The current five-year run of strong growth in the trailer market is “unprecedented,” says Don Ake, FTR vice president of commercial vehicles. And that makes him a little nervous, especially when Trailer/Body Builders asks him to look into his crystal ball and predict the next five years.

The transportation equipment industry is historically more cyclical than the economy, Ake notes, meaning the highs are higher and the lows are lower. So even a mild recession causes extreme fluctuations in the market.

So with the trailer market running at record levels, and the economy less than a year away from posting the longest expansion in US history, the safe bet would be that the boom times are about to end. The question becomes: How far, and how fast, will the transportation equipment market fall?

To understand where the market is going, it’s important to understand where it is today, Ake explains.

As of May, trailer orders totaled 335,000 units for the past 12 months. If OEMs could build all the orders being placed, 2018 would easily be a record year, Ake suggests. However, supplier constraints on key components and fabrications are holding back production. Even so, production is robust and still expected to set a record.

FTR had previously forecast 2018 US trailer production at 305,000 units, a conservative estimate based on concerns about supplier constraints—but Ake recently upped that to 310,000.

“Some of the supplier issues may not be as bad as originally anticipated,” Ake says. “Everybody assumes the supplier issues at this point in time are going to be the supplier issues six months from now. But the OEMs do not sit on their hands and accept that they can’t get supply. Over time those issues improve. If they do, then production will be higher than our forecast, potentially 10,000-15,000 units higher.”

Still, while the current run-up in the trailer market bears a resemblance to the 2015-2016 surge, supplier issues are “much worse” today, he notes, because the overall economy is stronger than it was two or three years ago as trailer manufacturers are competing with many other industries for materials.

The Forecast

“Obviously, the rest of 2018 looks very good, and we expect demand to roll over into 2019 for another great year,” Ake says. “The pivotal year will be 2020. If the economy is still strong, the trailer market will settle in at replacement demand, not expanding the fleet. That’s a very good scenario. Demand goes down, but not that much.”

If the economy slows, however, the trailer population that’s grown during the upswing suddenly becomes an oversupply.

The basic possibilities, of course, are simple enough: Either the expansion has run its course, and the economy is due for a downturn; or, assuming international trade issues are worked out, there’s no reason for the economy to slow substantially, Ake suggests.

A “wild card,” he adds, is the 2020 election.

“Historically, the government tends to try to do things to keep the economy strong through an election,” Ake says, so any sort of “artificial stimulus” might push a downturn into 2021.

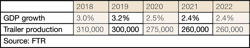

FTR’s forecast for the US settles safely in the middle, with US gross domestic product settling down to a level consistent with post-recession recovery: After reaching 3.2% GDP growth this year and 3.3% next year, the economy “settles down” to 2.6% GDP growth in 2020 and slips by a tenth of a percent in 2021 and again in 2022.

Ake is quick to note that while some economists contend that the likelihood of recession in the next three years is high, FTR doesn’t speculate.

“It’s impossible for anybody to forecast a recession this far out,” Ake says. “If our timing is off, a year either way, then the equipment forecast is off.”

If the economy is still growing around 2.5%, then the downturn in the trailer industry will be mild. But if GDP growth slips below 2% in 2020, then “the downturn has the potential to be significant,” Ake adds.

“Typically, the trailer market will cycle down several months before the economy. Once it starts down, that’s a warning point,” Ake says. “Our forecast reflects a mild downturn. If that economic downturn is greater in 2020, then the trailer market forecast is going to much lower. The critical year is going to be 2020.”

Following the 310,000 trailers to be built this year, FTR forecasts 2019 will come in at 300,000 in 2019, 275,000 in 2020, and 260,000 in 2021-2022.

“This is a positive scenario, because we can’t predict a recession,” he emphasizes. “If we have a recession, the numbers quickly go below 200,000.”

The model

FTR forecasts are built around “economically derived demand,” Ake notes, meaning the model calculates the expected amount of freight and, in turn, the number of trailers needed to haul that freight. Activity in the manufacturing sector is an important indicator.

