Metalformers more optimistic about economic conditions: PMA

Metalforming manufacturers are showing signs of improved confidence in near-term economic conditions, according to the July 2025 Precision Metalforming Association (PMA) Business Conditions Report. Prepared monthly, PMA’s report provides an economic indicator for the next three months of manufacturing, sampling 95 metalforming companies in the United States and Canada.

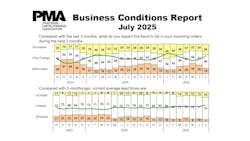

PMA’s July report shows that 27% of surveyed manufacturers anticipate an increase in general economic activity in the next three months (up from 24% in June and only 16% in May), 54% predict no change in activity (compared to 48% in June) and 19% expect a decrease in activity (an improvement from 28% in June and 38% in May).

“Our latest Business Conditions Report shows more optimism over economic conditions among PMA members,” said PMA President David Klotz. “Manufacturers welcomed the signing of the One Big Beautiful Bill Act (OBBBA) on July 4. The law brings long-sought tax certainty and includes important pro-manufacturing provisions advocated for by PMA’s government affairs committee and our One Voice advocacy team in Washington, D.C.—such as restoring 100% bonus depreciation, allowing full and immediate expensing of R&D activities, and making permanent the 20% passthrough deduction under Section 199A, which directly benefits two-thirds of our members.

“However, manufacturers still face challenges from trade uncertainty and continue to advocate for trade policies that support their global competitiveness and help drive job creation.”

Metalformers also predict an increase in incoming orders in the next three months, with 36% of survey respondents anticipating an increase (compared to 24% in June), 46% expecting no change (compared to 47% last month) and 18% forecasting a decrease in orders (down from 29% reported in June).

Current average daily shipping levels remained relatively steady in July, with 50% reporting no change in shipping orders (compared to 42% in June), 23% reporting an increase in shipping levels (compared to 29% last month) and 27% reporting a decrease in levels (compared to 29% in June).

The survey also showed that only 8% of respondents had workers on short time or layoff in July (down from 13% in June), while 36% are currently expanding their workforce (compared to 35% in June). Eighteen percent of respondents reported an increase in lead times in July, up from 13% in June.