EVEN with a slight decline forecast for trailer production in 2015, the market remains “very strong,” according to Don Ake, VP of commercial vehicles for FTR Associates.

Ake bases his outlook on net orders of 284,000 over the last 12 months in the United States; production that’s up 13% per day since April; an expected build of 264,000 this year, the highest since 280,000 in 2006; backlogs at 112,000 units in July, up 47% year-over-year; and market growth that’s a result of fleet expansion and pent-up demand.

And his forecast of 248,000 for 2015 could actually be bumped up while the 2014 totals are adjusted down.

“They should be building more but are having trouble adding capacity,” Ake said. “On the dry van side, most of the OEMs are out of capacity and the orders coming in are rolling over into 2015. One of the major OEMs is booking into February and March. People want those trailers before then.

“The tank market has a lot of orders but is having trouble finding workers to build tanks. They are having more problems in the tank segment because producing tanks takes greater degrees of specialty labor, better quality of workers, and more training. So they’re having the worst problem of any segment in increasing production and hiring workers.

“So now you have demand that should have been in your peak year of 2014 rolling over into 2015. So now, in re-evaluating the forecast I have, it’s not inconceivable to think that 10,000 trailers might roll into 2015. That’s something we will be looking at in making the forecast next month for 2015. That was something I was not taking into account with this forecast.

“And notice something strange: If you roll 10,000 units into 2015, you’re at 258,000 instead of 248,000. And this year is expected at 264,000 and would go down to 254,000. You are in range of a six-year peak. So 2015 is going to be an interesting year.”

Ake said the same thing could happen on the truck side, with OEMs running out of production.

“We’re looking at 295,000 this year and 293,000 next year, and my opinion is that you’re going to get that rollover,” he said. “That may mean the first quarter is stronger than it should be and we could see higher than 295,000 in the truck market next year. We are in a unique situation—a good unique situation for once.”

He said there is upside potential if the Class 8 market remains hot.

“Class 8 remaining hot would mean they still need to add capacity,” he said. “In the fleet and shipper panel earlier today, you heard people say they want to add capacity. There are issues preventing people from adding capacity. But if they’re able to add capacity and able to find drivers to drive those trucks, then they’re going to continue to order trailers. So we want to keep a close eye and track on Class 8 orders.

“The trailer orders are important also, but with Class 8 orders, we have an advantage because with the data collected we’re able to know when Class 8 orders are scheduled to be built. With trailer orders, I am not able to do that. So I have to call sources and say, ‘When are these getting booked?’ When I did that recently, the answer was that certain OEMs could be booking out. However, that always presents issue in both truck and trailer orders when you get the orders too far out. Right now, a fleet is ordering a trailer, and let’s say it’s for delivery in late February. Are we certain what the economic conditions will be in late February? No, we have an idea. And that fleet has confidence to order.

“But in the past, we’ve seen market fluctuations. That order’s been on the books for seven months and the OEM calls a fleet the month before and says, ‘Hey, are you ready to take delivery next month?’ And the fleet goes, ‘No, I’m ready to take delivery in October.’ Typically, it’s not one fleet that does that. It’s market conditions. All of a sudden we have a forecast built on backlog, and if that backlog changes and disappears, our forecast fails. We have a reason for that, but we don’t like that forecast.”

He said there is upside potential if the economy and freight accelerate. If freight goes up and pushes that capacity lever, orders will increase.

There is downside potential if the Class 8 market is over-inflated or the economy stalls.

Two good signs in his forecast are that GDP is projected to increase from 2.1% this year to 2.9% in 2015 and housing starts are projected to go from 980,000 to 1.09 million. But freight growth is projected to decline .5% (from 3.4% to 2.9%).

Ake said dry vans and reefers built up a lot of backlog in the past 12 months.

“Yes, orders are now below build, but that’s what’s happening in the summer,” he said. ”Typically, that happens much earlier in the year, but that just shows you how strong the market is. The flatbed market is not as strong, but there’s a similar pattern. The interesting one is tank. You see a disconnect.”

Since bottoming out at the end of 2010, truck loadings have increased steadily. Ake said growth started in 2013 but orders didn’t start.

Total Class 8 truck utilization peaked at the end of 2013, with 92% of the total fleet in use, fell back down at the beginning of 2014 but is growing and is projected to reach 93% by the end of 2015.

Trailer utilization also peaked at the end of 2013 at 96%, and isn’t projected to reach that through 2020.

For the first time, FTR is tracking North American heavy-duty equipment orders with the addition of Canada and Mexico. Through the end of 2013, trucks and trailers were very closely matched.

“In this upturn, the truck and trailer markets are following each other,” he said. “When we got to December last year, truck orders spiked before trailers. That happened because it’s more difficult to spec your trucks. You take more time to do that, plus your investment in your trucks is greater, so it makes sense you’re going to figure out your truck needs, get orders in, see how much money’s left, and then order your trailers. That’s why we’re seeing the disconnect.

“Class 8 truck orders spiked in the last three months, and we’re still trying to figure out what is happening exactly on the truck side. There were record orders for July. In August, they went down, but still at a very high level. Trailer orders are more traditionally down. They’re back down where they should be in a very strong market. June and July are very strong for those months.”

Quarterly estimates for trailer production in 2015: 65,000 in the first quarter, 63,000 in the second quarter, 62,000 for the third quarter, and 58,000 for the fourth quarter.

“You see a similar pattern as we saw in trucks, where we saw peak orders at a high level and a very gradual softening as we go through 2015,” he said. “In 2014 and 2015, we have a forecast set very close to the model. Going out, we have it set a little bit higher. So if you look going out, you’d have to say there’s a little downside to the forecast, but not much.”

The trailer market has experienced four major up-cycles in the past two decades: 1992-1995, 1997-1999, 2002-2006, and 2010-2014.

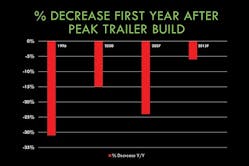

The decrease in the year following the peak was 32% in 1996, but much smaller in 2000 (15%) and 2007 (24%), and is projected to be 6% in 2015.

“We still don’t have a good answer for what happened in ‘96, because there wasn’t really an economic downturn, but the market collapsed, so that’s kind of an anomaly,” he said. “In 2015, our forecast is a 6% drop. Compared to everything else, that’s minor.”

The segment forecast for 2015:

• Dry vans: 144,000, down 5%.

• Reefers: 37,500, down 5%.

• Flatbeds: 23,500, down 5%.

• Dumps: 9000, down 13%.

• Liquid tanks: 8100, down 4%.

• Dry tanks: 3000, down 17%.