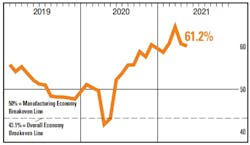

Economic activity in the manufacturing sector grew in May, with the overall economy notching a 12th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

The May Manufacturing PMI registered 61.2 percent, an increase of 0.5 percentage point from the April reading of 60.7 percent, according to the Institute for Supply Management. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. A Manufacturing PMI above 43.1 percent, over a period of time, generally indicates an expansion of the overall economy.

“The manufacturing economy continued expansion in May. Business Survey Committee panelists reported that their companies and suppliers continue to struggle to meet increasing levels of demand,” Timothy R. Fiore, chair of the ISM manufacturing business survey committee, said. “Record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy.

“Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential.”

Still, optimistic panel sentiment increased, with 36 positive comments for every cautious comment, compared to an 11-to-1 ratio in April.

What respondents are saying

- “Ongoing component shortages are driving dual sourcing and longer-term supply plans to be implemented.” [Transportation Equipment]

- “[A] lack of qualified candidates to fill both open office and shop positions is having a negative impact on production throughput. Challenges mounting for meeting delivery dates to customers due to material and services shortages and protracted lead times. This situation does not look to improve until possibly the fourth quarter of 2021 or beyond.” [Fabricated Metal Products]

- “Labor shortages impacting internal and supplier production. Logistics performance is terrible.” [Electrical Equipment, Appliances & Components]

- “Seeing a high demand and backlog of orders.” [Plastics & Rubber Products]

- “Very busy, but still experiencing labor shortages.” [Primary Metals]

Broadly, Demand expanded, with the New Orders Index growing at a strong level, supported by the New Export Orders Index continuing to expand; the Customers’ Inventories Index hitting another all-time low; and Backlog of Orders Index continuing at a record-high level.

Consumption (measured by the Production and Employment indexes) indicated slowing expansion, posting a combined 8.2-percentage point decrease to the Manufacturing PMI calculation. The Employment Index expanded for the sixth straight month, but panelists continue to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities. Consumption was clearly limited due to labor issues and supply constraints as demand remains very high.

Inputs—expressed as supplier deliveries, inventories, and imports—continued to support input-driven constraints to production expansion, at higher rates compared to April, due to continued trouble in supplier deliveries. The Prices Index expanded for the 12th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.