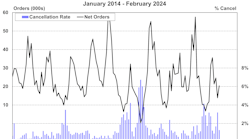

Confidence in the equipment finance market is 56.0, an increase from the September index of 53.8, and the highest level since April despite continued concerns about the November elections, according to the Equipment Leasing & Finance Foundation.

When asked about the outlook for the future, MCI-EFI survey respondent Frank Campagna, Commercial Equipment Finance Business Line Manager, M&T Bank Corporation, said, “We continue to see strong demand from our core commercial and industrial business throughout all regions of our footprint and via all finance product sets and asset classes. Our business optimism is tempered somewhat by the continued downward price pressure by some of our competitors, but that does not discount the fact that our customers are in the market and acquiring equipment. Some sectors related to infrastructure, albeit softer than in years past—especially those related to energy—continue to provide equipment financing opportunity and are poised for some significant growth in 2017.”

October survey results:

• When asked to assess their business conditions over the next four months, 12.1% of executives responding said they believe business conditions will improve over the next four months, a decrease from 18.8% in September. 81.8% of respondents believe business conditions will remain the same over the next four months, an increase from 62.5% in September. 6.1% believe business conditions will worsen, a decrease from 18.8% the previous month.

• 24.2% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 28.1% in September. 57.6% believe demand will “remain the same” during the same four-month time period, up from 53.1% the previous month. 18.2% believe demand will decline, down slightly from 18.8% who believed so in September.

• 18.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, an increase from none who expected more in September. 75.8% of executives indicate they expect the “same” access to capital to fund business, a decrease from 96.9% the previous month. 6.1% expect “less” access to capital, an increase from 3.1% last month.

• When asked, 30.3% of the executives report they expect to hire more employees over the next four months, an increase from 21.9% in September. 60.6% expect no change in headcount over the next four months, a decrease from 71.9% last month. 9.1% expect to hire fewer employees, up from 6.3% in September.

• None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 93.9% of the leadership evaluate the current U.S. economy as “fair,” a decrease from 100.0% last month. 6.1% evaluate it as “poor,” an increase from none in September.

• 15.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 6.3% in September. 69.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 75.0% the previous month. 15.2% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 18.8% who believed so last month.

• In October, 36.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 40.6% in September. 63.6% believe there will be “no change” in business development spending, an increase from 53.1% the previous month. None believe there will be a decrease in spending, a decrease from 6.3% who believed so last month.