Truck-trailer manufacturers chalked up another outstanding year of trailer production in 2019. It is the fifth year in a row that the Top-25 trailer manufacturers have built more than 300,000 trailers. It is also the ninth year in the current cycle that annual trailer output has exceeded 200,000 units.

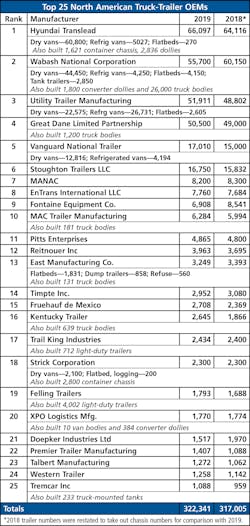

The Top-25 trailer manufacturers built 322,341 trailers in 2019. That is 5,336 more trailers than in 2018, or an increase of almost 2%.

Of the 25 trailer manufacturers reporting, only seven produced fewer trailers than in the preceding year. The other 18 manufacturers built more or the same number of trailers.

The four largest trailer builders, each completing over 50,000 trailers, shipped a total of 224,208 trailers, or 70% of the Top-25 total. The six largest manufacturers built 80% of the total.

This year’s report is slightly different in that it ranks the 25 largest manufacturers of truck-trailers, excluding container chassis in the rankings. Incomplete trailers such as container chassis are counted and reported, but not used for ranking. This change resulted in restating the 2018 column to take out the chassis numbers for better comparison with 2019.

The trailer totals reported here cannot be compared directly with other domestic surveys that do not include Canadian and Mexican trailer plants. This survey does not attempt to report on the many small trailer manufacturing plants scattered throughout North America, so the total trailer build is somewhat larger than the Top-25 numbers reported here.

This Trailer/Body Builders survey is made by telephoning a member of the management team at each manufacturing company. The ranking of the companies does not necessarily reflect their relative success in terms of profitability or revenue received, but only the number of trailers produced. The dollar value of a trailer can vary greatly depending on the design, type of construction, materials used and quality level.

Here is how the individual trailer manufacturers reported their trailer production in 2019:

Top 25 Trailer Ouput 2019 list PDF download

♦ Hyundai Translead of San Diego, California, built 66,097 truck-trailers in 2019, which is 12% more than in 2018.

This total includes 60,800 dry freight vans, 10% more than in 2018. It also includes 5,027 refrigerated van trailers, a 36% increase over 2018, and 270 flatbed trailers, down 21%.

This company total does not count any container chassis, which are counted separately as incomplete trailers.

Hyundai Translead also built 1,621 container chassis in 2019, down 76% from the 6,621 built in 2018. These are ranked separately as incomplete trailers. The company also built 2,836 converter dollies, a 60% increase, also not counted in the truck-trailer rankings.

Trailer production numbers are reported by Brian Jae Hak Shin, Senior Specialist, Business Strategy, Hyundai Translead.

All Hyundai trailer production is in two plants in Mexico just south of the company headquarters in San Diego CA. The main plant is in Tijuana on the border, and a new van trailer plant in Rosarito is 40 minutes away on the Pacific Ocean.

♦ Wabash National Corporation shipped 55,700 new trailers in 2019, which is 4,450 fewer than in 2018, or 7.4% less. This includes 44,450 dry freight vans, down 10%, and 4,250 refrigerated van trailers, down 2%.

However, tank trailers and flatbed trailers were both up in 2019. The company shipped 2,850 tank trailers, 8% more than the previous year, and 4,150 flatbeds, up 4%.

Wabash also shipped 26,000 dry and refrigerated truck bodies, 14% more than in 2018, and 1,800 converter dollies.

Truck bodies and dollies are not counted in the Top-25 rankings.

Wabash National had total revenue of $2.3 billion in 2019, the highest ever in company history. Brent Yeagy, president and CEO, announced at the February 12 investors conference call that the company also generated operating income of $142.8 million, which is 6.2% of net sales.

Trailer shipments announced at this meeting were 57,500 for 2019, but that number includes the 1,800 converter dollies, which are included with trailer shipments in Wabash financial results. Dollies are not counted in the Top-25 ranking, so 55,700 trailers is correct for Wabash total trailers shipped.

The outlook for 2020 was for a small downturn. Yeagy said, “I have given guidance of $2.05 billion to $2.15 billion in sales.” In other words, when compared to $2.3 billion in revenue for 2019, sales are forecast to be about 6% to 11% less.

♦ Utility Trailer Manufacturing Co built 51,911 trailers in 2019, an all-time record for the company and 6% above the 2018 level.

It includes 22,575 dry freight vans, a 7% increase, and 26,731 refrigerated vans, a 9% increase. Flatbed and curtainside production was 2,605 units, a 16% reduction.

