Manufacturing remains strong, despite challenges: ISM report

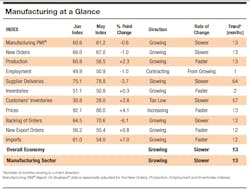

Economic activity in the manufacturing sector grew in June, with the overall economy notching a 13th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM Report On Business by the Institute for Supply Management.

The Manufacturing PMI registered 60.6 percent, 0.6 percentage point lower than the May reading of 61.2 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. A Manufacturing PMI above 43.1 percent, over a period of time, generally indicates an expansion of the overall economy.

“Business Survey Committee panelists reported that their companies and suppliers continue to struggle to meet increasing levels of demand,” Timothy R. Fiore, chair of the ISM manufacturing business survey committee, said. “Record-long raw-material lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy.

“Worker absenteeism, short-term shutdowns due to parts shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential.”

Still, optimistic panel sentiment remained strong, with 16 positive comments for every cautious comment.

What respondents are saying

- “Strong sales continue, and production output is at 100 percent. COVID-19 restrictions have been mostly lifted. Global chip allocation continues to limit some feature offerings — production schedules have been updated to restrict content affected by the chip shortage.” [Transportation Equipment]

- “Demand continues to be strong, and customer-ordering patterns are shifting to include long-term demand. Customers are now placing orders for fourth quarter 2021 and first quarter 2022 due to global supply chain issues.” [Fabricated Metal Products]

- “Customer demand remains strong. Supply chain issues continue to hamper materials availability and impact production scheduling. Supplier costs continue to rise due to increasing materials, labor and shipping costs.” [Machinery]

- “We continue to be oversold, based on what we are currently capable of producing. Lack of labor is killing us.” [Primary Metals]

- “Continue to see very strong demand across all business units. In many cases, we are limited on our ability to supply by raw-materials availability. Still running at record volume but could be producing much more. Even if we were able to get all the raw materials needed, we would have capacity issues on many of our production units. Manpower has been a concern.” [Chemical Products]

Broadly, demand expanded, with the New Orders Index growing, supported by the New Export Orders Index continuing to expand; the Customers’ Inventories Index continuing at very low levels; and Backlog of Orders Index continuing at a very high level.

Consumption (measured by the Production and Employment indexes) improved in the period, posting a combined 1.3-percentage point increase to the Manufacturing PMI calculation. The Employment Index, which held back further expansion, contracted after six straight months of expansion, as panelists continued to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities.

Inputs—expressed as supplier deliveries, inventories, and imports—continued to support input-driven constraints to production expansion, at higher rates compared to May, due to continued trouble in supplier deliveries. The Prices Index expanded for the 13th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.