US manufacturing grows at fastest rate in nearly 40 years: ISM

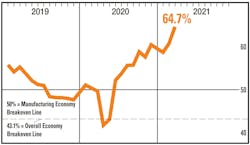

Despite parts and labor challenges, economic activity in the manufacturing sector grew in March to the highest level in almost 40 years, with the overall economy notching a 10th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

Indeed, the Manufacturing PMI registered 64.7 percent, 3.9 percentage points higher than the February reading of 60.8 percent. This is the highest reading since December 1983 (69.9 percent); prior to that, the Manufacturing PMI registered 66 percent in November 1983, according to the Institute for Supply Management. A Manufacturing PMI above 43.1 percent, over a period of time, generally indicates an expansion of the overall economy.

“The manufacturing economy continued its recovery in March. However, survey committee members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials,” Timothy R. Fiore, chair of the ISM manufacturing business survey committee, said. “Extended lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are affecting all segments of the manufacturing economy.

“Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential.”

But optimistic panel sentiment did increase, Fiore noted, with eight positive comments for every cautious comment, compared to a 5-to-1 ratio in February.

What respondents are saying

- “Business conditions are positive for our industry and company. The constraints are mainly related to parts availability (imports, supply chain congestion). Manpower is also a constraint; hiring new members is a challenge.” (Transportation Equipment)

- “A lack of qualified machine and fabrication shop talent makes it difficult to keep up with production demands when there is no backup (second string). Qualified new hires are an ongoing challenge. We have had to provide better compensation to keep qualified talent. Raw-material prices are up 50 percent to 60 percent over the last six months, which results in increased prices to our customers and a disincentive to build inventory.” (Fabricated Metal Products)

- “Widespread supply chain issues. Suppliers are struggling to manage demand and capacity in the face of chronic logistics and labor issues. No end in sight.” (Machinery)

- “Tremendous stress on the supply chain since the winter storm in Texas. Chemicals are on allocations or unavailable. Resin is on allocation and unavailable.” (Plastics & Rubber Products)

Broadly, Demand expanded, with the New Orders Index growing at a strong level, supported by the New Export Orders Index continuing to expand, Customers’ Inventories Index at an all-time low and Backlog of Orders Index growing to an all-time high.

Consumption (measured by the Production and Employment indexes) contributed positively—a combined 10.1-percentage point increase—to the Manufacturing PMI calculation. All top six industries reported moderate to strong expansion. The Employment Index expanded for the fourth straight month, but panelists continue to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities.

Inputs—expressed as supplier deliveries, inventories, and imports—continued to support input-driven constraints to production expansion, at higher rates compared to February. Inputs positively contributed to the PMI calculation, by a combined 5.7 percentage points. The importation of items marginally slowed in the period, driven by port backlogs. The Prices Index expanded for the 10th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.

Breaking down the PMI:

- The New Orders Index registered 68 percent in March, up 3.2 percentage points compared to the 64.8 percent reported in February. This indicates that new orders grew for the 10th consecutive month. This is the highest reading since January 2004, when the index registered 70.6 percent.

- The Production Index registered 68.1 percent in March, 4.9 percentage points higher than the February reading of 63.2 percent, indicating growth for the 10th consecutive month. This is the highest reading since January 2004, when the index registered 69.3 percent.

- The Employment Index registered 59.6 percent in March, 5.2 percentage points higher than the February reading of 54.4 percent. “The Employment Index grew for the fourth month in a row. This is the highest reading since February 2018 (59.8 percent); the index registered 62.1 percent in June 2011.

- The delivery performance of suppliers to manufacturing organizations was slower in March, as the Supplier Deliveries Index registered 76.6 percent. This is 4.6 percentage points higher than the 72 percent reported in February. This is the highest reading since April 1974—at the end of the 1973 oil crisis—when the index registered 82.1 percent.

- The Inventories Index registered 50.8 percent in March, 1.1 percentage points higher than the 49.7 percent reported for February. The Inventories Index moved back into growth territory after contracting for one month.

- The Customers’ Inventories Index registered 29.9 percent in March, 2.6 percentage points lower than the 32.5 percent reported for February, indicating that customers’ inventory levels were considered too low.

- The Prices Index registered 85.6 percent, a decrease of 0.4 percentage point compared to the February reading of 86 percent, indicating raw materials prices increased for the 10th consecutive month. In the last two months, the index has been at its highest levels since July 2008, when it registered 90.4 percent.

- The Backlog of Orders Index registered 67.5 percent in March, a 3.5-percentage point increase compared to the 64 percent reported in February, indicating order backlogs expanded for the ninth straight month. March’s reading is the highest since reporting for this subindex began in January 1993.

- The New Export Orders Index registered 54.5 percent in March, down 2.7 percentage points compared to the February reading of 57.2 percent.

- The Imports Index registered 56.7 percent in March, an increase of 0.6 percentage point compared to the 56.1 percent reported for February.