled by 2007 and 2008, both these years having had an unnaturally high level of trailer sales largely brought on by the number of countries that joined the EU in 2004-07. “All these factors point to a fall in demand for new trailers,” the CLEAR analysis says. “Fortunately for the industry, the fall will be relatively modest and short-lived.”

So should the industry be panicking over the forecast fall in the market? Arguably not. From 2017-21 trailer registrations are forecast to be higher than any five-year period in history, even though that will include 2019 when demand is forecast weaker. The previous record-breaking five-year period was from 2004 to 2008.

Not only will registrations have set a new record in 2018, but trailer production will achieve the same result, according to the analysis. The industry in Europe is therefore facing both high levels of output and relative stability in a traditionally volatile sector of the vehicle market.

The main changes are that the outlook for trailer registrations for France and the UK have improved, whereas for Spain and Portugal it has declined.

And what about the US market?

“After five very strong years of trailer demand in North America the region is due a slowdown, but it is always possible that the US could buck the global trend and have another good year; but I think a fall in demand is more likely,” Beecroft concludes. “I don’t put too much faith in full order books, as have been reported in the US for 2019. Order books were full in 2008 in Europe but empty by 2009. However, any slowing of demand in 2019 will be nothing like 2009. I expect it to be much less severe and much shorter in duration.”

Tech trends

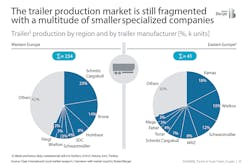

Similarly, in a recent study, “Trends in the truck and trailer market,” global consulting firm Roland Berger reports that European trailer production “is expected to remain rather flat” into the next decade. This comes after the market continuously grew by 5% a year until 2017, driven by Western Europe. Growth through 2030 will be led by Eastern Europe.

The study focuses on the broader trends impacting the commercial vehicle industry into the next decade (a new logistics model, CV electrification, autonomous trucks, and digitalization), and on “region-specific drivers (such as economic growth, modal shifts, emissions challenges and new regulations). The study then gets specific on what these changes will mean to OEMs and their suppliers.

Essentially, the broader trends will not necessarily drive equipment demand much one way or the other, but they do point to lower profitability for traditional products. OEMs and suppliers will need to focus on emerging technologies and the value-add to customers of advanced components (a boon to suppliers, but costly for OEMs) as well as on ways to capitalize on emerging fleet management solutions (a new opportunity for the equipment industry—if existing players can develop these solutions faster than outside service providers).

For truck makers, for example, even as the largest share of value in tractor trucks will remain with powertrain and cabin, connectivity solutions and advanced driver assistance systems (ADAS) are expected to gain importance.

Indeed, market growth of related component systems in Europe is expected to outperform the truck and bus production growth rate: Annual market growth of braking systems: 3.5-4%, powertrain: 7-8%, steering systems: 9-10%, ADAS: 10-12%, according to the study.

For trailers, the Roland Berger analysis of selected components shows a similar pattern: While the largest share of value in a standard trailer today lies in chassis and structural elements, a clear shift toward connectivity systems is expected.

And, amid these shifting dynamics, the market survey identified “a set of key success factors for the truck and trailer market”—and confirmed that some things will not change: Reputation and customer relationship are most important from the customer perspective for both suppliers and OEMs. High product quality and delivery reliability also are important factors; however they are all considered “an obligatory condition” and “a standard qualifier.”

Future is now

Leading European trailer OEMs already are investing in a connected future and adapting products to meet the demands of the modern supply chain.

Germany-based Krone Group, the No. 2 trailer maker in Europe, is planning a “significant” increase in its capacity to produce interchangeable systems and Dry Liners at its Herzlake site in Germany to take advantage of “positive market demand,” the company said.

Managing director Bernhard Brüggen said production output will be doubled to more than 25,000 units in the next 1½ years.

“We have already laid the foundation for this production offensive with the introduction of automatic component production in Herzlake,” Brüggen said. “Our swap body systems and Dry Liners stand for high product quality combined with numerous innovative load-securing solutions and are therefore in high demand on the market, as evidenced, for example, by our market share of around 70% for swap bodies.

