THE commercial truck industry can look forward to continued growth — but in an economy that may not be bouncing back from the recession quite as quickly as forecasters previously had thought.

Such was the consensus from four analysts who spoke at the National Truck Equipment Association's annual Business and Market Planning Summit September 19 in Dearborn, Michigan.

Each of the four watches the commercial truck and trailer industry closely. Speaking at the summit were Steve Latin-Kasper, the National Truck Equipment Association's market data and research director; Eli Lustgarten, senior vice-president of Longbow Securities; Ken Kremar, principal for the Industry Practices Group of Global Insight; and G Mustafa Mohatarem, chief economist for General Motors.

Latin-Kasper provided some very specific information for truck body manufacturers and truck equipment distributors regarding what could happen in the market in the near future. He said there are both positives and negatives as we close out 2011.

But it is being negatively impacted by erratic consumer confidence, federal budget deficits, persistent unemployment, real-income issues, high-inflation commodities, construction-industry woes, media negativity, and lower state and local expenditures.

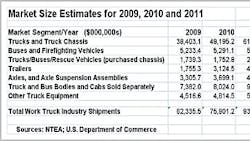

According to the NTEA and the US Department of Commerce, trucks and truck chassis — by far the largest market segment — were projected to grow 24% in 2011, while the biggest growth was expected to come in trailers (58%). Truck equipment shipments were projected to grow 21.6% — 1% more than in 2010 and a 47% increase over 2009.

The medium-duty trucks' production index is expected to grow by over 20% in 2012, with heavy trucks over 40%.

North American factory shipments compared to retail sales of straight trucks (Classes 7 and 8) will parallel each other and show strong gains, as will the market in tractors.

Through June, US straight truck chassis retail sales (box-off) were up 28.6% year-to-date over 2010, led by conventional (40%), cutaway (15.8%), LCOE (11.2%), and strip (5.4%). By GVWR: Class 2 (118.4%), Class 5 (69.8%), Class 6 (39.7%), Class 8 (34.4%), Class 4 (22.2%), Class 7 (10.5%), and Class 3 (-11.5%). US tractor retail sales (Class 7-8) were up 45.5%.

While business truck production increased 115% in 2010, state and local government spending on equipment fell 7%, but both trended in opposite directions in 2011. Total private construction stayed flat while business truck production skyrocketed, but both trended in opposite directions in 2011.

Producer price indexes for steel and steel products increased between June 2010 and June 2011, except for hot rolled sheet and strip (down 1.9%). The biggest gains were seen in aluminum sheet (20.5%), carbon steel scrap (20.2%), hot-rolled bars, plates, and shapes (11.6%), and steel pipe and tubes (11.5%).

Producer price indexes for trucks, buses, trailers, truck equipment, and selected materials were steadier between June 2010 and June 2011. Dump bodies were down 4.7%, while truck trailers and chassis (10,000 lbs per axle and over) experienced the biggest gain at 6.3%.

Expanding horizons

For those who aren't paying attention, Latin-Kasper hammered home a familiar message during his annual Truck Equipment Market Outlook presentation: Export markets are busting out.

“Because of the US dollar remaining low in terms of other currencies, 2012 will be another good year to find customers overseas,” he said.

The US's top trading partners were projected to stay in the same order in 2011, but the volume keeps increasing.

In imports: Mexico ($15.1 billion, compared to $13.4 billion in 2010), Canada ($1.49 billion, $1.36 billion), Japan ($579 million, $506 million), Germany ($309 million, $212 million), and the UK ($240 million, $168 million). In exports: Canada ($13.25 billion, $11.17 billion), Australia ($1.15 billion, $895 million), Mexico, ($604 million, $647 million), China ($581 million, $269 million), and Brazil ($234 million, $183 million).

In US exports of trucks, buses, bodies and other truck equipment, China is projected to show a dramatic 115% increase in 2011. Russia, a smaller player at $304 million, will be up 54%, and France, with $112 million this year after just $44 million in 2010, will be up 150%. Japan is projected to increase 35%, from $34.2 million to $46.3 million. The Mideast and Africa will grow 33%, from $705 million to $940 million.

US real GDP, which grew at a rate of 1.2% in the second quarter, was projected to grow at 2.1% in the third quarter and 2.5% in the fourth quarter, then stay between 2.2% and 2.8% next year.

Industrial Markets Outlook

Eli Lustgarten

Senior Vice President, Longbow Securities

Lustgarten said the recovery for on-highway vehicles gained steam in 2011, with the truck sector leading industrial market growth.

“Large fleets are now making money and have access to capital. Medium and small fleets are still having a hard time getting capital.

“A recent surge in orders has slowed, but a big backlog suggests that demand is there for production in the 250,000 to 265,000 range. Can the supply chain rise to the occasion? Bottlenecks include chassis components, transmissions, and tires.”

Up in a down market

Lustgarten said construction equipment experienced a strong demand in 2011 because of tax incentives, but construction activity remains the most challenged sector within the US economy.

Housing activity continues to remain muted, with the National Association of Home Builders further reducing its 2011 housing start outlook to 593,000 from 615,000 (it was 688,000 and 739,000), or 1.3% above the 585,000 in 2010. The 2012 preliminary forecast is now 728,000, up 23%.

Non-residential spending fell 13.9% in 2010, with private non-residential down 23.3% and public non-residential down 3.4%. He said he anticipates a modest, mid-single-digit gain in the non-residential sector this year.

“Infrastructure spending will likely be flat at best in 2011, or at least until a new highway bill is passed,” he said. “History suggests that growth will resume about a year after the new highway bill has been funded.”

A new proposal is emerging for the Highway/Transit Trust Fund, authorizing $230 billion over six years, he said. This funding proposal of $35 billion to $42 billion per year matches current revenue being deposited into the Highway Trust Fund and complies with House rules that do not permit authorization of more funds than collected. (The current spending level is $51.5 billion but exceeds funds collected.)

“Improving global economic activity continues to place pressure on input costs to the construction sector, with prices rising for most commodities, including copper, diesel fuel, steel, and components such as concrete-reinforcing bars and structural products placing further pressure on contractor profitability and a major headwind to the recovery of non-residential activity,” he said.

Strong sales for construction equipment?

Lustgarten said that while construction expenditures will still only see modest recovery, spending on new construction machinery may accelerate and be far stronger than originally anticipated.

“Our original forecast for sales and production of all classes of machines to rise at least double digits (10-15%) is too conservative, with gains in the 25% to 35% range or more possible, driven by several factors spurring more intense buying, particularly in the second half of 2011,” he said. “There is a new, more generous 100% bonus depreciation, which is set to expire at the end of 2011. Price increases for new equipment are being driven by two key factors: higher input costs (steel, copper aluminum) raising prices by about 2%; and regulatory-driven cost increases such as the implementation of Interim Tier 4 over the next several years, which we believe will ultimately drive up equipment prices by about 12%. These higher prices will likely be phased in about 4% increments. With rising, albeit modestly, construction outlays, the need for normal replacement will occur as most construction equipment fleets have aged (and shrunk), particularly in the rental sector.”

He said that used equipment prices are rising. Rental fleets are expanding and aftermarket demand is improving. With more stable industry activity, construction equipment demand has risen materially.

“The key to the current strength in equipment demand is fleet replacement,” he said. “The level of equipment sales was well below replacement levels, even at current levels of construction activity. Construction equipment sales fell over 66% from their peak in 2006 to the trough in mid-2009. Most construction equipment fleets have aged and shrunk during the downturn.

Past, present, future

In recapping the overall economy, Lustgarten said the recession likely ended in mid-2009, followed by modest recovery into 2010, which was a transition year leading up to 2011, during which the economic outlook was dependent on real growth in demand. The next year will be a search for a “new normal level of demand.”

He said most markets won't return to the recent 2006 to 2008 peaks — 2006 was the peak for housing, auto, trucks, and construction equipment.

There has been strong growth in China, India, and Brazil, leading the global economic upturn.

“The US is generally positive, with clear strength in manufacturing, and Europe and Japan show signs of slow economic growth,” he said. “But there are numerous concerns that may lead to volatility in world financial markets, especially the uncertain financial stability of the Sovereign Nationals: Greece, Portugal, Spain, and Ireland. Even in the US, there are rising concerns about Fannie/Freddie and state financial conditions, especially California, New York, and Illinois. What is the exit path for all the fiscal/monetary stimulus? There is concern over bank exposure to commercial real estate.”

He said productivity gains have been significant since the second quarter of 2009, driving 2009-2011 earnings surprises until now.

“Productivity is usually weak in a recession,” he said. “Manufacturing productivity improved since the second quarter of 2009, while costs plummeted. Increased productivity has been evident in strong operating margin rebound for many companies, post-2009 restructuring.

“Margins for many have approached or exceeded 2008 levels, though absolute earnings trailed prior peaks in 2010 due to lack of revenue recovery. In 2009, temporary (zero bonus payouts, furloughs, pay reductions, travel restrictions, eliminate overtime) and structural measures (layoffs, plant consolidations and closings, increased automation) were used to reduce costs.

Climbing out of a hole

Lustgarten said there was slow industrial capacity utilization recovery in 2010 — “a deep hole to climb out of in 2011.” Manufacturing Capacity Utilization is still in the mid-70s, compared to more normal upper-70s levels of the past decade.

He said there was little need for capital equipment for expansion in 2010.

“Production increases were mostly related to end-of-inventory liquidation; the production level will more closely match end-market sales,” he said. “2010 favored energy efficiency and productivity enhancement. There was a faster recovery for technology, components, and consumables as industrial production rose.”

He said a major upward revision in the personal saving rate coincided with a sharp decline in overall financial obligations as a percentage of disposable income, suggesting that the consumers are in better shape than suggested by earlier data. The savings rate peaked at 7% in the second quarter of 2009 and remained above 5% all year.

More money, less housing

Lustgarten said we have experienced decent real growth in disposable income, growth in exports, and business spending for equipment and software.

However, housing is still “going nowhere,” and federal government spending remains volatile and is under increasing pressure, and state and local government spending has been falling at a 3.4% rate in 2011.

“Consumer confidence indexes are consistent with slow growth in real consumption,” he said. “The University of Michigan index fell off a cliff in August. The high level of inventory benefit to the economy has come to an end. Monthly jobs reports continue the trend of a very slow recovery in employment.

Lustgarten said a real increase in demand is the key driver of economic growth in 2011.

“2010 was the year of the component supplier, but supply chains will likely have been stabilized in 2011, ending the component boom,” he said. “Virtually all industrial end markets will grow at least low double-digits in 2011, with trucks and rail the strongest — over 60% — and defense the weakest.

Just not stimulated

The impact of the original government stimulus program will wane, he said. The bipartisan bill supporting an extension of accelerated/bonus depreciation rules is likely to bring demand forward into 2011 at the expense of 2012.

“2011 will be the year of equipment demand, which will strengthen markedly,” he said.

He said the new more normal level of demand was perceived to be lower than the end-market demand realized from 2006-2008. The auto market is unlikely to return quickly to 16 to 17 million car sales that prevailed from 1999-2005 (“perhaps 12 million to 14 million is the new norm”) and housing is unlikely to return quickly to two million starts (“the new norm may be 1.3 to 1.6 million over the next few years, with cautious funding keeping starts well below one million at least through 2012”).

He believes the truck market is likely to return to more normal levels of demand as early as this year, with Class 8 trucks in the 240,000 to 265,000 range, but the prior level peak of 376,000 is unlikely until at least the next emission cycle.

A look at the segments

Lustgarten blazed through a list of industry segments that the commercial truck and trailer industry serves:

-

Construction and mining, engines and turbines, railcars, and other heavy equipment will see renewed recovery through 2012 to levels likely below 2006 to 2008, he said, and 2011 gains will likely be stronger than previously expected due to tax write-offs.

