Trailer manufacturers continue to play catchup, ramping up production as fleet orders remain firm.

August net US trailer orders of 17,777 units were 4.6% higher compared to the month before, but more than 37.7% above the year-ago August level, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

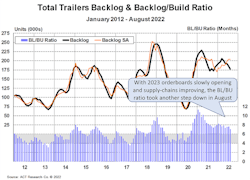

“Discussions across the past month indicate more OEMs opening 2023 build slots (some opening initial slots, others expanding into later in the year). OEMs continue to negotiate with fleets, and those efforts are quickly moving to booked business,” said Jennifer McNealy, director–CV market research and publications at ACT Research. “While manufacturers continue to wrestle with rolling supply-chain disruptions, as well as challenges on the labor front, tangible improvements are being made.”

Those improvements come as OEMs are investigating longer-term supply solutions, including increased parts inventories and automation to offset labor pains, in hopes of getting ahead of “potential future disruptions,” McNealy said. “Demand remains strong, cancellations remain insignificant as fleets in queue plan to stay in line, and we’re beginning to hear about price stabilization accompanying the smoother flow of materials in the supply chain.”

More broadly, ACT Research reported the forecasts are “essentially unchanged” from last month: Demand remains healthy, production remains constrained, and freight rates and volumes managed to squeak out small improvements compared to August, according to the latest release of Commercial Vehicle Dealer Digest.

“We’re hardly at the ‘living on a prayer’ stage when it comes to our outlook, but as the old investing maxim goes: don’t fight the Fed.” said Kenny Vieth, ACT president and senior analyst, “We believe wage inflation needs to moderate before the Fed can begin turning away from tighter monetary policy. As long as the jobs reports remains strong, the harder it may be to tame wage inflation—which may lead to more-aggressive-for-longer rate hikes and worse than expected economic outcomes.

“As it has been for several months, a mild recession centered in early 2023 remains our base case.”

The report, which combines ACT’s proprietary data analysis from a wide variety of industry sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets.