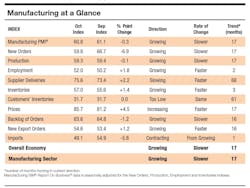

Economic activity in the manufacturing sector grew in October, with the overall economy achieving a 17th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The October Manufacturing PMI registered 60.8 percent, a decrease of 0.3 percentage point from the September reading of 61.1 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. A Manufacturing PMI above 43.1 percent, over a period of time, generally indicates an expansion of the overall economy.

“Business Survey Committee panelists reported that their companies and suppliers continue to deal with an unprecedented number of hurdles to meet increasing demand. All segments of the manufacturing economy are impacted by record-long raw materials lead times, continued shortages of critical materials, rising commodities prices and difficulties in transporting products,” Timothy R. Fiore, chair of the ISM manufacturing business survey committee, said. “Global pandemic-related issues—worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions and overseas supply chain problems—continue to limit manufacturing growth potential.”

Nonetheless, panel sentiment remains strongly optimistic, with four positive growth comments for every cautious comment, according to the report. Panelists are fully focused on supply chain issues in order to respond to the ongoing high levels of demand.

What respondents are saying

- “Strong sales continue; however, we have diverted chips (semiconductors) to our higher-margin vehicles and stopped or limited the lower-margin vehicle production schedules.” [Transportation Equipment]

- “Domestic original equipment manufacturer (OEM) capital-expenditure spending is trending up for our business. We are seeing an increase of capital equipment with life spans of more than 10 years in the fourth quarter.” [Fabricated Metal Products]

- “Customer demand remains high. COVID-19 related supply chain issues still hamper our ability to meet demand. Labor is still difficult for our suppliers to obtain, and labor costs are rising.” [Machinery]

- “Demand for our products remains strong, but we continue to struggle to secure enough raw material to keep our manufacturing lines running.” [Miscellaneous Manufacturing]

- “My prediction is that 2022 will be very similar to 2021 — similar demand, constrained supply, restricted logistics and rampant inflation.” [Plastics & Rubber Products]

Consumption (measured by the Production and Employment indexes) grew during the period, with a combined 1.7-percentage point increase to the Manufacturing PMI calculation. Although the Employment Index expanded for a second month, hiring difficulties at panelists’ companies show no significant signs of abating.

Inputs—expressed as supplier deliveries, inventories, and imports—continued to help constrain production expansion, especially with a contraction in imports, compared to September. The Supplier Deliveries Index slowed, while the Inventories Index continued to expand faster due to work-in-process inventory held longer due to key part shortages and more finished goods inventory held due to downstream customer issues. The Prices Index expanded for the 17th consecutive month, at a faster rate in October, indicating continued supplier pricing power and scarcity of supply chain goods.