-

Electrical markets resumed growth in 2011, driven by improving capital spending trends and the initial recovery of both residential and non-residential markets. Energy/alternative energy market growth awaits resolution of government policies and priorities.

-

Farm equipment end-market demand growth is dependent on global economic growth, global demand, and weather. He believes growth is likely in the next year as recent global weather issues have tightened global supplies and dramatically raised prices amid rising demand.

“Potential for shortages exists,” he said.

He said two types of pressures are driving equipment prices higher:

-

Manufacturing input costs, which are increasing as commodity prices surge. Pricing effect is mostly low to mid single-digit increases.

-

Regulatory-driven price increases. New emission regulations for off-road equipment involve interim Tier 4, which was effective January 2011 for equipment over 174 hp and all other equipment in January 2012. They're similar to 2007 truck emissions, but regulations will be phased into the off-road sector for multiple years. The final Tier 4 regulations are effective January 2014. They're similar to 2010 truck emission and also will likely be phased in over multiple years. There are also energy efficiency regulations, with the price impact appearing to be low to mid double digits.

What will happen in 2012?

“It may be the new normal at best,” he said. “The era of the big beat in earnings report and big bump of guidance going forward is coming to an end. Incremental margin analysis will give way to searching for organic growth. Companies will worry about sustaining profit margins and modest improvement, at best, of profitability. The new normal suggests top-line growth of mid to upper single digits in 2012, at best, with low to mid double-digit gains in operating earnings. Stock buy-backs will increase to help earnings outlooks. Accretive acquisitions will help. Beware of policy issues.”

Truck Industry Market Forecast

Ken Kremar

Principal, Industry Practices Group

While each of the analysts pointed to continued, growth, Kremar was less optimistic.

The Class 4-7 market has grown by over 25% this year, but Kremar described the recovery as “sluggish.”

He said small businesses are a key driver of light commercial and medium-duty truck demand. Small-business optimism and Class 1-7 truck sales have paralleled each other very closely for the last seven years.

Major trucking companies have been behind the recovery in Class 8, with sales up over 50% this year.

“Truck orders will reflect prevailing economic conditions and the performance of key truck-buying markets,” he said.

US economic growth prospects have dimmed, he said, with annual revisions to the GDP showing a deeper US recession and a slower recovery than previously reported.

“Consumers and businesses remain extremely cautious — fiscal policy uncertainties are inhibiting growth,” he said. “Business equipment investment, exports, and consumer durables will drive near-term growth. Recoveries in housing and commercial construction are delayed. The Federal Reserve is expected to do more quantitative easing.

The probability of a double-dip recession has increased to 40%.”

Slow recovery

Kremar said revised real GDP data show a deeper recession and a slower recovery that originally anticipated. Real GDP growth of 1.5% by the end of 2014 will result in an unemployment rate of just under 8%.

Manufacturing production has decelerated, and isn't expected to increase by more than 1% by the end of 2014.

US economic growth by sector will be led by residential investment, which is forecast to increase 5.1% next year and 17.1% in 2013. On the downside, federal government spending is expected to decrease 2.9% next year and 3.6% in 2013.

“The economic outlook has deteriorated,” he said. “Consumers remain cautious as they struggle to reduce debt burdens and rebuild retirement assets. Pent-up demand for housing will be eventually be the key to stronger economic growth.

“The Federal Reserve is expected to introduce another round of quantitative easing (QE3) later this year. Fiscal tightening is coming, but the big issues — entitlements, taxes — will not be settled until after the 2012 elections.”

Slower growth

In analyzing the outlook for key truck-buying markets, he said slower growth in the economy means slower growth in end-market activity for retailers, manufacturers, wholesalers and distributors, construction, for-hire carriers, mining, logging, agriculture, small business, services, special trade contractors, utilities, equipment leasing, and state and local government, Kremar said.

Prospects for retailers have dimmed. Over the summer, the Michigan Consumer Sentiment Index plunged to its lowest level (52) since May 1980, and the Conference Board Index tumbled in August to its lowest level (46) since April 2009.

