Volumes for used Class 8 trucks slipped slightly in May as the retail market slowed 4% month over month. The update on the used market was reported in the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research.

Auction and wholesale segments saw month over month gains.

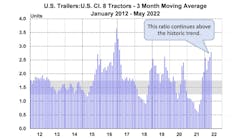

“The average selling price of total reported Class 8 trucks sold in May remains largely a ‘more of the same story,’” said Steve Tam, vice-president of Commercial Vehicle Sector with ACT. “Since January, prices have stayed within a very narrow band. This pattern is driven primarily by retail activity, which comprises about 70% of total reported Class 8 transactions so far in 2013. Longer term, softness is expected to be the order of the day.”

The report from ACT provides data on the average used price for the top-selling Class 8 model for each of the major truck OEM’s – Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo). For subscription information to the full report, visit http://www.actresearch.net.