Trailer orders climb, still lag long-term trend

U.S. trailer net orders rose 30% month-over-month in September to 10,142 units but were 19% lower year-over-year, FTR reported. But despite the improvement, orders continue to lag well behind the 10-year September average of 29,890 units as weak freight demand, tariff pressures, and pricing uncertainty persist.

Indeed, the 2026 order season may begin later than usual, per the monthly FTR trailer market analysis. The y/y decline in September suggests that some buyers are holding off until freight market conditions improve and/or there is greater clarity regarding trade policy and input costs.

For 2025 to date, net trailer orders total 120,750 units, up 23% from 2024, and averaging just over 13,400 units per month. As FTR has noted previously, this overall strength largely reflects backloaded demand following the November 2024 election, which boosted activity in the first quarter of 2025.

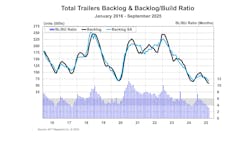

U.S. trailer production increased in September with builds up 5% m/m and 15% y/y to 17,899 units, according to FTR data. Output for 2025 to date totaled 151,743 units, down 19% y/y. Backlogs fell 9% m/m and 12% y/y to 74,824 units, reducing the backlog/build ratio to 4.2 months—the lowest level since mid-2020.

With production continuing to outpace order activity, OEMs face increasing pressure to align output with a softening demand environment as the industry transitions into 2026, the report noted.

“The U.S. trailer market faces mounting cost pressures and policy uncertainty amid rising global trade tensions, especially with China,” Dan Moyer, senior analyst, commercial vehicles, said. “Moreover, the Section 232 tariffs on steel, aluminum, and copper—explicitly expanded in August to include non-U.S. content in trailers and components—are driving higher input costs, margin compression, and consolidation pressures.

"Larger, vertically integrated OEMs are better positioned to manage the impact while smaller firms face growing financial strain. Many fleets are delaying replacement, extending equipment life cycles, and slowing or stopping expansion.”

Indeed, the US trailer market remains in “stay afloat” mode, as fleets continue their wait-and-see strategy, according to the latest issue of ACT Research’s State of the Industry: U.S. Trailers report.

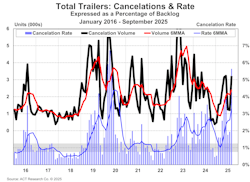

With lower build rates insufficient to offset soft orders in September, the industry backlog-to-build ratio fell 30 basis points sequentially, to 3.3 months, noted Jennifer McNealy, director–CV market research and publications at ACT Research.

“Cancelations started to escalate in February and have remained elevated relative to backlog since. September’s rate, as a percentage of backlog, was 5.6%, both overstated and the highest rate since May 2020,” McNealy said. “Data continued to show high dry van cancelations, with reefers and the tank segments also elevated. Per OEMs, cancelation activity is primarily from dealers, as they work to control stock against a backdrop of uncertainty and cost concerns.”