HOW are parts being purchased these days? Well, the old-school methods—by phone, fax, or directly through a salesman at a location—are fading away. The rapidly growing methods are ordering online, through email, and supplier-managed inventory.

E-commerce is where it’s at. Anything else is obsolete.

“If you’re not there, you need to get there because that’s what customers are looking for,” said John Blodgett, sales and marketing manager for MacKay & Company.

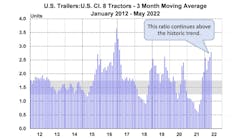

Last December, MacKay surveyed 760 fleets with 54,000 power units and 76,000 trailers and container chassis, asking them to describe how they ordered their parts five years ago, how they order them today, and how they think they will five years from now.

“The key takeaway is, they plan to do more online,” Blodgett said.

David Seewack, CEO of FinditParts, and Andy Schuurs, sales manager for WHI solutions, led a discussion on the value of e-commerce, using their stories to demonstrate the value.

FinditParts is the largest online marketplace, with over one million parts from over 800 manufacturers for heavy-duty trucks, transit, school bus, light-duty and medium-duty vehicles, trailers, forklifts, and off-road vehicles. The privately funded, Los Angeles-based company was founded by a team of heavy-duty and automotive parts specialists with more than 30 years of experience in aftermarket distribution, sourcing, and close ties to all of the major parts manufacturers and suppliers.

Seewack said stocking distributors, repair facilities, fleets, and end users looking for truck, bus, and transit parts typically do so by contacting local suppliers on the telephone, a process that requires a great deal of time and resources. FinditParts has streamlined and automated the search for hard-to-find parts, resulting in a faster and more efficient way to find everything a customer needs from one trusted source. Searchable by part number, manufacturer and most popular parts, FinditParts.com helps customers quickly and easily find the part they need to repair and maintain their trucks.

Seewack and Scott Spiwak met at Associated Truck Parts (ATP) and eventually became partners. ATP was started by Spiwak’s grandfather in the 1940s and was taken over by Spiwak’s father, Leo, in the late 1950s. In 1981, there was a single branch operation. Leo wanted to expand the company but lacked the management and people to make the dream come true—until his son and Seewack came aboard.

Seewack was a passionate technology junkie practically from birth and says he has “always believed that technology can be used to improve the way we do things.”

On his first day at the brick and mortar business, he noticed that:

• Sales people were disorganized and needed tools and information to better manage their accounts.

• Accounting hard-filed over 1000 invoices per day. “It looked like an old business. It was old. It was greasy.”

• It was a single branch location on a card system.

• They didn’t know where their vehicles were and when.

• A great deal of time was spent locating parts because they had certain parts in inventory, and every time they didn’t have something, they had to get on the phone and try to locate a part.

• 20% of sales were buyouts purchased from other sources. “We struggled to find the parts to satisfy our customers.”

He knew there had to be a better way, so he:

• Installed the first computer system and wrote custom software. “It was transformative for us because we were doing things where there was no catalog. So we started building cross-reference system.”

• Was the first to adopt GPS with vehicles. “We started seeing where all the trucks were and realized how we could route them better, so we became more efficient for distribution.”

• Barcode-scanned invoices and put them on an optical jukebox.

• Began a contact management system (CRM).

• Set up consignment dealers to grow the business. “That really caught on, so we started growing revenue not only at our physical stores, but at consignment dealers.”

Seewack was going to retire, but he decided to get back into the business. He noticed some things had changed: dealers had started selling more parts; consolidations continued; national aftermarket companies had been scaled; OEM dealers had grown their parts sales; and buying groups had become stronger.

But he also noticed some things hadn’t changed: people across the industry continued to source the same part, for different prices from many different sources; no major e-commerce player had emerged; and a centralized electronic catalog/look-up did not exist.

“I thought that e-commerce would be the shift in the way business was done, so I decided I’d be in an online business,” he said.

With FindItParts, his initial goal was to build the largest catalog possible available to the largest addressable market. He built a one-stop source to purchase any part in the HD space and put one million part numbers from as many suppliers as he could find; built a supplier network that could fulfill globally; created an ecosystem to interconnect suppliers electronically; and was fully searchable by part number.

He said FindItParts’ success is based on an idea—the buying process online should be easy, friendly, and convenient—that took hold across multiple industries: Zappos with footwear, Amazon with books, iTunes with music, US Autoparts with auto parts, and eBay with second-hand goods. The mantra: Search it, buy it, track it, receive it.

FindItParts now has nearly 200,000 visitors per month, has grown from 8% to 30% repeat customer

revenue monthly, has grown from one million parts with 195,000 images to 3.6 million parts with 390,000 images, and has a supplier network with over 1200 vendors and manufacturers.

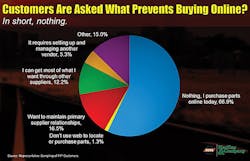

“People want high-quality content, including images, technical specifications, descriptions, features, benefits, etcetera, in a manner that is consistent with auto parts,” he said. “Customers want transparency of fulfillment, fewer suppliers, consistent pricing, and buying experiences and assistance on par with other aspects of their life.”

