Trailer orders shattered records in September, according to preliminary estimates from FTR and ACT Research.

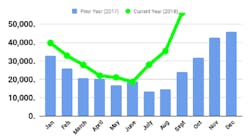

FTR reported a “tremendous” 56,000 units ordered in September, exceeding the previous record from October, 2014, but more than 10,000 trailers. Orders continue to exceed expectations, with September units 59% higher than August and up 133% year over year. Trailer orders for the past twelve months have now exceeded 400,000 units.

The OEMs opened their order boards for the remainder of 2019 and fleets responded with many large orders. Most of the order increase was in dry vans, but refrigerated van orders were healthy, as were flatbeds. There are still concerns about future raw material costs and component availability, but this did not hinder the fleets from ordering in huge numbers for future deliveries.

“The fleets have ordered an enormous amount of Class 8 trucks for 2019 and now are ordering the trailers to go with them,” said Don Ake, FTR vice president of commercial vehicles. “They want to reserve build slots throughout next year, so they can have equipment ready for what is anticipated to remain a vibrant freight market.

“This is the equivalent of tickets going on sale for a wildly popular concert and quickly selling out. Some dry van OEMs are largely booked up for 2019.”

ACT pegged September net trailer orders at 58,200 units in its preliminary estimate. Final volume is expected later this month.

“Fleets reached a never-before-seen trailer order level in September,” said Frank Maly, ACT’s director of commercial vehicle transportation analysis and research. “OEMs booked over 58,000 trailers last month, shattering the previous record level of just over 47,000 orders, which was set in October of 2014. That was more than 50% better than August orders, and 135% better than this point last year.”

Seasonally adjusted, September volume was just under 64,000, generating a seasonally adjusted annual rate of almost 760,000 units.

Year-to-date, fleets have ordered over 295,000 trailers, more than 50% better than last year. While dry vans continue to post solid unit and percentage gains, both sequentially and year-over-year, preliminary results indicate that flatbeds posted the best month-over-month percentage improvement in September.

“Order strength was widespread, with nine of the ten trailer categories in the black on a year-over-year basis, (and) grain trailers, the sole outlier, missing a positive result by less than a percentage point,” Maly said.

“Year-to-date performance was nearly identical to the year-over-year results, an indication both consistent and longer-term industry-wide strength.”