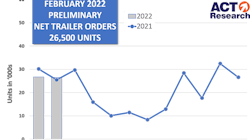

The trailer order pace that closed 2021 and opened 2022 continued for the third straight month in February, ACT Research reported in its State of the Industry: U.S. Trailers.

Preliminary estimates point to OEMs booking 26,500 net orders for the month, down 0.7% sequentially but 3.9% better than the same month last year. This preliminary market estimate should be within +/- 3% of the final order tally, the industry forecaster noted.

“The careful order management efforts underway at OEMs were confirmed by the pace of February order acceptance,” said Frank Maly, Director CV Transportation Analysis and Research of ACT Research. “Supply-chain and staffing headwinds continue to challenge OEMs in their efforts to increase output to meet extremely strong fleet equipment demands.”

Initial projections indicate that the supply chain has allowed OEMs to build at a “hard-fought consistent rate” over the last three to four months, Maly noted.

“Expect this to continue in the short-term, as the supply chain begins to adjust to underlying demand,” he said.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.