Employment improvement will come slowly, with Global Insight projecting that the unemployment rate won't dip below 7.5% until 2015.

“Consumer confidence remains in recession territory,” Kremar said. “Stock-market volatility and depressed home values are not helping. Employment gains are the key to any recovery in consumer spending. But employment recovery will come slowly. Households will spend cautiously. Retailers will lean on aggressive discounting to draw in consumers. Retailers will struggle over the near-term. CAPEX programs will improve slowly.”

Wail until next year

He said construction will turn “slightly positive” in 2012 after a six-year, 37% slide.

“The housing sector continues to struggle,” he said. “The recession led to a drop-off in household formation; sustained job growth is needed for revival. Record home affordability should boost demand, although credit conditions remain tight. Mortgage foreclosures have added to excess supply, depressing prices and holding back new construction.

“The recovery in manufacturing output on a monthly basis continues, but growth has slowed substantially. Consumers are not expected to ramp up spending. Capital equipment orders were up close to 10% year to date through the first half of this year, but new orders are starting to flatten out. Construction material recovery has been delayed. Export growth is expected to slow. The ISM index for manufacturing still remains above the 50% threshold for 25 consecutive months, but the August index was only 50.6.”

Not spending as much

He said a looming slowdown in consumer spending and manufacturing, and a sluggish construction sector spell trouble for some wholesalers and distributors.

“Warehouse and distribution activity has mirrored the performance of the ‘goods’ economy,” he said. “Consumer-goods wholesalers will experience slower sales growth as consumers reign in spending. Recovery in manufacturing activity has provided considerable support, but growth is slowing. Wholesalers and distributors tied to import and export activity have done well, but growth is likely to taper off. Building material wholesalers and distributors will continue to struggle in the near term. Agricultural commodity wholesalers will benefit from modest domestic demand and export growth.”

“Big trucking” has done well during the recovery, with the ATA truck tonnage index staging a strong comeback and major trucking companies benefitting from the bounce-back in consumer spending and manufacturing.

Carriers tied to construction have continued to struggle, but major carriers are also picking up the freight from failed operations. TL carriers have been behind the recovery in Class 8 truck demand, stepping up replacement buying after a long absence from the market.

“Slower growth in the key sectors of the economy means slower growth in trucking activity,” he said. “Equipment buyers will not abandon the market but are likely to adopt a more cautious approach in the face of a lackluster economy.”

Work truck customers

He said small businesses are big buyers of small commercial and medium-duty trucks, with carpenters, electricians, plumbers, painters, and masons buying a lot of small trucks. The Small Business Optimism Index — which bottomed out at 80 in 2009 — is now pushing 92.

There has been a slow recovery in repair and maintenance services activity and some improvement in waste management, and although employment is coming back, it is still well below peak.

New business volume ground to a halt in July — the Equipment Leasing & Rental Industry New Business Index was unchanged after being 25% higher in June, compared to a year ago.

All segments of the key truck-buying markets are expected to see growth in 2012, except for oil and gas extraction (down 4.2%) and mining support (down 2.4%). Logging is expected to see the biggest increase (9.8%). Construction will see the smallest (0.5%), but will grow 6.6% in 2013 and 14.9% in 2014.

He said Canadian and Mexican forecasts have been downgraded, with the Canadian economy expected to grow 2.6% in 2011 and 2012 — much slower than the 3.2% advance in 2010.

“There will be enough growth in the Canadian economy to allow the truck recovery to continue,” he said. “However, slower growth in the economy will dampen demand for new equipment to some extent in the near-term.”

The Mexican truck market remains a mixed bag, with strength at the upper end, Class 8, and weakness just about everywhere else. Mexico has close ties with the US economy, he said, and the downgrade of near-term economic prospects for the US will not do the Mexican economy or its truck market any good.

Mexican GDP growth will slow from 5.4% in 2010 to 4.3% in 2011 and 2.5% in 2012 before accelerating to 4% per year through 2016.

