Economic activity in the manufacturing sector grew in September, with the overall economy notching a fifth consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

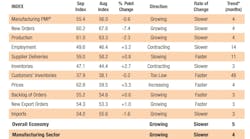

The September PMI registered 55.4 percent, down 0.6 percentage point from the August reading of 56 percent.

“This figure indicates expansion in the overall economy for the fifth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth,” Timothy R. Fiore, chair of the Institute for Supply Management Manufacturing Business Survey Committee, says. “After the coronavirus (COVID-19) pandemic brought manufacturing activity to historic lows, the sector continued its recovery in September.

“Survey Committee members reported that their companies and suppliers continue to operate in reconfigured factories and are becoming more proficient at maintaining output. Panel sentiment was optimistic (2.3 positive comments for every cautious comment), an improvement compared to August.”

- The New Orders Index registered 60.2%, a decrease of 7.4 percentage points from the August reading of 67.6%

- The Production Index registered 61%, down 2.3 percentage points

- The Backlog of Orders Index registered 55.2%, 0.6 percentage point higher

- The Employment Index registered 49.6%, an increase of 3.2 percentage points

- The Supplier Deliveries Index registered 59%, up 0.8 percentage point (a reading above 50% indicates slower deliveries)

- The Inventories Index registered 47.1%, 2.7 percentage points higher

- The Prices Index registered 62.8%, up 3.3 percentage

- The New Export Orders Index registered 54.3%, an increase of 1 percentage point; and

- The Imports Index registered 54%, a 1.6-percentage point decrease.

Demand expanded, with the (1) New Orders Index growing at strong levels, supported by the New Export Orders Index expanding moderately, (2) Customers' Inventories Index at its lowest figure since June 2010, a level considered a positive for future production, and the (3) Backlog of Orders Index expanding at a faster rate compared to the prior two months.

Consumption (measured by the Production and Employment indexes) contributed positively (a combined 0.9-percentage point increase) to the PMI calculation, with five of the top six industries continuing to expand output strongly. Employment neared expansion territory for the first time since July 2019.

Inputs—expressed as supplier deliveries, inventories and imports—continued to indicate input-driven constraints to further production expansion, but at slower rates compared to August. Inventory levels contracted again due to strong production output and supplier delivery difficulties. Overall, inputs improved compared to August and contributed positively to the PMI calculation. (The Supplier Deliveries and Inventories indexes directly factor into the PMI; the Imports Index does not.) Prices continued to expand at higher rates, reflecting a continued shift to seller pricing power—a positive for new-order growth.

"Suppliers continue to struggle to deliver, with deliveries slowing at a faster rate compared to August. Transportation challenges and continuing difficulties in supplier labor markets are still constraints to production growth,” Fiore says. “The Supplier Deliveries Index reflects the difficulties suppliers continue to experience due to COVID-19 impacts. These issues are not expected to diminish soon and, at this time, represent a continuing hurdle to production output and inventories growth.”

Among the six biggest manufacturing industries, Food, Beverage & Tobacco Products remains the best-performing sector, with Fabricated Metal Products and Chemical Products growing strongly. Computer & Electronic Products and Transportation Equipment expanded moderately. Petroleum & Coal Products remained a headwind to PMI performance, Fiore reported.

"Manufacturing performed well in the month with demand, consumption and inputs registering growth indicative of a normal expansion cycle,” Fiore says. “While certain industry sectors are experiencing difficulties that will continue in the near term, the manufacturing community as a whole has learned to conduct business effectively and deal with the variables imposed by the COVID-19 pandemic.”

What respondents are saying

- "Business is booming, and the supply chain has been caught off guard. We are working closely with our suppliers to ensure supply and try to control costs. The resin industry, along with plastics, is driving cost increases and scarce availability." (Transportation Equipment)

- "Our business has not begun to recover." (Petroleum & Coal Products)

- "Overall business conditions are improving, but not at the rates we saw them decline." (Fabricated Metal Products)

- "Our customer order intake is increasing significantly for deliveries in the first half of 2021. Outlook is generally positive." (Machinery)

- "Demand remains high, strong finish to 2020 projected, with an even stronger 2021 fiscal year. Prices have increased in certain categories, but no major price increases of our own have been implemented yet. We are seeing an uptick in reshoring opportunities in the third quarter across various industries and products." (Electrical Equipment, Appliances & Components)

- "Raw material shortages, especially of hardwood logs, are starting to impact overall supply. Domestic market demand is fragmented but remains sound. Export demand, especially to China, is robust." (Wood Products)

- "Business has continued to be strong, with September following August. October is also shaping up to be a good sales month as well." (Plastics & Rubber Products)