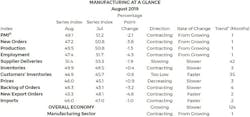

Economic activity in the manufacturing sector contracted in August, and the overall economy grew for the 124th consecutive month, say the nation's supply executives in the latest ISM Manufacturing Report On Business.

“Comments from the panel reflect a notable decrease in business confidence,” said Timothy R Fiore, chair of the ISM Business Survey. “August saw the end of the PMI (Purchasing Manager’s Index) expansion that spanned 35 months, with steady expansion softening over the last four months. Demand contracted, with the New Orders Index contracting, the Customers’ Inventories Index recovering slightly from prior months and the Backlog of Orders Index contracting for the fourth straight month. The New Export Orders Index contracted strongly and experienced the biggest loss among the subindexes.

“Consumption (measured by the Production and Employment Indexes) contracted at higher levels, contributing the strongest negative numbers (a combined 5.6-percentage point decrease) to the PMI, driven by a lack of demand. Inputs—expressed as supplier deliveries, inventories and imports—were again lower in August, due to inventory tightening for the third straight month and continued slower supplier deliveries. This resulted in a combined 1.5-percentage point decline in the Supplier Deliveries and Inventories indexes.”

The August PMI registered 49.1%, a decrease of 2.1 percentage points from the July reading of 51.2%.

Other highlights from the report:

- The New Orders Index registered 47.2%, compared to the July reading of 50.8%.

- The Production Index registered 49.5%, compared to the July reading of 50.8%.

- The Employment Index registered 47.4%, compared to the July reading of 51.7%.

- The Supplier Deliveries Index registered 51.4%, compared to the July reading of 53.3%.

- The Inventories Index registered 49.9%, compared to the July reading of 49.5%.

- The Prices Index registered 46 percent, compared to the July reading of 45.1%.

Also, imports and new export orders contracted to new lows, ISM said. Overall, inputs indicate supply chains are responding better and companies are continuing to closely match inventories to new orders, a positive sign for future expansion. Prices contracted for the third consecutive month, indicating lower overall systemic demand.

Machinery and miscellaneous manufacturing were among nine industries reporting growth in August. Fabricated metal products, transportation equipment and primary metals were among seven industries reporting contraction.

“Respondents expressed slightly more concern about US-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders,” Fiore said. “Respondents continued to note supply chain adjustments as a result of moving manufacturing from China.

“Overall, sentiment this month declined and reached its lowest level in 2019.”

Here are some selected comments from respondents:

- “Seeing some relief in the availability of electronic components in the marketplace, but there are still pockets of short supply, allocation, long lead times and the like. Tariffs continue to be a strain on the supply chain and the economy overall.” (Computer & Electronic Products)

- “While business is strong, there is an undercurrent of fear and alarm regarding the trade wars and a potential recession.” (Chemical Products)

- “Slowest month (July) this year so far in sales.” (Transportation Equipment)

- “Late planting of the corn and soybean crops has increased uncertainty over the final acres and yields. This is leading to volatile markets.” (Food, Beverage & Tobacco Products)

- “Slightly lower rate of incoming orders may be seasonal or a sign of a general slowdown. Monitoring closely.” (Fabricated Metal Products)

- “Incoming sales seem to be slowing down and this is usually our busiest season. Concerns about the economy and tariffs.” (Furniture & Related Products)

- “Business is starting to show signs of a broad slowdown.” (Machinery)

- “Generally, business remains steady. However, we continue to plan for a hard Brexit and a long trade war between the US and China.” (Miscellaneous Manufacturing)

- “The market for large building structures is slowing.” (Nonmetallic Mineral Products)

- “Current business is OK, nothing to brag about. Under projections and slightly below last year, [but] margins are hanging in there.” (Plastics & Rubber Products)