North American Economic Update

G Mustafa Mohatarem

Chief Economist, General Motors

Mohatarem said US growth stalled in the first half of this year, but “moderate improvement” is expected through the rest of the year.

Manufacturing PMI slowed further to 50.6 in August from 50.9 in July. Consumer spending increased 0.8% in July, better than the consensus expected, “suggesting consumers are cautious but not retrenching. So far, economic data are more in line with slow growth than recession.”

Concerns over the European debt crisis intensified as volatilities on financial markets remained high and sharply lower stock markets impacted consumer confidence negatively.

Industry sales held up “reasonably well” in August.

“The impact of supply disruption of Japanese OEMs remains,” he said. “More recovery is expected in the fourth quarter. Vehicle purchasing intent improved in August for the second month. Sales in coming months should improve as the economy stabilizes.”

A little good news

The good news is that consumer spending increased 0.8% in July, better than the consensus expectation of 0.5%. Initial unemployment claims declined to 409,000 in the week ending August 27 from 421,000. Consumer credit increased significantly in June. Manufacturing PMI dropped less than expected and non-manufacturing PMI unexpectedly increased in August. Industry sales held up reasonably well in August and are expected to continue to improve in the rest of the year. He said the intent to buy vehicles is improving, as is vehicle availability.

The bad news is that second-quarter real GDP growth was revised down from 1.3% to 1%, the unemployment rate remained high, and consumer sentiment fell sharply in August. Housing starts dropped 4.5% in July from June, and home sales also dropped. Stock markets fell sharply due to worries of the European debt crisis and the sharp slowdown in mature-market economic growth.

“Though improved from last year, the Small Business Optimism Index experienced setbacks in the past two months. Plans to increase hiring decreased slightly in July but remained positive. Even if non-farm payroll adds 200,000 jobs each month in 2012, job recovery will be slower than in the 1990s and more similar to the 2001 recovery.”

Low-rise housing

Housing markets remained at historical lows, he said. In July, one-unit housing starts decreased 4.9% to 425,000. Home permits decreased 3.2%. Existing home sales decreased 4%. New home sales decreased slightly from 300,000 to 298,000.

Banks have been more willing to lend and consumer credit improved significantly in the first half of the year, he said.

“The recent financial turmoil may dampen the willingness to some degree, but we are still cautiously optimistic about lending,” he said.

The Manheim Used Vehicle Value Index decreased from a record high of 128 for the second straight month in July. The average expenditure per car increased 8.3% between the end of 2010 and July 2011. August vehicle sales “held up well” at 12.4 million, he said.

“Much of the lost sales from Japanese OEMs was not picked up by non-Japanese OEMs,” he said. “This means sales will recover when vehicles become available.”

What to do with the data: Some action points to consider

Steve Latin-Kasper, the National Truck Equipment Association's market data and research director, had some specific suggestions for companies involved in the commercial truck equipment market:

- Hiring

“Try to stay ahead of the curve regarding hiring, especially high skill positions. Hiring should continue increasing slowly in the fourth quarter and into 2011. The labor market could heat up in 2012. Hold on to critical personnel.”

- Ordering

“Many truck OEMs and truck equipment companies have been increasing product inventories in 2011. It was harder to manage that process in 2011 than it was in 2010. It will be even more difficult in 2012. Work with your suppliers now to avoid having to stretch lead-times later.”

- Stocking

“Keep abreast of changes in metals prices as we move into 2012. If global demand heats up again, and it probably will, metals prices could start rising swiftly, again. Be ready to increase inventories of metals if those markets start trending up.”

- Selling

Consider selling internationally. Other nations are growing much faster than the US. And with the US dollar remaining low relative to other currencies, American companies have a price advantage.

About the Author

Rick Weber

Associate Editor

Rick Weber has been an associate editor for Trailer/Body Builders since February 2000. A national award-winning sportswriter, he covered the Miami Dolphins for the Fort Myers News-Press following service with publications in California and Australia. He is a graduate of Penn State University.