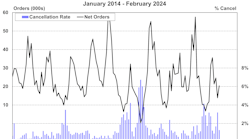

Overall new business volume for January was $6.7 billion, up 12 percent from new business volume in January 2014, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25).

Volume was down 48 percent from December, following the typical end-of-quarter, end-of-year spike in new business activity.

Receivables over 30 days were 1.1 percent, up slightly from 1 percent the previous month and from 1 percent the same period in 2014. Charge-offs were unchanged for the tenth consecutive month at an all-time low of 0.2 percent.

Credit approvals totaled 78.6 percent in January, unchanged from December. Total headcount for equipment finance companies was up 1.0 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for February is 66.3, a slight increase from the January index of 66.1 and the highest level in the last three years.

ELFA President and CEO William G. Sutton, CAE, said: “To begin the year, equipment finance activity picked up where it left off for most of 2014. New business volume continues to grow and portfolios are performing well, despite a slight uptick in receivables over 30 days. Interest rates should remain low--at least into the spring and, perhaps, later--as the Fed keeps a close eye on prospects for inflation and the improving labor markets. As long as the U.S. economy continues to perform, and absent any geopolitical or other external shocks to the system, we are hopeful that these factors will help promote a favorable climate for continued investment by U.S. businesses in capital equipment in 2015 and beyond.”