Tariff pressures, market volatility impact U.S. trailer demand

Key Highlights

- July trailer orders decreased 43% from June but remained 19% higher than July 2023, indicating ongoing market resilience.

- Backlogs contracted 11% sequentially, signaling potential production challenges if order activity does not rebound in the coming months.

- Tariff increases on steel and aluminum are impacting supply chains, potentially leading to higher prices and industry consolidation.

- Fleet operators are extending replacement cycles and deferring expansion, dampening demand for new trailers.

- Industry analysts emphasize the importance of disciplined production planning and flexible pricing strategies amid market volatility.

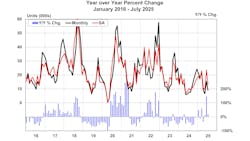

Trailer orders in July came in substantially below June’s surprise rush, but still ran quite a bit higher than July last year, according the latest reports from market analysts.

Net trailer order intake in July was 8,800 units, 43% lower than June but more than 19% higher than the subdued level of orders accepted last July, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

This puts the year-to-date order tally at 100,700 units, 23% higher than the 81,800 bookings for the first seven months of 2024.

“At this point, weaker intake continues to be expected through at least mid-Q3 when more of the industry's 2026 order books open,” Jennifer McNealy, director–CV market research and publications at ACT Research, said. “As the industry remains in the weaker months of the annual order cycle, build again outpaced orders in July. Trailer production was about double order placements. As a result, backlogs contracted 11% sequentially and remain sharply lower against 2024’s already soft backdrop.”

FTR reported similar results, with July order down 39% month-over-month to 7,794 units as tariff pressures and freight market uncertainty erased June’s dry van-driven rebound. Orders were still 23% higher year-over-year (y/y) on weak 2024 comps, but volumes remain well below the 10-year July average of 14,856.

Year-to-date 2025 orders total 102,991 units, up 31% y/y and averaging 14,713 per month. Looking ahead, OEMs face elevated volatility, making disciplined production planning and flexible pricing strategies critical until freight demand and tariff conditions stabilize, per the FTR report.

“The U.S. trailer market is now under mounting pressure as tariff exposure broadens,” Dan Moyer, senior analyst, commercial vehicles, said. “Higher tariff rates for most major U.S. trading partners kicked in on August 7. Potentially more directly significant for the trailer sector is an expansion of the 50% steel and aluminum tariffs as of August 18 that apparently affects not only imported key components but also the steel and aluminum content of fully assembled imported trailers.”

Fleets remain on sidelines

The escalating tariff impact could affect the trailer market in both supply and demand, Moyer noted, as OEMs and suppliers must either absorb margin losses or raise prices, possibly accelerating industry consolidation and favoring larger, vertically integrated players.

“Meanwhile, many fleets are extending replacement cycles—leaning more heavily on used trailers—and deferring expansion, thus dampening demand for new build,” he said.

Order cancellations were 17% of gross orders in July, down from a peak of 39% in May. Cumulative net orders for the 2025 season (September 2024-July 2025) stand at 181,430 units, down 5% y/y and averaging 16,494 per month.

Total U.S. trailer build declined 1% m/m and 4% y/y to 17,999 units in July. YTD 2025 build is down 23% y/y to 116,826 units, averaging 16,689 per month. With net orders trailing build, backlogs fell by 11,364 units (-11% m/m; -10% y/y) to 92,132 units, lowering the backlog/build ratio to 5.1 months.

The shrinking backlog signals potential production headwinds if order activity does not rebound with the opening of 2026 order boards in or about September.

“The market is shifting toward heightened price sensitivity and cautious capital spending with some supply chains likely considering domestic reorientation—but at structurally higher cost levels,” Moyer said. “Policy uncertainty is compounding volatility, making long-term planning increasingly difficult.”