THE work truck market will continue to grow through 2014—probably at a faster growth rate than in 2013, and definitely at a faster rate than the United States economy—and 2015 is expected to be even better than 2014, according to NTEA market data and research director Steve Latin-Kasper.

“So we expect the next two years to be better than 2013, and 2013 wasn’t that bad,” he said in his presentation, “Planning For Your Company’s Future: Identifying Upcoming Industry and Economic Trends.”

“The global growth is slower, but opportunities remain. Commodity pricing is likely to remain favorable through the first half 2014.”

Pros:

• Room for growth, with consumers and businesses sitting on cash.

• The average age of trucks is still relatively high.

• Low inflation.

• Low interest rates, with the construction industry growing and credit available.

Cons:

• State and local government spending is still restricted, but improving.

• Labor market imbalance.

• Consumer confidence is still a bit shaky.

• Slow growth in the EuroZone and emerging markets.

• Political uncertainty, domestic and international.

“The labor market appears to be improving a little bit,” he said. “There’s more churn than there was in the last three to six months, and as result of that, I don’t think the unemployment rate is going to get too much better too fast. But inflation and interest rates will remain low and should be good business conditions to go along with that slow pace of growth throughout the year.”

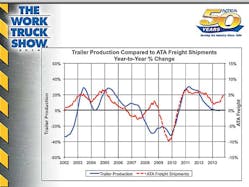

From the trailer angle, he said trailer production has closely followed the ATA Freight Shipments Index for more than a decade. When the Freight Shipments Index goes up, trailer shipments tend to follow not too long after. And freight shipments curled back up to a 5% growth rate at the end of 2013, so Latin-Kasper expects trailer shipments to follow this year.

“That relationship is holding pretty well,” he said, “and we expect a pretty good bounce in trailer sales in 2014.”

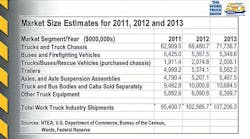

Total work truck shipments have grown from $95.4 billion in 2011 to $102.5 billion in 2012 to $107.2 billion in 2013. Latin-Kasper’s forecast is for the expansion to continue through 2016, peaking at between $120 billion and $125 billion, and then slowing down in 2017.

“Whether it’s just a slowdown or it actually goes negative compared to 2016 is a tough call right now, but the forecast that we work from indicates that we are not likely to see another recession in this industry until 2017 at the earliest,” he said.

Buses and firefighting vehicles, along with trucks/buses/rescue vehicles (purchased chassis), experienced a decline last year, but every other segment was up, led by trucks and truck chassis (from $68.4 billion to $71.7 billion).

Class 3 leading growth

US straight truck chassis sales (box-offs) were up 6.9% between November 2012 and November 2013. By type: strip 22.7%, cutaway 10.5%, low cabover 5%, and conventional 3%.

By size, Class 2 (down 20.1%) and Class 8 (down 7.1%) were the only ones experiencing a decline, while Class 3 led the growth at 51.9%.

“One of the interesting things is that Class 3 was growing so strongly throughout 2012 and 2013—well ahead of the rest of the industry in terms of percent growth rate,” he said. “And then Class 2 was struggling in that same time period. A lot of that Class 3 growth was driven by the revival in the construction industry. Construction supplies a lot of trucks, from smaller ones to larger ones and pretty much all of the classes. But primarily, it was the residential sector of construction that really came back in 2012 and 2013, and the forecast is for it to grow stronger in 2014. The residential segment of construction seems to have more to do with Class 3 than with medium or heavy-duty trucks.”

Total US and Mexico straight truck retail sales by chassis type are approaching 20,000 units a month.

“It’s interesting to note all segments of the industry started growing again at the bottom of 2009, and there’s been pretty consistent growth,” he said.

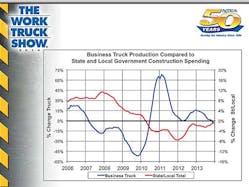

In terms of state and local government spending on equipment compared to business truck production, the rate for business trucks slipped from 4% at the start of 2013 to flat by the end of the year. Equipment minus computers has been basically flat for the past two years.

Total private construction compared to business truck production was up 14% to start last year and fell to 9%.

Producer price indexes for metal ore, scrap, and products are rising after experiencing declines for most products in 2013.

“Steel prices are clearly coming off the bottom and starting to rise again very slowly,” he said. “Hot-rolled bars, plates, and shapes were up .5 % for quarter. Steel pipe and tubes were down 5% for the year and flat for the last quarter. Hot-rolled sheet and strip prices are already coming up for the year and quarter. Carbon steel scrap was up 12.2% for the quarter and 8.8% for the year, and that’s the general pattern for the steel products market for pricing right now. We’re pretty clearly in the midst of a change in trend. We can’t expect steel prices to continue to slowly slide down. They’re coming off the bottom and because of past load capacity utilization in the global steel industry, we expect prices will rise slowly.”

As usual, Latin-Kasper used the statistical increases for US exports of trucks, buses, bodies, and other truck equipment to encourage NTEA members to look abroad for big opportunities.

Exports increased 14.1%, led by Germany (157.8%), Mexico (93.9%), Eastern Europe (74.9%), France (22.5%), and the Mideast and Africa (21.9%).

“There are always going to be certain geographic markets around the world that are growing faster than the US, and there are others that will grow more slowly,” he said. “It’s just a matter of keeping people in tune with the idea that customer differentiation is a good thing and diversification is a good thing. There are ways to do that geographically, not just by looking at different products or tweaking existing products or getting new distributors in other regions inside the United States. There are clearly opportunities for growth outside the US.”

Exports to Mexico, second behind Canada, nearly doubled last year.

“NAFTA was a huge factor in making Mexico a more critical trading partner for the US and Canada,” he said. “It has rapidly become a more important market in terms of what the US buys. It is, in the course of the past year, seemingly becoming a more important buyer of US products as well.”

He attributed the 93.9% growth rate to US companies, mostly the OEMs, relocating plants and ramping up production in those plants. ♦