U.S. exports fell to all world regions for 2014, with business to Europe, South America and Australia/Oceania the hardest hit, according to the Association of Equipment Manufacturers (AEM).

Year-end 2014 U.S. construction equipment exports by major world regions compared to year-end 2013:

- Canada dropped 2 percent, for a total $6.66 billion

- South America declined 28.3 percent, for a total $2.57 billion

- Asia decreased 7.1 percent, for a total $1.98 billion

- Europe dropped 22.6 percent, for a total $1.98 billion

- Central America fell 11.4 percent, for a total $1.95 billion

- Africa decreased 5.2 percent to $1.23 billion

- Australia/Oceania fell 32.4 percent to $889.5 million

The top countries buying the most U.S.-made construction machinery during 2014 (by dollar volume) were:

- Canada - $6.66 billion, down 2 percent

- Mexico - $1.59 billion, down 11.3 percent

- Australia - $808.3 million, down 34.9 percent

- Brazil - $720.5 million, down 19 percent

- South Africa - $669.5 million, down 1 percent

- Chile - $617.4 million, down 38.2 percent

- Belgium - $461.3 million, down 25.2 percent

- Peru - $460.4 million, down 27.8 percent

- China - $367.8 million, down 3.1 percent

- Saudi Arabia - $326.9 million, up 10.7 percent

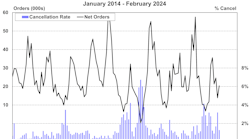

The fourth quarter of 2014 marked the eighth consecutive quarter that U.S. construction equipment exports experienced year-over-year declines.

While exports have been decreasing steadily since the second quarter of 2012, imports have been trending higher. The fast growth in the post-recession export figures (2009-2012) was a strong driver for domestic manufacturers, though it appears the domestic market has become one of the more robust growth engines for the industry.

The recent declines in total construction equipment exports, which were in line with regional development, have been partly due to:

- A retrenching from accelerated spending earlier in the economic recovery

- A strengthening dollar against the Japanese Yen

- Declines in commodity prices, particularly oil, copper and coal

From a global perspective, the U.S. market remains strong, though somewhat affected by the oil price declines.