Wait 'til this year!

Truck-trailer manufacturers anticipated an industry rebound in 2021 after the COVID-driven disruptions of 2020. And the economy did bounce back—in a big way. But some pandemic problems persisted, such as keeping workers on the job in light of government assistance programs and then finding new employees to meet surging demand became a significant drag on production for many manufacturers.

Not having enough workers was one thing, while not having a steady supply of materials, and predictable costs, was another. As a result, trailer manufacturers in 2021 had many “uncomfortable” conversations with customers regarding delivery schedules and pricing.

Still, even with the challenges, nearly 270,000 units on the books marked a 27% increase from the year before and the tenth consecutive year that trailer output has exceeded 200,000 units.

The trailer totals reported here cannot be compared directly with other domestic surveys that do not include Canadian and Mexican trailer plants. This survey does not attempt to report on the many small trailer manufacturing plants scattered throughout North America, so the total trailer build is somewhat larger than the Top 25 numbers reported here.

This Trailer/Body BUILDERS survey is made by contacting a member of the management team at each manufacturing company. The ranking of the companies does not necessarily reflect their relative success in terms of profitability or revenue received, but only the number of trailers produced. The dollar value of a trailer can vary greatly depending on the design, type of construction, materials used and quality level.

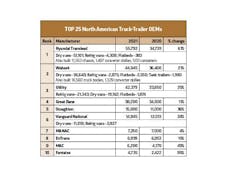

Below is how the individual trailer manufacturers reported their trailer production for 2021:

♦ Hyundai Translead of San Diego, Calif., produced 55,792 truck-trailers in 2021, up 61% from 2020.

The total includes 51,101 dry freight vans; 4,308 refrigerated van trailers, and 383 flatbed trailers.

Hyundai Translead also built 11,553 container chassis and 1,497 converter dollies, not counted in the rankings.

Trailer production numbers are reported by Hyun Jin Noh, senior business strategy specialist, Hyundai Translead. Trailers are built at the company’s plants in Mexico.

"While 2021 results were lower than hoped due to the supply chain challenges experienced across the industry, Hyundai Translead was able to add needed capacity to take advantage of the hard work of our extended supply partners in producing equipment for its customers," the company reported. "This added capacity serves as a springboard into 2022 as Hyundai Translead seeks to further satisfy customer requirements for equipment."

♦ Wabash shipped 44,045 new trailers in 2021, a 21% increase compared to the year before.

The total includes 36,640 dry freight vans; 2,875 refrigerated van trailers; 2,550 flatbeds; and1,980 tank trailers. Wabash also built 16,560 truck bodies and shipped 1,329 converter dollies, not counted in the rankings.

“We remain optimistic about 2022 as our One Wabash organization has executed meaningful cost recovery within our order backlog, which grew to another record level during the fourth quarter,” President and CEO Brent Yeagy said in the Feb. 2 conference call with investment analysts.

Indeed, he credited the organization with constructing the backlog to provide options in 2022, should supply chain and workforce conditions improve, to move up orders that have already been pushed into 2023.

“Longer-term we remain focused on bringing new products and technologies to market, building out adjacent revenue streams and growing beyond the equipment cycle,” Yeagy said.

♦ Great Dane Limited Partnership built 38,200 trailers in 2021, up 11% over the previous year.

“2021 was a year of continuing challenges with supply chain and labor which affected our ability to fill all the orders our customers placed. Like most companies we pushed some of our orders into 2022 to complete the prior year’s business,” shared Chris Hammond, EVP of Sales for Great Dane.

“For 2022, we are optimistic that we’ll get to the end of COVID and the supply chain will begin to correct itself later in the year allowing some growth from our 2021 totals. We continue to see strong demand across all segments we serve.”

♦ Utility Trailer Manufacturing Co. produced a total of 42,379 trailers, up 25% from 2020. Of that, 21,343 were refrigerated trailers, 19,162 were dry van trailers, and 1,874 were flatbed trailers.

“Trailer demand continued to be very strong throughout 2021, but it turned out to be one of the most challenging production years we have experienced,” Brett Olsen, marketing manager, said. “We were challenged by both the labor market and the supply chain challenges the whole manufacturing industry saw. Absenteeism was a challenge as the various COVID variants spread though the country, and taxed an already undermanned work force, resulting in a real struggle to maintain the production capacity to meet the market demand.”

