Key Highlights

- U.S. trailer orders in November dropped 19% month-over-month and 45% year-over-year, indicating weakened demand and deferred fleet replacements.

- Trailer production declined 23% in November, with backlogs shrinking and elevated cancellations, especially in dry van and tank segments due to declining oil/gas activity.

- Trade policies, tariffs, and rising input costs are increasing industry costs and uncertainty, prompting OEMs and fleets to adopt cautious strategies and local sourcing.

- Order volumes remain below normal levels, with fleets delaying discretionary purchases until economic and freight fundamentals improve.

- Industry experts highlight the need for stronger revenues and clearer policy outcomes to stimulate demand and support a recovery in trailer orders.

U.S. trailer net orders weakened in November, falling 19% month-over-month (m/m) to 13,071 units and plunging 45% year-over-year, FTR reported. The decline “highlights the fragility” of demand as October’s seasonal lift proved short-lived rather than the start of a sustained recovery.

“The U.S. trailer market is increasingly constrained by trade policy, elevated input costs, and cautious fleet behavior,” said Dan Moyer, FTR senior analyst, commercial vehicles. “Policy-related actions are now a central driver of both cost inflation and demand uncertainty. Limited visibility on trade outcomes continues to complicate pricing, sourcing, and capital allocation decisions across the industry.”

Order volumes remain well below historical norms, pressured by tariff-driven trailer cost increases, soft freight demand, tight margins, and limited confidence in near-term rate recovery, per FTR. The sharp y/y drop suggests fleets are deferring discretionary replacements deeper into 2026 and possibly 2027. Growth-oriented ordering is “unlikely” until freight fundamentals and fleet profitability materially improve.

For 2025 to date, net trailer orders total 148,862 units, up 7% y/y. However, FTR noted, part of 2025’s y/y gain results from demand early in the year that normally would have occurred in 2024 as many fleets held off until after the November election. A more meaningful comparison period is the 2026 order season. September-November 2025 orders are down a “concerning” 28% y/y.

ACT Research put preliminary net trailer orders in November at 13,000 units, 4,100 units lower than October’s 17,100 level—a 24% month-to-month decrease. November order intake was 37% below last November’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to about 10,500 units. The year-to-date net order total comes to 151.3k units, or 9% more net orders through year-to-date November 2024.

“Looking forward, concerns about moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous government policies remain as challenges to stronger trailer demand,” McNealy concluded. “While pent-up demand is building, and fleets will eventually need to divert capex to trailing equipment purchases deferred over the past few years, stronger revenues will be needed before the purchase spigot is opened wider.”

“Sequentially, a slight dip in net orders is expected, as October is usually the strongest order intake month of the annual cycle, with orderboards for the next year beginning to open,” said Jennifer McNealy, director, CV market research and publications at ACT Research. “Not only do net orders continue to underwhelm, cancellations remain elevated.

“Looking forward, concerns about moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous government policies remain as challenges to stronger trailer demand. While pent-up demand is building, and fleets will eventually need to divert capex to trailing equipment purchases deferred over the past few years, stronger revenues will be needed before the purchase spigot is opened wider.”

Production slides

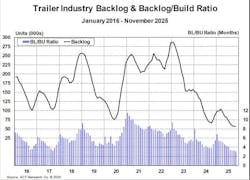

U.S. trailer production finally pulled back in November. Builds dropped 23% m/m—roughly twice the typical seasonal decline—and edged 1% lower y/y to 13,533 units. Despite the pullback, production continues to run ahead of demand as OEMs manage labor levels, fixed-cost absorption, and year-end capacity utilization, FTR noted. As a result, backlogs were down 1% m/m and 23% y/y to 72,697 units, but the backlog/build ratio improved to 5.4 months due to the larger m/m drop in production than in orders. Additional production cuts likely will be needed to prevent further backlog erosion unless the 2026 order season improves meaningfully.

November’s cancellation rate, as a percentage of backlog, was 2.5%, with data continuing to show elevated cancellations in dry van and tank segments, according to ACT Research. The largest level of cancels came from the tank segments, attributed to a decline in oil/gas activity.

“Despite having moved to the historical start of the order season, build again outpaced orders in November. Trailer production was 1,800 units above orders, with backlogs contracting 2% sequentially and 24% compared to the same period in 2024,” McNealy said. “Backlogs and build levels, with five fewer production days in November, conspired to carve a little more off the BL/BU ratio. After two consecutive 3.3-month readings, the BL/BU slipped to 3.1 months in November, which still commits the industry into mid-Q1’26 albeit at a somewhat anemic level.”

The big picture

“Section 232 tariffs remain the industry’s most significant and durable cost headwind, and trade risk is also building around van trailers,” Moyer said. “A U.S. International Trade Commission antidumping and countervailing-duty investigation into van trailers and subassemblies imported from Canada, China, and Mexico adds further uncertainty for cross-border supply chains and pricing dynamics in the high-volume van segment.

“Overall, tariffs and expanding trade actions are locking in higher costs and sustained uncertainty across the U.S. trailer market. OEMs and suppliers likely will respond by prioritizing localized sourcing, tariff-aware design, and flexible pricing. Dealers must manage inventory carefully and set clear expectations as higher price floors constrain demand. For fleets, rising acquisition costs and policy risk favor selective ordering, longer trade cycles, and a sharper focus on total cost of ownership.”

McNealy likewise cited concerns about moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous government policies.

“US trailer constituents’ concerns remain high entering 2026, given the already low BL/BU already on the books, soft demand fundamentals, the impact of tariffs, higher input costs, weak carrier profit margins, as well as consumers’ financial health and their willingness to spend,” McNealy said. “Looking beyond the trough, we continue to hear anxiousness about whether or not the industry will be prepared for a possible sharp increase in demand once tariffs and trade stabilize, particularly given the rising replacement demand from an aging fleet.”

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.