Economic activity in the manufacturing sector expanded in May, and the overall economy grew for the 121st consecutive month, the nation’s supply executives said in the latest ISM Manufacturing Report On Business.

“Comments from the panel reflect continued expanding business strength, but at soft levels consistent with the early-2016 expansion,” said Timothy R. Fiore, chair of the ISM Business Survey. “Demand expansion continued, with the New Orders Index strengthening, but remaining in the low 50s, the Customers' Inventories Index remaining at a 'too low' level, and the Backlog of Orders Index contracting for the first time since January 2017.

“Consumption (production and employment) continued to expand, resulting in a combined PMI contribution of 0.3 percentage point. Inputs—expressed as supplier deliveries, inventories and imports—were lower this month, primarily due to inventory softening and supplier's continuing to deliver faster, resulting in a combined 4.6-percentage point reduction in the Supplier Deliveries and Inventories indexes. Imports contracted for the second straight month.”

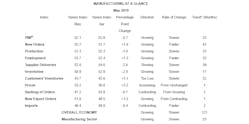

The May PMI registered 52.1%, a decrease of 0.7 percentage point from the April reading of 52.8%.

Other highlights from the report:

- The New Orders Index registered 52.7%, compared to the April reading of 51.7%.

- The Production Index registered 51.3%, compared to the April reading of 52.3 percent.

- The Employment Index registered 53.7%, compared to the April reading of 52.4 percent.

- The Supplier Deliveries Index registered 52%, compared to the April reading of 54.6 percent.

- The Inventories Index registered 50.9%, compared to the April reading of 52.9 percent.

- The Prices Index registered 53.2%, compared the April reading of 50 percent.

Also, imports contracted for the second straight month, ISM said. Overall, inputs reflect supply chains’ ability to respond faster and indicate that supply managers are closely watching inventories. Prices remain at a relatively stable level.

Machinery and miscellaneous manufacturing were among 11 manufacturing industries reporting growth in May. Primary metals and fabricated metals reported contraction.

“Respondents expressed concern with the escalation in the US-China trade standoff, but overall sentiment remained predominantly positive,” Fiore said. “The PMI continues to reflect slowing expansion.”

Here are some selected comments from respondents:

- “Ongoing tariffs [issue is] impacting costs and influencing supplier realignment on country of origin. Border issue is causing delays in imports from Mexico.” (Computer & Electronic Products)

- “The threat of additional tariffs has forced a change in our supply chain strategy; we are shifting business from China to Mexico, which will not increase the number of US jobs.” (Chemical Products)

- “Sales continue to decline. Volumes are off, [and] profits haven't decreased in proportion to sales. Higher-margin vehicles continue strong sales, but low- to mid-range sales are down.” (Transportation Equipment)

- “Sales remain strong. Labor remains tight. Tariffs are having a significant impact on cost of goods. No impact on where we buy our goods. ” (Food, Beverage & Tobacco Products)

- “Business is continuing to grow and expand. The pressure for driving out costs has increased significantly, and my company is facing major changes over the next several years to remain cost competitive.” (Miscellaneous Manufacturing)

- “The threat of a 15% increase on Section 301 tariffs is a concern. Although the potential has been around for months, the recent deadline was not expected. We had calculated and communicated the potential cost impact to our leadership.” (Petroleum & Coal Products)

- “Weather in the middle of the country has slowed construction and infrastructure projects.” (Nonmetallic Mineral Products)

- “Business continues to be very strong. Our company and our supply base continue to be challenged getting manpower for production. Key commodity costs like steel have continued to come down. Lead times with suppliers have stabilized after moving out two to three times what they were a year ago. Supply base performance has improved over the last 90 days and stabilized.” (Machinery)

- “Newly increased tariffs on Chinese imports pose an issue on a number of chemicals and materials that are solely produced in China. We are expecting increases in raw materials starting June 1.” (Plastics & Rubber Products)

- “General slowing due to inventory correction.” (Primary Metals)