Aftermarket forecast ‘positive’

While the forecast for the heavy-duty aftermarket is “not exactly robust,” MacKay & Co. Vice President John Blodgett suggests it’s still “a good forecast, a positive forecast” based on the growing population of commercial trucks and trailers on the road.

“If we look at the number of vehicles that we’ve seen sold into the marketplace the last couple of years, and if the forecasts hold true for what they anticipate to be sold this year and into next year, there’s going to be a nice sweet spot of a lot of vehicles down the road that positively impacts the aftermarket,” Blodgett said, speaking at Heavy Duty Aftermarket Dialogue, ahead of this year’s HDAW.

That forecast was backed by an extensive analysis of the numbers.

U.S. retail sales of Class 6-8 trucks is projected to remain stable through 2020, and slightly above the 20-year average of 125,000 vehicles per year. In Class 8, sales will continue to climb this year, up another 10% peaking at 274,000 trucks, before taking a 12% percent dip in 2020. Still, Class 8 sales remain at a very high level, well above the 20-year average of 189,000 vehicles. Sales of heavy-duty trailers also will continue at near record numbers, though falling off slightly from 2018’s 316,000 trailers in 2019 and 2020. The 20-year average for trailer sales is 223,000 units.

“Again, strong numbers,” Blodgett said. “So the more vehicles we sell and put out there in the marketplace, down the road that has a good impact. That’s a big positive, as long as the economy is chugging, for the aftermarket.”

But, Blodgett noted, the “very robust” Class 8 and trailer forecasts for 2019 were based on the large number of backlog orders already on the books, and that it will be several months into the year before manufacturers will know if fleets are going to “walk the walk” and take delivery, or cancel.

Adding all those new vehicles to the U.S. commercial fleet, the total operating population forecast through 2023 shows a 12% increase in Class 6 trucks, climbing to 924,000 vehicles; Class 7 will drop 6% to 1.25 million; and Class 8 will climb 8% to 3.68 million. The highway trailer population will rise 7% to 4.9 million units.

Translating those population totals into aftermarket sales, the MacKay & Co. forecast calls for a steady climb from 2018’s $30.1 billion to $36.3 billion by 2023. That’s a compound annual growth rate of 3.8%.

Breaking down aftermarket sales by point of final sale, truck dealers claimed a 49% slice of the pie chart, with heavy-duty distributors getting 18% of the business and independent garages 9%.

Looking more closely, MacKay & Co. surveys aftermarket distributors to develop an overall industry parts pricing forecast. Blodgett noted that the survey for 2018 was not quite complete at the time of his presentation, but the preliminary result shows an increase of 3%, more than double the 1.3% forecast. And that comes after a 1.7% increase in 2017. For this year, the parts pricing forecast calls for a 1.5% increase.

For its Aftermarket Index, MacKay & Co. surveys component manufacturers, with U.S. respondents reporting parts sales up 7.4% in 2018. That represents a 9.7% increase in sales to original equipment suppliers and 4.2% increase for the independent channel.

“It was a more positive year than we initially anticipated,” Blodgett said.

MacKay & Co. also conducts a monthly sales survey with heavy-duty distributors, independent parts distributors and truck dealers. For dealers, parts sales have rebounded after a slip in 2016, improving 3 or 4% throughout most of 2017 before climbing to a 10% level of gain through the first half of 2018 then settling in the 7-8% range.

“That’s another strong indication of a good year for the aftermarket for the truck dealer segment, and was a similar profile for the heavy-duty distributors,” Blodgett said, although the parts sales gains reported for 2018 ran at a steady rate of about 4%.

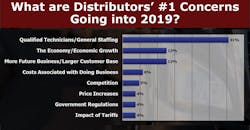

MacKay & Co. also surveyed fleets and distributors regarding their leading concerns for 2019, For fleets, the top three remained the same from 2018, although the order was shuffled: General economic activity came in as the top concern, followed by driver shortages and the complexity of new components.

Distributors easily were the most concerned about finding qualified technicians, followed by the economy and growing their business.

“I think the economy is a little bit more top of mind, both on the distribution side and for the fleet,” Blodgett said.