Utility currently has six trailer manufacturing facilities. Multi-temp refrigerated trailers are built in Marion, Va; Clearfield, Utah, and Piedras Negras, Mexico. Dry vans are manufactured at the Glade Springs, Va, and Paragould, Ark., plants. Drop deck platforms and curtain-siders are built in the Enterprise, Ala., plant.

♦ Vanguard National Trailer Corp. produced 14,945 trailers in 2021, a 24% increase from 2020.

This includes 11,018 dry freight vans produced at its headquarters plant in Monon, Ind. and its newer plant in Trenton, Georgia.

Vanguard also built 3,297 refrigerated van trailers at its Monon plant and its West Coast plant in Moreno Valley, Calif.

♦ Stoughton Trailers produced 15,000 units in 2021, a 36% increase from the prior year. This total includes dry vans, grain, and refrigerated trailers. This number also includes a small startup quantity of intermodal equipment.

“In 2021, Stoughton focused on rebuilding our workforce, ramping up dry van production while optimizing our investments in equipment and facilities. We installed an entirely new production line in Stoughton and purchased property for a new chassis manufacturing plant in Waco Texas.” said Bob Wahlin, president and CEO of Stoughton Trailers. “We are realizing efficiency gains as we fine tune our state-of-the-art fabrication and material handling system. Our new laser cutting equipment and robotic welders are improving our component throughput and product quality while reducing our dependency on manual labor.

“Though extremely challenging, we are effectively managing our inbound material and component supply chain. Being nimble with our suppliers and customers has allowed us to maintain our production and avoid shutting down any production lines. 2022 will be a banner year for the company as we anticipate exceeding our all-time unit production output thanks to our large order book for chassis and dry vans.”

♦ MANAC Inc of Saint-Georges, Quebec, built 7,250 trailers in 2021, up 4% from 2020.

“To say the least, 2021 was an interesting year,” Charles Dutil, president of MANAC, said. “We start 2022 with backlog levels that would clearly support a higher output for the year. We expect the availability of various components to hold us back, but plan for a increased number in production.

“On the labor front, 2021 also had many challenges. We view 2022 with more optimism on this important factor.”

♦ EnTrans International LLC of Athens, Tenn., reports shipments of 6,939 truck-trailers in 2021. This is a 15% increase from the previous year, according to Jake Radish, senior vice president of sales and marketing.

“We have seen good rebound improvements in booking activity since H1 of 2020,” Radish said. “All business unit backlogs are up covering well into 2023 with most segments showing significant growth.”

EnTrans shipments include tank trailers built by Heil Trailer International of Athens Tennessee, and Polar Tank Trailer of Holdingford, Minnesota, as well as the heavy-haul trailers built by Kalyn Siebert of Gatesville, Texas.

EnTrans International LLC is owned by American Industrial Partners, an operationally oriented middle-market private equity firm. It also owns other oil and gas related companies such as JARCO, SERVA and Polar Service Centers.

♦ Fontaine Trailer Co. manufactured 4,745 trailers in 2021, up 65% from 2020, the Alabama-based manufacturer reported.

“Flatbed has taken off like everything else has; demand is certainly outpacing everyone’s ability to produce,” Fontaine Commercial Platform President Alan Briley said. “Demand was very strong in 2021 and it continues to be strong as we get into 2022. We’ve struggled with same challenges that most everyone did in 2021, primarily supply-chain driven. Those challenges are going to continue into 2022, although it does seem to be stabilizing—it’s not getting better, but it doesn’t seem to be getting significantly worse.

“We have some supply chain partners that have helped shield us from the worst of this with consignment inventory programs—that’s given us a little more safety stock than maybe others have, and that continues to help us. We were blessed that covid wasn’t devastating for us. We had our share of cases, but that really wasn’t a detriment to production in 2021.”

♦ Dorsey Trailer and Pitts Trailers built 4,645 trailers in 2021, a 5% increase—but JP Pierson, president of Pitts Trailers, suggested the companies could have nearly doubled that output were it not for supply chain and labor challenges. Indeed, the “extremely high” market demand is “changing the way we do business”:

“We’ve had to do a lot more forward thinking, from our forecasting perspective—the way we’re interacting with our customers, our dealers, and our direct fleet accounts,” he said. “Obviously, we've dealt with some challenges on the vendor front; but, overall, they've done their best to take care of us as most of them are long-term partners.”

Pierson also pointed to ongoing capital expenditures, funding expansion projects that began more than a year ago. Additional equipment and automation is being installed to fill the production-line holes left by the extremely tight labor market, while also allowing the manufacturing footprint to be redesigned for more efficient production. He noted wage increases of 20% or more.

