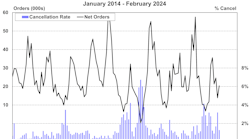

As of June, steel prices were still increasing in the U.S., which will continue to be an issue for the work truck industry, according to an article by NTEA Director of Market Data & Research Steve Latin-Kasper that was published in the August 2017 edition of NTEA News.

“Steel prices will likely keep rising in the second half of this year, but if the rate of increase decelerates in the third quarter, it will signal an accurate World Bank forecast, which means prices could fall again by 2018,” he said.

On an annual percent change basis, U.S. cold-rolled steel sheet/strip prices were up about 15 percent as of May 2017. Hot-rolled sheet/strip was not far behind, growing at a 13 percent rate. Steel prices started rising in the second quarter of 2016 on a month-to-month basis, and the growth rate accelerated significantly in the first quarter of this year.

“Steel prices have only increased twice since the 2007–2009 recession,” he said. “We are in the middle of the second cyclical increase. While prices are growing much faster than in 2014–2015, the length of time they rise may be about the same as back then.

“This is because U.S. steel prices are closely connected to the global market for steel, which means global economic forces will have as much impact on U.S. steel prices as economic change in the U.S. itself. According to World Bank’s Commodity Prices History and Projections, steel, as well as most other metals and minerals prices, may start falling by the end of this year.

“The U.S. wasn’t the only nation seeing increased steel prices in the first quarter of 2017 — countries all over the world experienced it as well. This is primarily attributed to a substantial increase in demand to support renewed growth in China’s manufacturing and construction sectors. Iron ore prices rose even faster as a result of low stocks in China. The rapid jump in prices is unlikely to last, though.”

World Bank expects iron ore/steel prices to fall in the second half of this year for a number of reasons.

“First and foremost, it thinks the construction boom in China peaked, which means the country that accounted for more than 50 percent of the increase in steel demand over the last 15 years will not have the same impact on global steel prices going forward,” he said.

“Steel futures prices started falling in April as it became apparent that iron ore inventories were accumulating at Chinese ports, which signaled the restocking was done. Australian and Brazilian exports of iron ore reached record levels in the first quarter, but the rise in price led to the reopening of closed Chinese plants. Brazil is bringing additional capacity online, and India’s steel industry is becoming more productive. In sum, lower Chinese demand and higher global production should put downward pressure on steel prices through 2025.

“It remains to be seen what the effect of economic growth in the European Union and U.S. will be. World Bank believes any increase in demand in the world’s two largest economies will not outweigh the decline in demand from China. Indian economic growth will also be a factor.”