The model also takes into account factors such as fleet productivity, which in turn is impacted by regulations and truck driver availability.

For instance, in anticipation of the federal government’s electronic logging device (ELD) mandate, fleets bought extra trailers to increase drop-and-hook operations to mitigate a reduction in driver productivity. The impact was reflected in higher-than-projected dry van and reefer production beginning in 2015.

“The whole market dynamic has changed [because of ELDs],” Ake says. “Refrigerated shippers have redesigned the dock area to maximize drop-and-hook shipments. Because the trailer market has stayed strong and the driver shortage has continued, it’s hard for us to measure in real time the exact impact—but we know it’s there. Some of these factors will go away, but what will be normal?

“We’ve added a lot of trailers to the mix in the last five years to handle certain conditions. Once those conditions normalize, how do those trailers get put into the normal market? That is a variable that’s difficult to look at. That’s why, if the economy is not strong in 2020, we’ll have somewhat of a trailer glut that could make the downturn worse. How far that downturn goes is the question.”

The unknown unknowns

The risk in any long-term outlook is that forecasters simply can’t know what they don’t know. And even trends that can be anticipated can’t be modeled effectively.

For instance, FTR Chairman and CEO Eric Starks recently presented a near-term outlook on the truck industry, and closed with some evolving technologies to keep an eye on over the longer term. Additive manufacturing topped the list, with the potential to radically change freight transportation.

But the FTR five-year forecast doesn’t reflect any impact on the trailer market from the evolving supply chain in the era of e-commerce.

“For a five-year window, we don’t have any new-technology factors built in that would move things a lot,” Ake says.

And looking back at the five-year trailer forecast from 2012, Ake admits that he underestimated the coming strength of the market.

“There were a lot of factors that we didn’t have in play,” Ake says.

But that’s the way it goes for those in the crystal ball business.

“So right now, we sit here in 2018 trying to look ahead. Five years from now, there’s going to be factors in play that we don’t know about. Those technologies may have an impact, but we don’t know when and we don’t know how,” he says, then laughs. “But five years from now, we will know. And we will know when and we will know how.”

And he’ll do it again in 2023.

Last mile to drive CV future (side bar)

While the trailer outlook for the next five years doesn’t feature any obvious changes in the freight marketplace, significant shifts are already underway in the market for light- and medium-duty commercial vehicles. The question: Just how much of an impact will e-commerce and electrification have?

The number of packages delivered in 2016 was around 32 million, and that’s going to double by 2026, reports Chad Heminover, president, Fleet Vehicles and Services, for Spartan Motors. And someone, or something, is going to have to do the delivering.

“We know that there is going to be growth in the number of vehicles,” Heminover says, noting that the company’s Utilimaster brand has recently opened a new truck body plant, and has added two facilities for smaller vehicle upfits. “In the last-mile segment, these vehicles are going to continue to get smaller, lighter, faster,” he says.

Heminover puts the current total market for walk-in vans and truck bodies at about $2.2 billion, with cargo vans at $1.2 billion, and projects growth in the number of units at 5% and 8%, respectively, over the next three to five years. That brings the total to 139,000 units for walk-in vans and truck bodies.

Electric vehicles are expected to have an increasingly significant role in the last-mile segment.

“All of our customers are talking about electric vehicles. At some point, electric vehicles are going to be prevalent in the Last Mile—and that could be a Class 2 vehicle, a Class 4 or 5, all the way up to a Class 7 vehicle as well,” Heminover says. “These large fleet companies are really focused on fuel efficiency, and these electric vehicles are what they’re looking at to get there.”

The challenge, currently, is that “the economics don’t make sense,” he adds.

“But costs have been coming down, and that’s going to continue to improve,” Heminover says. “In the very near future the economics are going to make sense for these fleet managers that EV is an optimal solution.”

Indeed, a recent Bloomberg New Energy Finance analysis says the upfront cost of EVs will become competitive on an unsubsidized basis starting in 2024; and by 2029 almost all segments will reach parity with traditionally fueled vehicles as battery prices continue to fall.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.