Food service trailers (multi-temperature compartments and multiple door opening reefers) were particularly strong and show a big backlog going into 2020, says Craig Bennett, senior vice-president, sales and marketing.

Bennett is predicting a slowdown from these last two frenetic years of trailer production.

“We are at the top of this strong 10-year cycle. With the elections and unrest, the slowdown in used trailer values, and the viruses and tariff wars, the industry will be building fewer trailers in 2020. We may bounce along the bottom of the cycle for a while before the next cycle begins.”

Utility currently has six trailer manufacturing facilities. Multi-temp refrigerated trailers are built in Marion, Virginia; Clearfield, Utah, and Piedras Negras, Mexico. Dry vans are manufactured at the Glade Springs, Virginia, and Paragould, Arkansas, plants. Drop deck platforms and curtain-siders are built in the Enterprise, Alabama, plant.

♦ Great Dane Limited Partnership built 50,500 trailers in 2019, a 3% increase over the previous year. The company also built 1,200 truck bodies.

♦ Vanguard National Trailer Corp produced 17,010 truck-trailers in 2019, an increase of 13% over 2018 production, reports Charlie Mudd, president.

This includes 12,816 dry freight vans, an 8% increase, produced at its headquarters plant in Monon, Indiana, and its newer plant in Trenton, Georgia.

Vanguard also built 4,194 refrigerated van trailers, a 31% increase, at its Monon plant and its West Coast plant in Moreno Valley, California.

Production of CIMC container chassis, which are defined as incomplete trailers, are reported in adjoining columns.

♦ Stoughton Trailers LLC produced 16,750 units in 2019, a 6% increase over the prior year. This total includes dry vans, grain, livestock, and refrigerated trailers.

“We saw increases in production across our primary lines of dry and refrigerated vans, but we had slight reductions in grain and livestock levels,” says Bob Wahlin, president and CEO of Stoughton.

“With the tight labor market, our overall production increase was primarily the result of productivity gains supported through investment in automation and further implementation of lean manufacturing concepts. Also we continue to aggressively invest in team member development.

“It was an outstanding year for our company and the whole industry,” Wahlin adds. “Although production was strong throughout 2019, we steadily experienced softer order demand, particularly as the year closed.

“We don’t expect 2020 to be nearly as robust, but we do plan to take advantage of the industry pause to further invest in facilities, equipment, business systems advancement, research and development, and our team member development throughout our organization.”

♦ MANAC Inc of Saint-Georges, Quebec, built 8,200 trailers in 2019, down 1% from the company’s all-time best year in 2018.

“Van trailers remained strong throughout the year,” says Charles Dutil, president of MANAC. “But we saw some weakness in the various vocational lines during the second half of 2019.

“We expect 2020 to be another good year, but not at the record levels of the past two years.”

♦ EnTrans International LLC of Athens, Tennessee, reports shipments of 7,760 truck-trailers in 2019. This is a 1% increase or 76 trailers more than were shipped the previous year, according to Ryan Rockafellow, VP sales and marketing.

EnTrans shipments include tank trailers built by Heil Trailer International of Athens Tennessee, and Polar Tank Trailer of Holdingford, Minnesota, as well as the heavy-haul trailers built by Kalyn Siebert of Gatesville, Texas.

EnTrans International LLC is owned by American Industrial Partners, an operationally oriented middle-market private equity firm. It also owns other oil and gas related companies such as JARCO, SERVA and Polar Service Centers.

♦ Fontaine Trailer of Birmingham, Alabama, built 6,908 trailers in 2019, a 19% decrease from 2018.

“The first quarter of 2019 was our best quarter ever,” says Alan Briley, president of Fontaine Commercial Platform. “Now we are at or near the bottom of the cycle.”

Going from best to worst in 12 months can be depressing, but looking up from the bottom has to be optimistic.

♦ MAC Trailer Manufacturing of Alliance, Ohio, built 6,284 trailers in 2019, a 5% increase over 2018 production. The company also built 181 bodies for straight trucks, which are not counted in the trailer totals.

“We had a great year in 2019,” says Michael A. Conny, president of MAC Trailer Enterprises. “We also opened two new plants in our westward expansion. One is in Rhome, Texas, building pneumatic dry bulk tanks and liquid tank trailers, and the other in Davis, Oklahoma, is building all-aluminum flatbed trailers, drop-deck platforms, and dump trailers.”

♦ Pitts Enterprises dba Dorsey Trailer and Pitts Trailers produced a total of 4,865 trailers in 2019, which is a small increase of about 1% over 2018 production.

Over half of these were Pitts’ new all-aluminum flatbed and drop-deck platform trailers introduced three years ago and built in a dedicated 40,000-sq-ft facility in Elba, Alabama.

