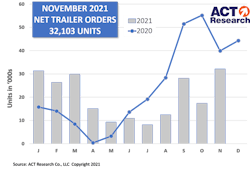

November net U.S. trailer orders of 32,103 units increased more than 84% from the previous month, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report. Before accounting for cancellations, new orders of 33,900 units were up more than 73% versus October.

Year-to-date net orders and new orders for the first 11 months of 2021 were both about 11% lower compared to the same time period in 2020, which included the COVID-stricken spring data.

“Trailer OEMs continue to be cautious regarding order acceptance, as they attempt to maintain acceptable delivery schedules given their available staffing and anticipated supply-chain support,” said Frank Maly, director–CV Transportation Analysis and Research at ACT Research. “The difficulty of developing pricing in the current inflationary market conditions also impacts order acceptance. OEMs are attempting to avoid the renegotiation cycles that occurred earlier in 2021, and the best way to achieve that is to extend their orderboards in small steps as the year progresses.”

Maly suggested that trailer OEMs will continue to closely manage their backlogs, which now edge into the second half of 2022.

“There were concerns that more 2021 commitments might need to be shifted into 2022, resulting in an additional surge in cancels,” he said. “It now appears that most of that adjustment occurred in September, and excluding September, the industry has had an average 1% cancel rate since May.”

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.