IT’s about small businesses. And they’re balking right now.

In his presentation, “A Bifurcated Economy,” Dr William Dunkelberg, chief economist for NFIB, chairman of Liberty Bell Bank and economic strategist for Boenning & Scattergood, said 99% of US businesses have fewer than 500 employees. They produce half of the private-sector Gross Domestic Product (GDP), employ more than 50% of private-sector employees and two-thirds of the new jobs.

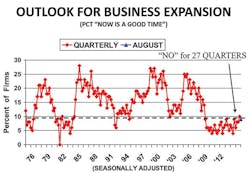

And, at least from a historical perspective, small-business owners are “depressed,” according to the Small Business Optimism Index, which has been depressed since 2006.

“They’re saying business conditions will be worse in six months than they are today,” Dunkleberg said. “How much money do you think they’re going to invest in their business? This is clearly not a good time to expand business.

“They’re saying, ‘If the roof leaks, I’ll fix it, and if the roof fails, I’ll replace it.’ But expand? Not going to happen. Why is it bad time to expand? About 50% say the political climate is the reason. There’s so much uncertainty generated. The issues small-business owners consider important will not be solved in the next two years. Regardless of what happens in this election in November, the next few years are going to be more of the same.”

Dunkleberg said employment peaked in January 2008, hit rock bottom in 2008, and still has not climbed high enough to match 2008 levels. Meanwhile, GDP has exceeded pre-recession levels.

“We’re producing much more stuff today, but using fewer workers to get it done,” he said. “Payroll has reached and slightly exceeded pre-recession levels. The reason for the difference between total employment and payroll is that self-employed workers are not counted.”

Housing starts peaked at 2006—at an annual rate of one million. But we’re still about 500,000 short of that right now.

“Housing is very labor-intensive,” he said. “We have the same percentage of homeowners now as in the mid-‘90s after a big surge in home ownership. That gives you a sense of how fast things change. We do have a large increase in multi-unit housing, so we have a lot of people who can’t be owners anymore because they’ve been through a bad experience or don’t want to be owners. So you wonder about the Millennial Generation. We’ll have to see how that all works out.”

The University of Michigan Index of Consumer Sentiment peaked in 2000 during the dot-com bubble, and sentiment has not recovered since then.

“For a long time now, consumers have been very pessimistic,” he said. “And we had better readings last year than this year, so consumers are just not very optimistic about where we’re going.

“Most of the income gains have occurred in the top 10% of the population. So it’s not going very well. We have to get that changed if we really want to get the economy going.”

The rating of government policy has been moving downward. Thirty-eight percent thought the government policies were good in 2000, but that trended downward dramatically to a rock bottom in 2009. That climbed in 2010, but two years later plunged back down to the previous rock bottom level. It’s 10 percentage points higher now, but isn’t trending up.

Consumer net worth is reported to be $80 trillion after subtracting national debt, but Dunkleberg isn’t buying it.

“Even after going through the worst recession since the Great Depression in the ‘30s, we’re worth $80 trillion,” he said. “I find this really unbelievable. If this is really true, we should have no Great Recession. Look at how wealthy we are after two horrible periods. So I’m very skeptical about those numbers, especially when I look at it relative to GDP.

“I’m very concerned. We had a dot-com bubble and then a housing bubble. I think we’re back in a bubble. I’m concerned about where we’re going.”

He said we’ve lost more than $3.5 trillion in consumer interest income since 2008.

“Maybe that’s why we’re not spending so much these days,” he said. “We don’t have the income we used to.”

Expected real sales are still slightly negative. Borrowing activity is at a 40-year low.

“Question: Who needs a loan?” he asked. “If you’re not optimistic about the future, you don’t want to borrow. Banks have money to loan, but no good credit risks want it.

There are plenty of excess reserves. But you need borrowers. The money being loaned is being spent on acquisitions, not expansion.”

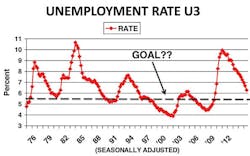

Unemployment is 6.2%. That’s the lowest since 2009, but it hasn’t been at 5.5% since 1976.

“If you are not looking for a job, you are not considered in the labor force,” he said. “The rate is the percentage who want a job and don’t have a job. A larger percentage of our population is not looking.

“Inflation is a tax on everyone, but the Fed is willing to do it to bump up the employment rate. We built too many buildings and companies prior to the recession. A lot of companies then went out of business and few were formed during the recession. Births and deaths of companies now are both below the recession.

“Unfilled job openings are rising. But job-creation plans are low. It has improved since the recession, but it’s still low. When we stop spending, companies shed inventories and employees. We have now stopped firing people, but haven’t begun hiring much.” ♦