CEO Jeff Pitts sees continuing growth in 2020 for both the aluminum platform business in Elba and the company’s forestry trailer and heavy-haul trailer manufacturing at the headquarters plant in Pittsview, Alabama.

Also, a big potential may come from Pitts’ entry into container chassis production three years ago. The company is well-positioned to serve the Port of Charleston and other seaports in the Southeast.

♦ Reitnouer Inc in Birdsboro, Pennsylvania, built 3,963 all-aluminum flatbed trailers in 2019, a 7% increase over the previous year.

“We could have built 5,000 trailers, but we just could not hire enough quality workers,” says Bud Reitnouer, president. The company did expand the work force by about 10%, so now it is poised for a (questionably?) bigger 2020.

“The market slowed for the last two months of 2019, and now the first quarter of 2020 is challenging,” says Reitnouer. “There is still a good demand, but customers are not ordering as fast.”

Reitnouer flatbeds and drop-deck platforms are unusual in that they are all-aluminum and are bolted rather than welded. That customers are willing to pay for lighter weight is indicated by the fact that 90% of the Reitnouer trailers ride on aluminum wheels.

♦ East Manufacturing Co of Randolph, Ohio, built 3,249 mainly aluminum trailers in 2019, down 4% from 2018.

This company total includes 1,831 flatbeds, down only 2%; 858 dump trailers, down 25%; and 560 refuse transfer trailers, up 64%. East also built 131 truck bodies that are not counted in the trailer total.

Now in the first quarter of 2020, ordering is a little slow in the flatbed line but picking up activity across the board in the second quarter, reports Gary Brown, senior vice-president, operations.

♦ Timpte Inc in David City, Nebraska, built 2,952 hopper trailers for hauling grain and other bulk materials. This is down 4% from 2018, which was also down 4% from 2017.

“We have had a very busy start to the new year,” says Dale Jones, president. “I am forecasting market conditions will improve in 2020 in the range of 10% to 15%.”

Timpte just opened in January a new corporate center and product show room in Nebraska. The company also added two new sales, parts and service centers in 2019, one in Indiana and the other in Nebraska.

♦ Fruehauf de Mexico built 2,708 truck-trailers in 2019, a 14% increase over 2018. This includes van trailers, flatbeds, dump trailers, and tank trailers, as well as special designs and some truck bodies that are not counted in the trailer total.

Fruehauf de Mexico has been building trailers at the same plant 20 miles north of Mexico City for over 50 years. It is located on the Via Jose Lopez Portillo in the satellite city of Coacalco de Berriozabal. Some 500 employees work there. Carlos Porragas is chief executive officer of Fruehauf de Mexico.

♦ Kentucky Trailer of Louisville, Kentucky, built 2,645 trailers in 2019, a big increase of 42%, reports Gary Parker, chief operating officer.

Most of these were custom 53-ft van trailers with special tie-down equipment and underbody cargo boxes for hauling furniture and household goods. Kentucky also built 639 truck bodies for household goods moving companies, a 12% increase.

Some of the increased trailer production results from an acquisition of a company that manufactures bulk animal feed trailers.

♦ Trail King Industries in Mitchell, South Dakota, built 2,434 truck trailers in 2019, an increase of 1%. They also built 712 light-duty trailers with axles of less than 10,000-lb capacity, 5% fewer than in 2018.

“We enter 2020 with a good solid backlog typical of the strong, steady pace of the last two years,” says Gene Astolfi, chief financial officer.

“However, we are forecasting a 10% to 15% downturn for the year. Our customers in construction are nervous about unrest in the last half of the year.”

♦ Strick Corporation built 2,300 truck-trailers in 2019.

This includes 2,100 dry freight vans built in Strick’s van plant in Monroe, Indiana, and 200 logging and flatbed trailers built in Strick factories in Sumter, South Carolina and Berwick, Pennsylvania.

Strick also built 2,800 container chassis in its Sumter and Berwick plants, but these incomplete trailers are not counted in the full trailer rankings. Strick also built 400 converter dollies in its Monroe and Berwick factories, according to Ben Katz, marketing manager.

♦ Felling Trailers Inc of Saux Centre, Minnesota, built 1,793 truck-trailers in 2019, a 6% increase over the previous year. Patrick Jennissen, sales and marketing vice-president, says they also built 4,002 light-duty trailers having axle capacities of less than 10,000 each.

♦ XPO Logistics Trailer Manufacturing in Searcy, Arkansas, almost repeated its 2018 build numbers. The company built 1,770 van trailers in 2019, four trailers fewer than in 2018.

This includes 1,251 short doubles trailers 28-ft long, and 507 of the 48-ft vans. Only 12 of the 53-ft long trailers were built. All of these trailers were newly built.

XPO Logistics also built 10 van bodies for straight trucks, and they have another seven on order for 2020. Converter dollies are also needed, and XPO built 384 in 2019 and another 350 on order for 2020.