And the company instituted surcharges in 2021 to cover “exorbitant” material costs, as well as increased logistics and freight charges. While the manufacturer hopes to repeal those surcharges, the cost increases haven’t hurt orders, Pierson noted.

“We're doing everything we can to try to meet market demand,” he said. “That's the key.”

♦ MAC Trailer Enterprises of Alliance, Ohio, built 6,200 trailers in 2021, a 49% increase over 2020 production.

In addition to multiple manufacturing facilities around Ohio, MAC builds tankers in Haslet, Texas and flatbeds in Davis, OK. The company acquired Portland, Ore.-based Beall brand tankers from Wabash National at the end of 2021.

♦ Timpte Inc. in David City, Neb., in 2021 built 4,037 hopper trailers for hauling grain and other bulk materials, an increase of 23% from 2020.

“We expect the market for 2022 to continue to be strong, with year-over-year double-digit growth. Our backlog is very good currently,” President Dale Jones said. “We’ve had the same challenges, I assume, everyone has had: supplier shortages in conjunction with unprecedented cost increases. Labor availability continues to be a very significant issue.”

♦ Premier Trailer Mfg. Inc., in Visalia, Calif., built 2,046 trailers in 2021, a 16% decrease over the year before.

“This marks a minor decline over 2020. Premier continues to excel in the 22-ft long ‘hopper’ bottom dump trailers and the 24-ft flatbed trailers segments. With that said, 2022 looks to be off to a fast start with our production calendar rapidly approaching capacity,” GM Michael McGinn said. “Premier is excited about initial orders received in 2022 for 3 new models: an agricultural spray trailer with tank and, the highly sought after, 20-ft and 40-ft container chassis. With these new additions, we fully anticipate a 20% increase in production in 2022, resuming our significant growth trend of the past several years.”

♦ XPO Logistics Trailer Manufacturing in Searcy, Ark., built 2,021 units in 2021, a 14% improvement from 2020.

This includes 1,300 28-ft. trailers and another 175 liftgate units; and 400 48-ft units plus 146 liftgate units, according to Paul Reed, manufacturing senior director.

XPO Logistics also built 21 van bodies and 350 converter dollies.

♦ East Manufacturing Co. of Randolph, Ohio, built 2,604 mainly aluminum trailers in 2021, up 29% from 2020.

This company total includes 1,290 flatbeds; 887 dump trailers; and 427 refuse transfer trailers. East also built 56 truck bodies that are not counted in the trailer total.

“Trailer demand remained very strong throughout 2021 and going into 2022,” said Chris Cooler, vice president sales and marketing. “Our greatest challenges right now are overcoming supply chain disruptions and hiring enough factory workers to help us increase our production capacity.”

♦ Strick Trailers built 1,800 truck-trailers in 2021, a 10% decline from the year before.

This includes 1,700 dry freight vans built in Strick’s van plant in Monroe, Ind., and 100 logging and flatbed trailers built as Evans Trailers in Strick factories in Sumter, S.C., and Berwick, Pa.

Strick built 2,600 container chassis (up 37%) as Cheetah Chassis in its Sumter and Berwick plants, but these are not counted in the full trailer rankings. Strick also built 150 converter dollies in its Monroe and Berwick factories, according to Ben Katz, marketing manager.

““Right now, the biggest headwind that we face in terms of being able to increase production is the difficulty we face getting the parts that we need,” Katz said. “We seem to be making some progress, but every day brings a new challenge in this area.”

♦ Kentucky Trailer of Louisville, Ky., built 1,968 trailers in 2021, a decrease of 26%. The company also built 549 truck bodies.

“Similar to most businesses, Kentucky Trailers’ 2021 production totals were negatively impacted by the effects of the global pandemic,” Chief Operating Officer Gary Parker said. “Particularly, Kentucky Trailers was impacted by a significant pause in orders in the April-May time frame. Moving and Storage customers in particular paused to see how events would develop.

“Kentucky Trailer’s approach to social distancing was to implement additional shifts of production, spreading the staffing over 7-day operations with 2 shifts per day. These strategies now position Kentucky well with a greater capacity and available production spots that are generally favorable to the overall market.”

♦ Felling Trailers Inc of Sauk Centre, Minn., built 1,960 trailers with a 10K or larger axle in 2021, a 9% increase over the previous year, Patrick Jennissen, vice-president of sales and marketing, reports. Felling also built 3,342 light-duty trailers.

