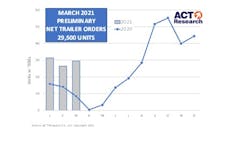

ACT Research has put preliminary trailer orders at 29,500 in March. That's 12% better than February and more than triple the volume seen last year, when COVID-driven pressures began to meaningfully impact the market, according to ACT Research’s State of the Industry: U.S. Trailers report.

“Normal seasonal order patterns predict a month-over-month decline in net orders in March, so the rebound from February shows that fleets continue their positive expectations for the remainder of this year and into next,” said Frank Maly, director CV Transportation Analysis and Research at ACT Research. “Initial results point to dry van orders being the major source of strength; after a normal seasonal easing in February, they bounced back to a level similar to January volume.”

The solid order volume will result in further industry backlog growth, Maly noted.

“In response to those ever-growing commitments, OEMs have been struggling to increase their production levels. It appears those efforts are beginning to have an impact, he said. “This preliminary report shows them achieving a higher daily production rate in March. It also appears that March will post a positive year-over-year comparison for total production, the first positive comparison since July 2019.

“That being said, staffing challenges and component and material supplies remain a concern as production ramps.”