The order board for 2020 shows more new van trailers are planned, including 1,340 short doubles vans and 650 of the 48-ft trailers, according to Paul Reed, manufacturing general manager.

♦ Doepker Industries in Anaheim, Saskatchewan, Canada, built 1,517 truck-trailers in 2019, down by 453 units or 23% from the previous year. The year started off strong, but started trailing down in the second quarter, says Devin Leonard, Canadian director of sales and marketing.

The oil and gas sector and forestry took the biggest hits, but agriculture held up well. Doepker’s Super B-train ag hauler in both tandem axle and tri-axle configurations led the way. It is the company’s signature development and is expected to steady their market during the coming year.

♦ Premier Trailer Mfg. Inc, in Visalia, California, built 1,407 trailers in 2019, a 29% increase over 2018. Jason Evett, operations manager, predicted a year ago a 10% increase because of the strong growth in the tree nut industry.

The company primarily builds 22-ft long hopper trailers to haul tree nuts and grains in the fields and on the highway as doubles connected by a 6-ft drawbar. Further growth is coming from the flatbed trailer and cotton trailer segments.

“We anticipate the upward growth of the last three years will continue,” says Evett. “We are projecting an even bigger step in 2020—production and sales breaking the 2,000-unit mark.”

♦ Talbert Manufacturing in Rensselear, Indiana, built 1,272 trailers in 2019, a 20% increase over the previous year, which was also a big year (33% increase over 2017).

Talbert is best known for its heavy-haul trailers and the first detachable gooseneck patented by company founder Austin Talbert in 1947. This first mechanical detachable gooseneck was followed by development of hydraulically detachable goosenecks 15 years later.

Now the company has expanded into building many other heavy duty and construction-related trailer types. It also expanded geographically with a second manufacturing plant added in 2014 in Liberty, North Carolina. Troy Geisler, VP sales and marketing, continues to be optimistic for the coming year, at least through the election.

♦ Western Trailer in Boise, Idaho, built 1,258 trailers in 2019, a 10% increase over the previous year’s production.

“It was like a re-run of 2018,” says Todd Swanstrom, engineering manager. “We were busy all year, right through to the end of 2019, and now it is continuing into the new year.”

♦ Tremcar Inc in Montreal, Canada, built 1,088 tank trailers in 2019, a 13% increase over 2018. It also built 233 truck tanks for mounting on truck chassis at its tank truck plant in Malden, Massachusetts, a 7% increase.

Total Tremcar tanks produced in 2019 was 1,321 tanks, a 12% increase. Tremcar is anticipating a stable transition into 2020.

“We forecast a slight economic slowdown for both Canada and the USA of about 20% for the coming year,” says Melanie Dufresne, director of marketing and communications.

Top Container Chassis Builders

Container chassis are defined as incomplete trailers, just as are the containers (box van, flatbed, liquid tank, pressure gas tank) hauled on the chassis.

Container chassis manufacturers built about 51,000 chassis in 2018, but that output dropped to a little more than 30,000 in 2019.

The spike to 51,000 chassis in 2018 was a shock because production was more like 32,000 chassis for each of the past six years. Production did reach 40,000 chassis in 2015, the highest point since the year 2000, when about 44,000 chassis were assembled.

Chassis production numbers had previously been reported by the federal government along with truck-trailer numbers as part of the Census of Manufacturers. When those reports proved unreliable, the staff of Trailer/Body Builders started collecting trailer production numbers directly from trailer manufacturer executives in 1993.

♦ CIMC Intermodal Equipment is the largest manufacturer of container chassis trailers in the United States, and in the world, according to Frank Sonzala, president and CEO.

CIMC’s headquarters plant in South Gate, California, and newly renovated Eastern plant in Emporia, Virginia, had previously produced a record number of chassis in 2018, when it turned out 45,441 chassis, a 53% increase over 2017.

In 2019, however, the output from the two CIMC plants dropped to 25,369 chassis, down 44%.

In late January, the company announced a name change to a shorter CIE Manufacturing Inc.

♦ Strick Corporation has been building container chassis and other incomplete trailers since the start of intermodal containerization.

Strick plants in Berwick, Pennsylvania, and Sumter, South Carolina, built 2,800 intermodal container chassis in 2019, according to Ben Katz, marketing manager. This is down 20% from the 3,500 chassis in 2018.

♦ Hyundai Translead of San Diego, California, produced 1,621 container chassis in 2019, down 76% from the 6,621 reported in 2018. These incomplete trailers are built in Hyundai’s two plants in Tijuana, and Rosarito, Mexico, that built a record number of 66,097 full trailers in 2019.

♦ Pitts Enterprises in Pittsview and Elba, Alabama, is starting to build some container chassis because of its proximity to ports in the Southeast.