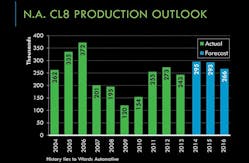

EVEN with the North American Class 8 truck market projected to decline in 2015 and 2016, FTR Associates president Eric Starks said it’s actually quite healthy.

“Our forecast is 295,000 for this year and 293,000 for next year, then 266,000 in 2016,” he said. “I get a lot of questions: ‘Why do we have things coming back down in 2016? Why are they not at sustained levels?’ People think, ‘Holy cow, the market’s shrinking again.’

“Well, let’s not look at it from a production standpoint. Let’s look at it from a fleet standpoint. If the fleet can grow at a level where, let’s say the replacement rate is somewhere between 225,000 and 250,000 units for North America. … Well, any time you get above that number, you’re going to be adding trucks into the fleet.

“All we’re saying is that we’re going to be adding trucks into the fleet. It’s just going to be at a slower pace. So we’re going to continue to see the fleet size grow. That’s an important thing. It’s not that the market is shrinking necessarily. It’s just saying, ‘I don’t need to add to my fleet at the same pace as I initially needed to.’ ”

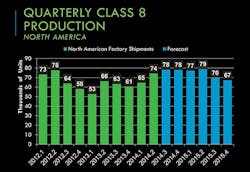

FTR Associates is projecting quarterly Class 8 production in 2015 of 77,000, 79,000, 70,000, and 67,000.

“We traditionally see overbuying and an overbuild as the cycle starts to soften,” Starks said. “We expect the cycle is starting to hit its peak and will start to ease back as we move into the middle of 2015. This is a scenario where we say, ‘They will continue to maintain build levels above what we’re saying.’ So in total, we’re talking about roughly a 320,000 market. It’s a realistic upside risk opportunity for 2015.

“That has nothing to do with economic conditions. That is only a behavior issue where they say they will continue to buy. If that occurs, it comes out of 2016. This is clearly on our radar. 2016 would be a 240,000-type of number.

“It’s interesting. A couple of the years ago, if I told people we were going to be in 240,000 market, they’d be happy. Now, we’re looking at that as a depressed number. But that is really a healthy number. We are always going to continue to see volatility. Even some of the stability we’ve seen recently has been unprecedented, especially on the trailer side. That has been rock-solid, for the most part. The power-unit side has been more volatile, but not significantly.”

The average age of the Class 8 population has been increasing steadily since being 8.3 in 2006. But the 9.6 average age in 2013 is expected to be the peak, with the age falling to 9.3 in 2016.

“I get so many people who come up to me and they go, ‘Starks, holy cow, the equipment is so old—they’ve got to replace equipment now,’ ” he said. “I say, ‘Phooey, that’s not always the case.’

“Just because a truck is old doesn’t mean it has to be replaced. It just means you have to keep an eye on it. It is useful life that is the most important aspect of the truck. When we look at the total age of this equipment, it is old, but it is not significantly older that what we saw in ’92 (9.3). The dynamic is different, where the age of equipment stays relatively old for a long period of time.

“How do you get the average age of the fleet down? Buy new trucks to get better emissions. Scrap older equipment. If you scrap older equipment and the average age comes down, did you do anything to the trucks? The average age in and of itself is not a very good way for us to understand what the pure replacement market is going to be.”

He said FTR has a mortality model that estimates when trucks come out of the system. When FTR has plotted that against actual sales activity, it has found that the scrappage number is the bottom for the market. The only time that was different was in ’91, which was very minor, and in the Great Recession between 2008 and 2010.

“This trend continues to move higher,” Starks said. “If this is typically our bottom, this continues to be a growth market. This gives us a level of confidence that if things do fall, what’s your bottom? Well, your bottom typically is that scrappage number (and it was around 160,000 in 2013). We’re not expecting to get back to those levels within this particular cycle. We have found that during recessions, it starts to trend back to that number.”

North American Class 8 orders remain healthy, and actually went up in June (26,000) and July (30,000).

“Orders are staying relatively strong,” he said. “Typically, we expect them to weaken as we get into the summer months, but they didn’t. They are holding up really well. It suggests there is still pressure in the system for demand for equipment. I think that’s a really good sign.”

Class 8 backlogs are also healthy and rising, and have been at levels we haven’t seen for several years—120,000 in July.

Starks said an increase in utilization during 2013 pushed demand into 2014.

“There tends to be that lag that when utilization starts to pick up and people start realizing they’re going to buy equipment,” he said. “We started seeing the utilization number picking up in 2013, but it wasn’t until 2014 that people started taking the plunge. Around March to May of last year, we were actually calling for significant production numbers in the first and second quarters of 2014. Well, it happened two quarters later, so we were jumping the gun. Some of that was because we were seeing tightening in capacity and we were trying to say, ‘OK, it looks like it’s coming. We’re making the call.’ And that was a little bit delayed. This upcoming cycle is looking more and more like 2011. Things are heating up and then starting to ease back down.”

He said the North American Class 8 backlog/build ratio is “sitting in that sweet spot,” with no pressure to increase or decrease production in the short term.

“Orders come in and somebody says there are 30,000 in orders,” he said. “Intuitively, you think, ‘Holy cow, we’re just going to build them in the next couple months.’ But is that realistic? No. We can go in and estimate relatively well when they will get these units produced. From July data, we can see that 6000 were for the third-quarter build and 15,000 for the fourth-quarter build. So most of it was for the short term, for the end of the year. That is a good thing. The thing that scares me to death is when you see people placing orders and wanting them out three or four quarters. That becomes problematic. That becomes more speculative-type ordering, for me.

“OEM build plans they provide to us suggest that the third quarter should finish up with over 74,000. We’re calling for 78,000 in production for the third quarter, and the same type of thing for the fourth quarter. So we’re up about 5% in the third quarter and 7% in the fourth quarter. This is normal.

“Some of it has to do with the fact that we are able to make a call and say what we’re seeing. I think OEMs are very responsive to it. When it comes to actually putting out build plans, it becomes an issue of how to get that through the system. But we do believe there is upside pressure within the system. Usually when things are accelerating, we’re above, and when things are coming down, we’re below. Right now, we’re above. We think the numbers will look relatively decent.”

With data through July, the third quarter was almost filled—with only 4500 orders left.

“OEMs are saying, ‘My third quarter is pretty much filled,’ ” he said. “So anything they do above it is gravy. So now they’re looking to fill up the fourth quarter and the first half of next year. So I’m feeling pretty good about the end of this year.

“In fact, some of the analyses we’re seeing would suggest the numbers should be higher than what we currently are forecasting. It will come down to what the OEMs decide to build. The real risk starts to happen when you start looking at the first half of 2015, because there are no filled slots there for the most part. But typically, order behavior comes around when they start ordering equipment in October, November, December. They start filling up those first- and second-quarter build spots, so I’m not worried in that respect. We’d expect those numbers to come in the next few months and they will start placing orders for 2015.”

He said there is concern about the natural-gas market. In July, that accounted for just 1.3% of total sales in the United States and Canada—down 3.1% from March.

“We have found that they were trending higher through last year and even the early part of this year, and all of sudden started to ease back down,” he said. “A lot of people were saying, ‘This market’s going to go up 15-20%.’ But the market potential is not happening. From a market share standpoint, we’re seeing less than 1.5% of the overall size of the sales market. This market, while it still has structural legs, has for the moment fallen off. There are clearly a lot of hurdles.” ♦