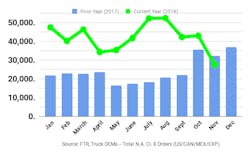

ACT and FTR are reporting a decline in North American Class 8 truck orders in November.

ACT’s preliminary data shows the industry booked 27,900 units during the month, down 36% from October but only 15% from last November. Complete industry date for November, including final order numbers, will be published in mid-December, ACT said.

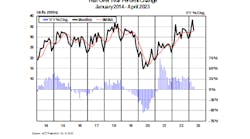

“Through year-to-date November, Class 8 orders have totaled 468,600 units, an average monthly order intake of 42,600 units per month,” said Steve Tam, ACT’s vice president. “November typically has a slightly above average order seasonal factor, and as such, actual data is moderately lower when seasonally adjusted.

“Seasonal adjustment drops November’s order intake to 26,800 units, down 29% from October.”

Medium-duty orders, on the other hand, stayed relatively even.

“Disaggregation of the medium- and heavy-duty markets reveals that medium-duty order activity perpetuated its trend-like bias in November, with orders for 25,100 vehicles besting short and long-run averages.” Tam said.

“Over the course of the past six and 12 months, medium-duty orders have averaged 24,000 and 24,900, respectively.”

FTR’s preliminary Class 8 report indicates orders for November fell to 27,500 as the market winds down from five consecutive months topping 40,000 units. November orders were the lowest total this year and the weakest since September 2017, FTR said. However, the drop-off in order activity was expected, as OEMs have nearly filled their order boards for 2019. Backlogs will start to recede, but still remain close to record volumes. North American Class 8 orders for the past twelve months now total 499,000 units.

“It was expected that orders would fall fairly soon, as the available 2019 slots filled up,” said Don Ake, FTR vice president of commercial vehicles. “A couple of the OEMs that had some open capacity actually had solid order numbers, while the rest appear to be nearly sold out for next year.

“This drop in orders was reasonable considering the huge volumes of the last five months, although 27,500 is not that bad of a number. The freight fundamentals remain strong and we still expect the equipment markets to have a great year in 2019.

“We do expect cancellations to rise in November. Not as a result of market weakness, but because backlogs are enormous, and fleets will continue to move orders around as needed. This trend is expected to last well into next year. With OEMs filling up the last available build slots, it is possible that orders may drop below 20,000 in December.”

Final data for November will be available from FTR later in the month as part of its North American Commercial Truck & Trailer Outlook service.