FTR Associates senior consultant Larry Gross used a line from Charles Dickens’ A Tale of Two Cities to sum up the intermodal market in today’s State of Freight webinar, “Intermodal at a Critical Crossroads.”

Gross said that “the winter of despair” has given way to “the spring of hope.”

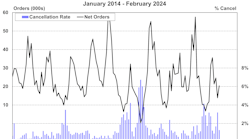

The week ending April 28 was just 0.2% below the all-time record for intermodal loadings, set last year during the week ending September 21.

“The intermodal pipeline is wide open and volume is flowing in,” Gross said. “This is true growth that’s occurring and an indication of some very robust growth in the intermodal demand picture.”

March was the fourth-highest month for domestic activity in intermodal history. Year-over-year growth was 7%, with domestic at 6% and international at 8%.

“It’s unusual for domestic to be growing at a slower rate than international,” Gross said. “I don’t think that international growth is necessarily sustainable. What we’re seeing is pentup demand from the winter. As well, you have timing effects in place for the lunar New Year, which occurred earlier this year than usual.

“On a seasonally adjusted basis, January was an extremely strong month—the strongest intermodal month in history. It’s been drifting downward since then, but still higher than it was at the end of last year, which is another indication of good growth in the intermodal arena.”

Gross said service remains a “big issue,” with average intermodal train speeds “dropping like a stone” over the winter.

“The industry is struggling to recover,” he said. “We’ve seen some modest recovery. It’s still down by about 6% year-over-year. We are a long, long way from where we were a year ago, which was in the 31-32 mph range. Now we’re in the 29 mph range. We’ve got quite bit of work to do and it’s hard for the industry to recover when volume keeps coming at them the way it has. The good news is that based on normal seasonal trends, they should get breathing room between now and June. We would not normally expect volume to ramp up dramatically between March and June.”

He said slower equipment velocity is constraining growth in domestic container loadings.

“Domestic container growth has substantially downshifted in year-over-year improvement, and trailer growth has really skyrocketed and is growing faster than domestic containers, which is quite an unusual event,” Gross said. “We believe primarily 53-foot trailers are flowing into the system to take up the slack caused by constraints on the domestic container supply. If we make the assumption that we were limited in March by turn times of domestic containers, our estimate is that productivity of the domestic container fleet has gone down about 10% based on slower turn times for the equipment. We have not seen large growth in the domestic container fleet. It depends on whether railroads can get the average train speeds back to enable the fleet to fulfill its full capabilities.

“This is particularly critical right now because of what’s going on on the highway side. There are constraints in capacity, and therefore this is a great opportunity for intermodal to convert volume from highway to rail. Despite problems the intermodal system has had, we believe the intermodal market share did increase in the first quarter, based on our estimate of what truck activity was.”

Gross said there is “absolute dysfunctionality” occurring in the international side with regard to port operation. There is “no port in the storm” and shippers are encountering problems at every turn:

• New York/New Jersey continues to be bogged down after a tough winter and an ongoing regulator conflict/labor shortage.

• Norfolk also is in difficulty due to spillover from New York.

• Trucker protests at Los Angeles/Long Beach, and long lines at Oakland.

• The West Coast ILWU contract expiration is less than two months away.

• Effects remain from the Vancouver drayage strike.

• The BNSF Northern Tier problems reduce the viability of PNW routing.

“Drayman are having a lot of difficulty procuring chassis,” he said. “They are in the wrong spot in the wrong terminal. The only ports working smoothly are in the Southeast and the Gulf Coast.”

He said drayage will be a “real flash point” because drivers can’t earn a decent living.

“They’re spending hours at terminals and not getting turns,” he said. “All over-the-road carriers are hungry for experienced drivers. Capacity will be king, and dray carriers will be in a position to raise rates in a differential manner. If a shipper isn’t treating drivers with respect, that shipper will have a tough time finding dray capacity this year.”

Overall, he said that despite service issues, 2014 will look a lot like 2013.

“Much depends on the sector’s ability to get operational snafus under control,” he said.