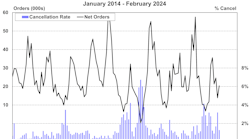

FTR’s Shippers Conditions Index (SCI) for September, at a near neutral reading of -0.5, reflects benign conditions for shippers. The index will start a steady downward trajectory during 2015Q4 through 2016, reflecting the current expectations for freight haulers to institute increased pricing toward the end of next year.

A portion of the index is based on forward-looking expectations, so it will rise or fall based on future probabilities.

The Shippers Conditions Index is a compilation of factors affecting the shippers transport environment. Any reading below zero indicates a less-than-ideal environment for shippers. Readings below -10 signal conditions for shippers are approaching critical levels, based on available capacity and expected rates. Details of the factors affecting the September Shippers Conditions Index, along with dialogue offering some clues to the current heavy duty ordering activity are found in the November issue of FTR’s Shippers Update published November 9, 2015.

Jonathan Starks, Director of Transportation Analysis at FTR, commented, “There are definite signs of a slowdown in activity throughout the North American supply chain. High inventories, weak manufacturing, and slowing intermodal moves are all indications of this slowdown. Slowing order activity from truck fleets for new tractors is another indication of the slowing market, as well as the fact that the driver shortage is less persistent than it was one year ago.

“It is a good sign that the economy continues to grow, and this weakness shouldn’t persist; however, that also means the coming regulations in 2016 and 2017 will have a greater impact if they occur when the market is more robust. Weak pricing may persist through the winter, but keeping abreast of regulatory action is necessary to understand the coming impacts on truck capacity.”