An unprecedented capacity crisis, driven by the impacts of trucking regulations, will be followed by a revolution in transportation productivity, and the winners and losers in the supply chain will be sorted out based their preparations for the coming market upheaval, industry analysts explained at Connected 2015, the Truckstop.com user conference here this week.

“We are on the cusp of the biggest event in transportation since the invention of the superhighway in the ’50s. The size of the threats we have—or the opportunities—are bigger than they’ve been in a long time,” said economist Noël Perry, senior consultant for FTR. “The problem is that the precise timing of these events is not clear, even though the events themselves are. What it says is we have to get ready before. If we haven’t prepared, we’ll be left behind.”

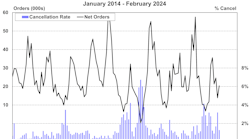

The supply and demand imbalance will initially tilt toward carriers, with the extent of the capacity shortage to be determined by how quickly the Federal Motor Carrier Safety Administration imposes its regulatory agenda, and tempered by the freight demands of the economy, Perry told the gathering of brokers and carriers.

That conclusion is based on Perry’s analysis of the regulations now in the works or under consideration—led by the coming ELD mandate, speed limiters, hair testing as a drug screen, for instance—and how those rules will negatively impact productivity and, in turn, substantially increase the demand for drivers.

“If FMCSA does what they say they're going to do, [the capacity imbalance] will peak at levels we’ve never experienced before,” he said. “So if you’re a broker, in 2017-18-19 your survival will depend on your ability to find trucks.”

However, by the next decade new transportation technologies—specifically, automation—will reverse the trend.

“The business of the 2020s will be finding loads,” Perry said. “The productivity of the industry will be increasing as rapidly as it did in the 1960s. So there’s this wrenching change from one crisis in one direction to a crisis and in the other.”

Indeed, as transportation analyst and Stifel Managing Director John Larkin explained, efficiency improvement through automation in No. 1 in his list of the top 10 factors influencing transportation and logistics over the next 10 to 15 years.

Automation will have a significant impact of manufacturing and distribution, including the growing use of autonomous trucks.

“You may still need the pilot in the cockpit to monitor the systems, but the technology is not too far away,” Larkin said. “Whether the regulators will allow autonomous trucks is debatable.”

And while the technology changes to transportation management systems rank second on Larkin’s list of the most significant future factors, the “Uberization” of freight will happen more quickly in some sectors than in others.

“Given all the nuances in the truckload sector in particular, it will be interesting to see how this works,” he said. “Most of the people developing this technology are not freight guys or gals—they’re technology people who see it as a very simple problem. But they’re missing the complexity of most freight moves, and I think they’re going to lose a lot in the translation.”

His list of influences also pointed to government policy, domestic energy production, industry consolidation, the shift to a service economy, changing demographics, shifting production trends and de-globalization, and changes in the way goods get to consumers.

“These are the themes that are going to determine the winners and the losers in the supply chain Olympics,” Larkin said. “This is more important than even economic growth, which has been a little tepid of late. It’s important for all companies to do strategic and scenario planning. Think about how you plan would be affected if one of these big trends cam to reality.”

But the problem for carriers and brokers, as NASSTRAC Executive Director Gail Rutkowski added, is that shippers aren’t committing the forethought or the resources to their transportation needs.

“When I reach out to my membership, the shippers, what I find is that the things that are bothering them are much more tactical and much less strategic. But they’re down in the foxhole every day, fighting fires, getting trucks and moving freight,” she said. “It’s so difficult for a transportation person at a shipper to pull back and look at these issues that are so important, and are so going to affect how they’re doing business down the road. It’s a little scary.”

Shippers’ main concern is “increased customer expectations,” Rutkowski noted, referring to the stresses caused by ever tighter schedules and more complex delivery requirements.

“Customers really don’t care what the shippers face or what they’re dealing with—they just want it done,” Rutkowski said. “So the shipper then puts the pressure on the broker who puts the pressure on the carrier, and it just keeps rolling along.”

And internally, despite the customer-caused headaches, transportation is often an afterthought in the boardroom—but expectations to cut costs year after year remain.

“Its low tech and no tech,” she said. “When it comes to the IT department, transportation does not tend to come in high on the priority list.”

On the other hand, shippers’ lack of market awareness and logistics expertise presents opportunities for brokers and carriers to solve some of these supply chain problems.

“The need somebody to handle them and walk them through the process,” she said. “No one really wants to tell shippers how bad they’re doing, how bad their freight is—but shippers need to hear those things. They spend so much time looking over their shoulder, they don’t see what's in front of them. They don’t take that broader view of the marketplace.”

Of course, carriers and brokers likewise can get caught up in the here-and-now—but a business-as-usual mindset is increasingly a formula for failure, Stifel’s Larkin concluded.

“At the end of the day, the status quo doesn’t cut it,” Larkin concluded. “The pace of change is accelerating. It makes for a very exciting environment.”