After initial disruption, COVID creates supply chain of the future

The pandemic severely disrupted supply chains in 2020 as consumers and businesses rapidly changed behaviors in March and April. As the U.S. slowly emerges from the initial stages of the pandemic, things are changing again, according to Lee A. Clair, the managing partner of Transportation and Logistics Advisors.

“As we look going forward, wherever you are today in your supply chain—big companies, small company, sophisticated, unsophisticated—you're probably not well-positioned for the future because things keep moving more today than ever before,” Clair said during a recent Stifel Capital Markets conference call on supply chain opportunities. “Because even if you did a good job of planning for your future, disruption of this whole COVID scenario is making for a different future than what you would have planned pre-COVID.”

But the pandemic was just one problem for manufacturers to deal with this year.

COVID-19 hit the U.S. market as importers were still grappling with Trump Administration-imposed tariffs, which Clair said many businesses tried to beat by ordering products early, which created other supply chain kinks. “It’s not only COVID—there are other changes happening that are making this one of the most disruptive times ever in the supply chain.”

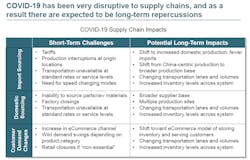

These supply chain disruptions have led to lots of import-sourcing problems, Clair noted. These problems include production interruptions, rising transportation rates, difficulty sourcing parts and raw materials, closed factories, and increased demands on e-commerce.

“Your supplier may not have a problem but their supplier or their supplier’s supplier might, and that starts interrupting what's coming in your direction,” Clair explained. “The other piece that’s happening is as those sourcing legs—both import and domestic—are being impacted. The truck lines and transportation networks are networks built around flows. Once you start changing flows, you lose productivity out of the carriers as well. Their availability and pricing and service levels start going in the wrong direction.”

Disruption can create opportunities

These COVID-led supply chain stresses are setting up long-term repercussions. It’s not just the pandemic, Clair noted, but the tariffs are creating shifts to domestic production and companies are looking for broader supplier bases.

“There are a lot of companies that have been single-sourcing,” Clair said. “With all the disruption happening, the push now is towards having multiple suppliers of most key components.”

The other big change is e-commerce, where the cost per pound, per mile can be 10 times more for last-mile delivery than larger-volume shipments, which means fulfillment centers need to be as close as possible to the customer, Clair added.

“These changes probably are going to keep going long-term,” he said. “We’ve had a big, disruptive hit to the system. The supply chains are broken.”

While the larger shippers can use their sophisticated supply chains as competitive weapons, Clair said, most mid-size companies have not made previous investments in the technology to benefit from their own supply chains.

Along with the growth of more expensive e-commerce deliveries, hurdles facing mid-sized shippers in 2020 include more supply chain shifts such as increasing warehousing and transportation costs. There are also U.S. population shifts to deal with as more people are moving out of once populous northern states such as New York and Illinois to Sun Belt states.

Those companies that improve their supply chains will create internal and external value, Clair explained. A lot of value—for both the company and the customer—can come with improved cash flow thanks to reduced transportation costs, lower warehouse and operations costs, along with lower inventory levels.

These changes, based on improved supply chains, can create higher earnings before interest, taxes, depreciation and amortization (EBITDA) in the near- and long-term. More earnings can give companies more opportunities to create new services and products to better serve their customers.

“The piece I cannot emphasize enough in this new world is beyond lowest total delivered cost,” Clair explained. “How can we create new service and product options that add value and better serve customers and making the supply chain part of that? Then dovetailing it into our marketing and commercial capability so that we can actually gain revenue as well.”