Every link in the value chain purchases from FindItParts: owner-operator, 41.3%; repair facility, 15%; reseller, 7%; business with a fleet, 7%; transportation, 6.1%; OEM/dealer 5.3%; fleet, 4.4%; construction services provider, 3.4%; warehouse distributor 3.4%; agricultural service provider, 2.5%; auto parts store, 2.3%; government agency, 2.1%; and municipality, 0.4%.

“We don’t want to be a price leader,” Seewack said. “We want to be a full-service supplier to customers. We don’t think being a price leader is the most important part. We want to be a reliable supplier to our customers.”

He said the heavy-duty market has historically trailed the auto parts market by 15 years.

“Suppliers need to provide rich content about their products,” he said. “If you look online for auto parts, you will see big pictures and good descriptions. You feel comfortable. In heavy duty, there’s not a lot of content. You need to provide great content so as the market shifts, your brand will be recognized as a leader.

“It makes sense for manufacturers because digital shoppers are not always digital buyers,” he said. “They may research it online and then buy it at the store. It’s collateral for what you’re doing on the brick and mortar side. Creating a strong alliance with an e-commerce provider will increase your supplier power and reduce cherry-picking. We try to offer a consistent brand offering for each and every one of the brands. We’re not offering a replacement brand for an original part they’re looking for.

“This is an opportunity to increase your addressable market to a global scale without infrastructure development. There’s an ability to test new products in the marketplace without inventory investment. So you can decide what it is you want, play around with pricing, and do that before you make a giant investment on the brick and mortar side.

“Suppliers need to recognize that e-commerce is a new channel that is accretive to their existing business. People are buying online no matter what. It’s just happening.”

Innovations launched

WHI solutions has started its heavy-duty aftermarket e-catalog project, according to Andy Schuurs, sales manager for WHI solutions.

Schuurs, who has 26 years of software sales and marketing experience in the automotive aftermarket, the e-catalog has data sent by 750 parts manufacturers, along with 7.4 million SKUs, 3.9 million images, and 4.7 million interchanges.

“It’s modeled after our aces automotive parts catalog, which has 435,000 users,” he said. “We’re going to take that user interface and the heavy-duty data and try to get as far as we can with year, make and model. Our goal is to have a user-friendly look and feel, so if a user is connected to a distributor, that distributor might have auto and truck parts. If you have Nexpart and the brands you carry are in there, your customers can go to the same catalog and look up a part for a car and for a heavy-duty truck. That’s the goal. You might think we’re crazy but that’s what we’re trying to do. We’ve already loaded 250,000 parts. Early adopters already sent us data.

“We’re doing it because heavy duty is painfully behind the curve on e-commerce adoption. We can only get so far with Nexpart in the heavy-duty business if users can only look up the part number by knowing the part number or a partial part number. We believe this is going to change the game of selling heavy-duty parts.”

Nexpart from WHI Solutions is a real-time transaction processing engine that has accelerated Internet parts ordering. Nexpart allows service dealers, car dealerships, fleets, national accounts, government agencies, and distributors to order quickly and easily over the Internet from their parts suppliers.

With only a computer and Internet connection, you can enter part numbers or use the online catalog, stock-check your distributor, and order parts. One click places your order printing the invoice at the chosen location. Your parts are pulled and delivered as normal.

Access is available virtually 24 hours a day, seven days a week, allowing you to order parts at your convenience.

Nexpart Virtual Inventory is a web-based supply chain tool that seamlessly adds the inventory of a network of over 3000 manufacturers and wholesaler locations to your own; ensuring you have the products your customer’s need, when they need them. Installers, contractors, jobbers and distributors with Nexpart access can view real-time inventory across your entire supply chain and order the part they need.

Schuurs said this is how it works:

Your customer logs in your Nexpart e-commerce site to check inventory either with a part number or using the integrated eCatalog. Not in stock? No problem. With a single click, your customer can execute a real-time stock check in your supply chain. The virtual inventory appears as a branch location of your operation. Behind the scenes, Nexpart virtual inventory is handling all necessary special order transactions within your supply chain to properly pull, deliver and invoice the part.

Whether your supply chain consists of jobbers, manufacturers, or other distributors; each has a highly configurable interface to control the special order process so it is seamless to the customer. Brand availability, delivery methods and timing, surcharges and other critical special order process rules can be configured to your business rules.

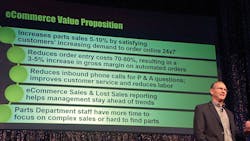

“It does increase parts sales 5-10%. Your staff may go home at 6 but your e-store is working non-stop for you. There’s no human interaction so it reduces order entry costs by 70-80%. We learned that by asking them, ‘What does it cost to man the counter?’ Employees have more time to do important transactions because the phone isn’t ringing off the hook.” ♦

__________________________

This story was based on presentations at the recent Heavy Duty Aftermarket Dialog sponsored by the Heavy Duty Manufacturers Association and MacKay & Company. For information about next year’s even contact HDMA (www.hmda.org) For more information regarding MacKay & Company, visit www.mackayco.com.