Wabash Q1 revenue and income fell slightly short of prior expectations, due to slower customer pick up of equipment, according to the company’s quarterly earnings report on April 24.

The company's net sales for the first quarter of 2024 was $515.3 million, a 17% decrease compared to the same quarter in 2023. Consolidated gross profit came in at $76 million, or 14.8% of sales. Operating income amounted to $29.6 million, representing 5.7% of sales for the quarter.

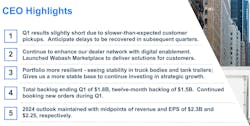

“I'd like to emphasize that, particularly for a year of weaker demand, Q1 tends to be seasonally weaker,” Brent Yeagy, president and CEO, told investment analysts on the Wabash earnings call. “Additionally, the size of our products necessitates that we rely on customers to pick up their equipment before we were able to recognize revenue. That said, our production outstripped shipments during the first quarter. The associated income will flow into subsequent quarters during 2024, particularly Q2.”

As of March 31, total Wabash backlog stood at approximately $1.8 billion, a decrease of 5% compared to the fourth quarter of 2023 as new order activity “nearly kept pace” with shipments during the first quarter of 2024, the company reported. Backlog expected to be shipped within the following 12-months amounted to approximately $1.5 billion.

Regarding market conditions, Yeagy explained that while customers continue to experience “a challenging freight environment,” Wabash has seen “important leading indicators” take a turn for the better.

“While these positive indicators have yet to meaningfully translate into improved freight conditions, we are optimistic that improvements maybe on the horizon when you pair the strengthening macro backdrop with the amount of capacity that has left the transportation industry since the market downturn began in early 2022,” he said.

The Wabash financial outlook for the full year remains unchanged, with a forecast of $2.3 billion in revenue, Yeagy added.

“2024 is a pivotal year for our strategic advancement. Despite a down year for dry vans, we view this as an unprecedented opportunity to continue investing in our business," Yeagy said. "We are strengthening our competitive position by leveraging our dealer network to create national scale and integrating digital solutions to better enable access to parts, trailers and services across this network. With the ongoing development of our Wabash Marketplace digital platform, we anticipate streamlining the supply chain experience and offering best in class access to parts, services as well as Trailers as a Service (TAAS).”

Segment results

Wabash shipped 8,500 new trailers in the first quarter, down from 11,780 in Q1 last year (-27.8%), along with 3,690 truck bodies, down from 3,815 the year before (3.3%).

“As we gain more clarity for 2024, it's important to emphasize the resilience of our portfolio that has grown over the last decade,” Yeagy said. “We see relative stability in customer demand for our truck bodies and tank trailers, which helps mitigate the anticipated decline in dry van demand this year.”

During the first quarter, Transportation Solutions achieved net sales of $470.4 million, a decrease of 18.6% compared to the same quarter of the previous year. Operating income for the quarter amounted to $44.3 million, representing 9.4% of sales.

Parts & Services' net sales for the first quarter reached $49.2 million, an increase of 4.4% compared to the prior year quarter as the segment “continued to make strides” along its path of strategic growth. Operating income for the quarter amounted to $10.5 million, or 21.4% of sales.