ACT Research points to reasons for trailer industry optimism

Another record year for trailer manufacturers may not be in the offing, but conditions look solid for continued healthy performance in the coming year, according to a series of speakers at the ACT Research seminar held March 21-22 in Columbus, Indiana.

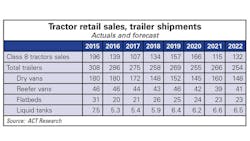

“In the last two months, with trailer orders ripping, our dry van forecast has gone from 135,000 to 160,000,” said Kenny Vieth, president of ACT Research. “That’s how strong orders have been over the last several months.

Vieth pointed out how in recent years trailer manufacturers have broken with their history of boom and bust. Coming out of the Great Recession, trailer shipments have rebounded and have hovered at or near record levels. And the ACT Research forecast calls for it to remain that way.

“There is something wrong with this picture,” Vieth said. “From 1980, trailer shipments have been up and down. I know this forecast is wrong, but I don’t know where it is wrong. One or two of these years will be profoundly wrong. There are enough questions economically. Stimulus? Do we end up with a trade war? 100% of Navistar’s heavy truck production comes out of Mexico, with Freightliner and Paccar at between 50% and 60%. What happens when you put a 20% tariff on those trucks?”

Yet the fundamentals point to continued good times. In the last five years, we have shipped more trailers than in any five-year period in history—1,329,000—as well has the most in any three-year period—862,000.

“We are forecasting that 2017 will be the fifth best year ever for the trailer industry—and we are predicting that there will be no meaningful downturn,” he said.

Yet trailer demographics are changing, Vieth said. Thanks to the growth of trailer shipments in recent years, the population of trailers sometime in 2017 will surpass the peak previously reached in 2006-2007.

“Very old units falling out of the fleet, combined with multiple years of solid demand are causing the age of the trailer fleet to decline rapidly,” Vieth said.

Nevertheless, enough pent-up demand exists—particularly in the dry-freight market, to reinforce trailer sales for the next few years.

“In aggregate, underlying replacement rates remain elevated through 2020-2021,” Vieth said. “There are still plenty of very old trailers that will need to be replaced. As long as the economy is doing okay, replacement demand will help drive trailers.”

Vieth said replacement demand is about 220,000 units per year. That will decline to about 208,000 in 2022.

“Economic cycles don’t die of old age,” Vieth said. “There is no reason why we can’t have economic growth through 2022. We think trucker profits will be pretty good throughout this period.”

Regulations are the wildcard

Question: Will there be a pre-buy as the Greenhouse Gas Phase 2 regulation is scheduled to take effect next year on 2018 model trailers?

ACT Research surveyed fleets earlier this year to find out. The answer: Doubtful—only 2% of the fleets surveyed indicated that they would buy trailers early in order to avoid having to buy GHG2-compliant trailers.

“The equipment that this regulation will require is here, it’s tested, and in works,” said ACT’s Frank Maly. “Still, there are some who will buy early in order to avoid the additional expense—even though these devices have shown that they can reduce fuel costs. Some people avoid buying new technology, and others have concerns about maintenance.”

Maly expects to see some uptick late in the year as small and medium fleets do some last-minute trailer shopping. The purchases, however, likely will be from dealer inventory, rather than placement of new orders.

Implementation of the regulation remains uncertain, however. The Truck Trailer Manufacturers Association lawsuit against the regulation has yet to be resolved. TTMA is trying to keep the regulation from being applied to trailers. The association’s argument is that Congress granted the EPA regulatory authority under the Clean Air Act. However, the Act only authorizes EPA to regulate motor vehicles. Trailers, TTMA points out, do not have motors.

The industry also could see a boost from 33-ft pup trailers, Maly said, but their future is uncertain. “They’re in…they’re out…they’re in…they’re out…etc.”

Adoption could generate a market for stretching existing 28-foot trailers to 33 feet, much like what occurred when maximum trailer length was extended to 48 feet back in the early 1980s.

Moving from 28-foot to 33-foot trailers would increase capacity 18%.

Current market conditions point to slower than 2016 (which was the third best year in industry history) but still good demand. Maly sees reasons for optimism, including:

• Solid labor numbers

• Positive growth in the Industrial Production Index

• Backlogs are growing, but lag 2015 and 2016.

• After a high rate previously, order cancellations generally now are back to expectations.

• And after a slow start, production is now back on track. Production, however, still trails last year’s levels.

• Flatbeds improving after significant cancellation pressure

• Liquid tanks bottomed out in mid-2016 and have been showing slow gains since.

A strong foundation

The U S economy is fundamentally strong, ACT Research chief economist Sam Kahan said to start off the two-day seminar. One of the strong points in the economy has been the strength of the housing market.

“Housing is a positive,” he said. “Growth has been subdued, but millennial household formation has begun to accelerate.”

Manufacturing is another sector of the economy that has grown lately. As a contributor to overall GDP, it is now on par with the service sector. Industrial production was unchanged in February, but manufacturing up a half percent.

Kahan expects GDP to grow 2-2.5% real growth this year.

Risks are associated with government, particularly fiscal policy.

“The budget deficit is especially important,” he said. “Will Republicans change past positions and blow up the deficit? Or will the Republican Party maintain discipline with regard to the deficit? Will Democrats cross the aisle?

Kahan expects no surprises from the Federal Reserve. Their decisions will be data-driven, well-advertised, and moderate as they wrestle between fear of inflation and fear of financial dislocation. He believes inflation will be around 2% this year.

Energy will remain a bargain. He expects oil to remain between $40 and $60 per barrel.

His forecast can be summarized this way:

• Economy is firm for 2017.

• The risk of recession in low for now. Beyond this year, the outlook will be impacted significantly on the policies coming out of Washington.

• Optimism is high but so is the uncertainty.

• The outlook for transportation is positive.

• Trade sector is major negative.

• A sustainable commodity price surge seems unlikely.

• US oil industry on the upswing

• Government policy appears positive but iffy.

• The prospect of infrastructure spending is a plus, but when will it be passed and how much? ♦

About the Author

Bruce Sauer

Editor

Bruce Sauer has been writing about the truck trailer, truck body and truck equipment industries since joining Trailer/Body Builders as an associate editor in 1974. During his career at Trailer/Body Builders, he has served as the magazine's managing editor and executive editor before being named editor of the magazine in 1999. He holds a Bachelor of Journalism degree from the University of Texas at Austin.