Allison to buy Dana's off-highway business

Allison Transmission Holdings Inc. has entered into an agreement to acquire the Off-Highway business of Dana Incorporated for approximately $2.7 billion.

This acquisition aligns with Allison's strategic priorities to expand its emerging markets footprint, enhance core technologies and deliver strong financial results, according to a news release outlining the deal. Upon completion of the transaction, Allison will be able to offer a wider range of commercial-duty powertrain and industrial solutions to more customers and end users worldwide.

"This acquisition marks a transformative milestone in our commitment to empowering our current and future customers with propulsion and drivetrain solutions that Improve the Way the World Works," said David Graziosi, Allison Transmission chair and CEO. "We look forward to harnessing this momentum to increase value for all of our stakeholders worldwide."

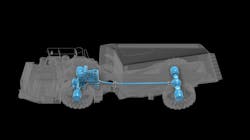

Dana's Off-Highway business operates in over 25 countries and serves a global customer base supported by approximately 11,000 employees, providing solutions for a wide range of applications in construction, forestry, agriculture, specialty, aftermarket, industrial and mining.

"Dana's off-highway business has long been committed to delivering innovative solutions for off-highway applications, and we are confident that under Allison's ownership, the team will be well-positioned to continue that legacy," said R. Bruce McDonald, Dana chair and CEO. "This agreement represents a strategic opportunity to ensure the ongoing success of the business, while allowing Dana to focus on our core priorities. We look forward to seeing the off-highway business thrive under Allison's leadership."

Allison will deploy a transition and integration process across the business that continues to support customers, employees, suppliers and partners.

The acquisition was approved by both companies' boards of directors, and it is expected to close late in the fourth quarter of 2025, pending customary regulatory approvals.