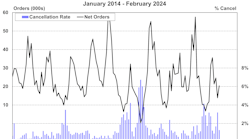

FTR’s Shippers Conditions Index (SCI) for June, as detailed in the August issue of the Shippers Update, improved again month-over-month to a near neutral reading of -0.7.

FTR expects the Shippers Index to remain fairly moderate in the near term because of slow contract pricing increases and a modest weakening of the expected regulatory environment. Monthly data also indicates a slower growing economy for the balance of 2017 with matching slower freight growth. In spite of the current neutral environment for shippers, indicators still are pointing to tightened capacity at the new year.

The SCI is a compilation of factors affecting the shippers transport environment. Any reading below zero indicates a less-than-ideal environment for shippers. Readings below -10 signal that conditions for shippers are approaching critical levels, based on available capacity and expected costs. The August issue of FTR’s Shippers Update, published August 10, details the factors affecting the June Shippers Conditions Index along with a look into the spot market using powerful new analytical tools and data available through FTR’s partnership with Truckstop.

Jonathan Starks, Chief Operating Officer at FTR, commented, “Weak contract pricing is helping to keep the SCI in relatively neutral conditions. However, spot market pricing is approaching 20% y/y increases, and contract increases are only a short time from occurring. More importantly, Hurricane Harvey’s impacts on Texas and other gulf region states is strong enough to affect nearly 10% of the trucking market. That could serve as a catalyst for further capacity constraints and stronger rates as we head into the fall shipping season. In addition, the Electronic Logging Device (ELD) scheduled for December will maintain pressure on truck capacity as we head into 2018. The recent decision from the Commercial Vehicle Safety Alliance (CVSA) to delay full penalties for ELD compliance until April 2018 does reduce some of the near-term pressure, but the overall picture remains the same - trucking capacity is tightening, and rates are moving up.”