“In addition, there is a significant increase in demand, which is also generated by the booming online trade.”

Krone said the production increase is associated with an “investment offensive.” As part of the automation implementation and associated robot production systems, the entire product range is being revised with the goal of increasing quality and maximizing customer benefits.

At the Herzlake site, Krone manufactures steel swap bodies, curtain swap bodies, box semi-trailers and CEP vehicles for courier and express deliveries. The cases are available in a variety of designs, from telescopic support legs and double-deck equipment to roller shutters and more. The curtain boxes, which are available in different lengths and storage heights, as well as with different roof and wall systems, also are flexible and practical, Krone said.

The Dry Liner dry freight boxes, also built in Herzlake, can be used to transport high-quality and moisture-sensitive goods. The Dry Liner is available with side walls made of steel, plywood or carbofont, and various equipment modules also are specifiable for the interior.

Krone also uses a coating system with KTL-plus powder coating.

Cathodic dip painting (KTL) is a dip coating which is applied electrolytically to the metal body and baked at approximately 200 degrees Celsius (392 degrees Farenheit). The coating is then applied to the metal body for “incomparable” corrosion protection. Characteristics of KTL-plus powder vehicles include brilliant shine, high stone impact resistance and protection against rust.

Steel structures up to 16 meters long, 3.2 meters high and 2.6 meters wide can be coated in one piece at the Herzlake production facility. The total area of the plant is around 352,000 square meters (3.79 million square feet).

The Herzlake investment is the latest in a series of forward-looking steps undertaken by the Krone Group, which saw record revenue last year. The company, which employs almost 5,000 people, reported ending the 2017-18 fiscal year with revenue of about 2.1 billion euros ($2.37 billion)—a “significant increase” from the previous year. Krone’s commercial vehicle products make up about 70% of its sales, with the balance going to agricultural machinery. International business accounts for nearly three-quarters of the total.

Bernard Krone, managing partner of the Krone Group, said he’s delighted with the company performance in the 2017-18 fiscal year.

“The repeated increase in sales bears testimony of our successful strategy of positioning ourselves as a provider of ... comprehensive services for commercial trailers and agricultural machines,” he said. “Furthermore, as a medium-sized and family-run enterprise, we benefit from being quick, flexible and innovative. An equity ratio of 47% gives us a solid financial foundation (and) the entrepreneurial leeway to implement further innovations, and hence continue the path of sustained growth.”

He also cited product diversification for offering “exceptional” opportunities around the globe.

“Digitization plays a key role in this context,” Krone said, confirming the Roland Berger analysis. “Already today, Krone provides a wide range of future-oriented solutions for smart farm machines and smart trailers.”

Total investments by the Krone Group in the past fiscal year amounted to $76 million. The highest single investment of about $45.2 million was the new coating center at the Werlte, Germany production site. The Spelle, Germany site implemented various measures to expand its manufacturing and assembly capacities. In addition to investing in modern clamping and quick-swapping systems that reduce set-up times, the division advanced the development of a universal tool management system.

Biggest gets bigger

Europe’s largest trailer builder, Germany-based Schmitz Cargobull, wants to be the world No. 1. And to help it get there, the company is focusing on connectivity and telematics.

“We are experiencing strong growth in our service divisions. With the new generation of our TrailerConnect trailer telematics system, we are already able to offer our customers the infrastructure needed for future communication with data transmitters on transported freight,” said Andreas Schmitz, chairman of the Schmitz Cargobull AG board of management, during the company’s IAA press conference last fall. “This means that our trailers are already ‘digital ready’ and prepared for the future of transport logistics.”

As well as improving the efficiency of production processes, products and value-added services, the company is also looking at new “disruptive” business models, while working with customers to create solutions for digitalizing fleet management and logistics processes. To develop these technologies, the company launched its own tech startup, and acquired another.

For the current financial year, the company plans to produce around 67,000 vehicles and generate revenue of 2.4 billion euro ($2.8 billion).