♦ IPO Fruehauf de Mexico built 3,623 truck-trailers in 2021, an 97% increase over 2020, reports Don Brown, USA Commercial Director. This includes van trailers, flatbeds, dump trailers, and tank trailers, as well as special designs and some truck bodies that are not counted in the trailer total.

“Fruehauf’s outlook in 2022 is positive and anticipating a good year based on the activity in the industry and the addition of our new facility in New Bowling Green, KY,” Brown said.

Fruehauf de Mexico has been building trailers at the same plant 20 miles north of Mexico City for over 50 years. It is located on the Via Jose Lopez Portillo in the satellite city of Coacalco de Berriozabal. Some 500 employees work there.

♦ Trail King Industries in Mitchell, S.D., built 1,850 truck trailers in 2021, an increase of 6% from 2020. They also built 950 light-duty trailers with axles of less than 10,000-lb capacity.

“We were hampered a lot by supply chain issues, extended lead times, skyrocketing material costs—and then, of course, the shortage of labor and dealing with people being out for COVID-19 for extended periods of time,” CFO Gene Astolfi said. “I'm hoping the employment in the Dakotas changes and we're able to get the people that we need. But we're really going to be hampered in 2022 based upon employment.”

♦ Reitnouer Inc. in Birdsboro, Pa., built 2,627 trailers in 2021, a 72% increase from 2020.

“We survived the lockdown COVID year, so 2021 was the time to make good and have a really, really good year,” Bud Reitnouer, company president, said. “But we were just constrained the whole time with labor issues and supply issues. You’re building trailers and missing some items, so then you have a lot of equipment you have to bring back in and finish off later. It’s very frustrating because customers are angry and we’re angry because you’ve got to make hay when the sun is shining and we weren’t able to do nearly as well as wanted to do.”

On the other hand, those customers didn’t go elsewhere because everyone was “in the same boat.” Similarly, while Reitnouer did implement one price increase during 2021, the company “tuck with the deals that we had,” he noted.

“One of the most frustrating things was that we basically do one-year deals, especially for bigger fleets and what they would order for the year,” Reitnouer said. “Prices were always stable—they might go up or down a point or two, but nothing major—but this year, it was so ridiculous. We went to different pricing strategies that were much shorter term, and they can either live with it or not.”

♦ Talbert Manufacturing in Rensselear, Ind., built 1,230 trailers in 2021, a slip of 3% from 2020.

“I consider this a success, considering the fact we, along with the rest of the world, were navigating through our ‘current normal’—supply chain interruptions, unpredictable material spikes as well as the limited labor pool,” said Troy Geisler, VP sales and marketing. “These challenges definitely kept us on our toes as we had to be more fluid than ever with planning. We are extremely grateful to our dealers and customers alike for working with us along the way.”

Talbert is best known for its heavy-haul trailers and the first detachable gooseneck patented by company founder Austin Talbert in 1947. This first mechanical detachable gooseneck was followed by development of hydraulically detachable goosenecks 15 years later.

The company has expanded into building many other heavy duty and construction-related trailer types. It also expanded geographically with a second manufacturing plant added in 2014 in Liberty, North Carolina.

♦ Western Trailer in Boise, Idaho, built 1,087 trailers in 2021, a 14% decrease over the previous year’s production.

“We are ramping up for a much better year, with lots of activity so far,” Todd Swanstrom, engineering manager, said.

♦ Doepker Industries in Anaheim, Sask., built 1,001 truck-trailers in 2021, down 34% from the previous

“Demand was strong throughout the year in many sectors we service including grain trailers, flatdecks, gravel and heavy haul. While we did experience growth over 2020, supply chain challenges throughout the year did impact our trailer output,” Devin Leonard, vice president of sales and marketing, said. “We expect to increase our output again in 2022 as we continue to ramp up production in our newest production facility in Georgetown, Ontario. Customer demand at this point remains strong in all sectors.”

♦ Tremcar Inc. built 830 tank trailers and 260 tank trucks in 2021, with total Tremcar tanks of 1,090 breaking even with the year before, Melanie Dufresne, director of marketing and communications, reported.

“The supply chain as a whole was difficult this year: Parts supplier deliveries delays and production time increased considerably,” Dufresne said. “Customers were having trouble getting truck chassis, for example, and this slowed tank sales for new truck mounts. Fluctuation of metal prices and employees out because of COVID-19 were also challenges in 2021. Let’s hope for a better situation in 2022.”