Holiday freight bottlenecks drive carrier profits, CV orders: ACT

The strength in new commercial vehicle demand is a direct result of strength in freight rates, according to recent report updates from ACT Research.

“Freight is typically not a backlog business, but in the holiday season of 2020, with imports at record levels, we have a flotilla of containerships off Southern California waiting to unload,” Tim Denoyer, ACT Research vice president and senior analyst, said. “This bottleneck suggests strong freight volume growth will continue even after the holiday season, as retailers restock inventories.”

The ACT Freight Forecast, U.S. Rate and Volume OUTLOOK report details these trends and more. It is designed to provide unmatched detail on the freight rate outlook, helping companies across the supply chain plan with greater visibility and less uncertainty.

“The freight market imbalance of strong demand and tight driver capacity should begin to rebalance gradually after the holidays, as there is early evidence of initial easing in the driver shortage,” Denoyer said. “But this month, we add a steel shortage to the list of the economic shocks emanating from COVID-19, which threatens to impact Q1’21 manufacturing activity.”

Similarly, the latest release of the North American Commercial Vehicle OUTLOOK forecasts the future of the industry, looking at the next 1-5 years, with the objective of giving OEMs, Tier 1 and Tier 2 suppliers, and investment firms the information needed to plan accordingly for what is to come.

“An ACT-favorite axiom is, ‘fleets buy equipment when they make money,’ and truckers are going to make a lot of money in 2021,” Kenny Vieth, ACT president and senior analyst, said. “A strong freight pipeline and structural and regulatory challenges surrounding driver recruiting suggest an unprecedented level of intractability in the supply-demand balance. Barring an exogenous event, the data suggest strong carrier profits are likely to extend through 2021 and well into 2022.”

And those profits will continue to drive equipment order activity.

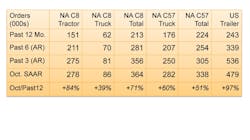

“This year started with a whimper, and in spite of the pandemic pause in Q2, is going out with a bang,” Vieth said, regarding equipment markets. “Comparing October’s order rate to 12-month order totals generates some impressive comparisons and highlights the across-the-board order surge that began in September. Additionally, on a preliminary basis, November orders are at or above recent levels.”