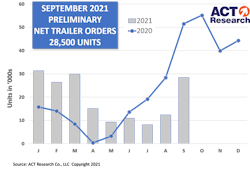

Preliminary reports show trailer OEMs posted 28,500 net orders in September, a 130% sequential surge over August—but orders still trailed the same month last year by 45%, ACT Research’s State of the Industry: U.S. Trailers report.

“We’ve been awaiting the opening of the 2022 orderboard, and that finally occurred during September. While demand remains very strong, that action was not universal as the market was a mix of OEMs accepting orders while some remain on the sidelines,” said Frank Maly, director of CV Transportation Analysis and Research of ACT Research. “Concerns about component and materials pricing and availability, as well as staffing challenges, were noted as the major reasons for continued reticence in order acceptance.”

The “major impetus” in September came from dry van orders, which will extend already long lead times further into next year, Maly suggested. ACT also a reported a “notable churn” in the backlog, as new orders approached 34,000 trailers for the month.

“That means cancellations came in at the highest level since April of this year, but it appears many were due to cancel/re-orders, as some delivery commitments likely shifted from 2021 to 2022,” Maly said. “With fleet demand still strong, expect further order strength in upcoming months, as more OEMs begin to book orders for the new year.”

Broadly, near-term commercial vehicle production forecasts have been trimmed again, amid continued supply-side constraints, according to ACT’s latest release of the North American Commercial Vehicle OUTLOOK.

“The setup for the entire industry remains unchanged: Despite rock-solid demand metrics across the spectrum of medium and heavy-duty vehicle types, industry capacity remains range-bound across a broad front of supply-chain constraints,” Steve Tam, ACT vice president, said. “Just like heightened inflation, the current situation in North American commercial vehicle manufacturing is transient: The issues impacting production will pass. Of course, while ‘transient’ implies a return to normal, the word does not describe magnitude or duration.”

Indeed, demand-side activities remain at “as-good-as-it-gets” levels, as ACT has reported for months—but supply constraints continue “to mushroom.” And while semiconductors remain the “primary culprit” in automotive supply-chain woes, they have become a generic reference to the supply-chain’s shortcomings, Tam noted. In actuality there are “scores of parts” that continue to be impacted by the pandemic, by the lingering impact of steel tariffs which have domestic steel prices well above other global benchmarks, and the February storm that incapacitated Texas and substantially limited US plastics industry output for two-plus quarters.

“Aluminum extrusions are a challenge, wire is hard to find, and tires have been mentioned since day one of the new cycle,” Tam added. “And, reiterating, like the supply-chains themselves, the issues are not only domestic and not only commercial vehicle.”