Wabash National Corp. posted “a strong finish” to 2017 and begins 2018 with “a historically strong backlog of orders,” according to the publicly held trailer giant’s fourth-quarter earnings report. And while a “small reset” was expected following a fifth consecutive record year of profitability in 2016 (and rising raw materials costs), the past year served to position the company for a coming upswing in its markets, Wabash executives explained in a conference call with investment analysts.

“We are pleased overall with the company’s 2017 performance, as we successfully established a stronger foundation for further growth and productivity for the current year and beyond,” CEO Dick Giromini said. “Looking at the current year, we continue to believe the demand environment for trailers overall will remain healthy as fleet age, regulatory compliance requirements such as the ELD implementation, a strong economy and customer profitability all support a continuation of an extended trailer cycle.”

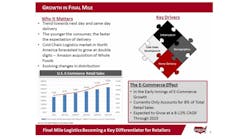

The addition of the Supreme truck body business in the third quarter of 2017 was “a key accomplishment” as it adds immediate revenue and profit opportunity and also provides “significant diversification” into a high-growth segment driven by e-commerce, Giromini continued.

Additionally, the “significant turnaround” in demand in the Wabash platform and tank trailer businesses has led to the strongest backlog in more than two years in those segments.

Those market factors combined with the impact of the new Tax Cuts and Jobs Act of 2017, and the effects of cost and productivity improvement initiatives “create a great recipe for success,” Giromini said.

Indeed, the new federal tax plan means a net rate reduction of 10% for Wabash—and a “meaningful increase” in available funds to support the business, he added.

Specifically, Wabash has been able to increase wages for 2018 “at levels well beyond what we would’ve normally been able to do.” On average, annualized workforce wage increases of more $1,700 were awarded, and that excludes additional opportunities under the now accelerated wage rate increase plan, according to Giromini.

For 2017, Wabash shipped 52,800 new trailers under its Commercial Trailer Products business, down from 58,850 the year before, while the Diversified Products business posted a gain, to 2,250 trailers from 2,100. For 2017, the company reported net income of $111.4 million on net sales of $1.77 billion, compared to net income of $119.4 million on net sales of $1.85 billion for 2016.

In 2018 Wabash expects to ship in the range of 56,000 to 60,000 trailer units, along with 22,000 to 24,000 truck body units, for a revenue projection of $2.05 billion to $2.15 billion.

“While the first quarter will be slow out of the gate due to timing of shipments, we believe that pace will accelerate beginning in the second quarter and throughout the balance of the year,” Giromini said.

In an update on the regulatory outlook, Wabash President and COO Brent Yeagy noted that Phase 2 of the federal commercial vehicle greenhouse gas standards (GHG 2) is still on hold for trailers, pending court review and a Trump administration reevaluation. However, the California Air Resources Board (CARB) is expected to announce soon its own plan which likely will mirror GHG 2 with a “2020 timeframe” for implementation. He also said that the impact of the electronic logging device mandate has been “more significant than anticipated” and will likely spur demand for additional equipment.

In terms of new products, the company said its honeycomb composite panel technology is “near commercialization readiness” and will be displayed on a truck body at the Work Truck Show in March.

The stock market responded favorably to the Wabash report, with share price surging 10% after the Q4 earnings were posted. But some Wall Street watchers cautioned that truck equipment may be heading toward a cyclical peak in 2019.

“Things are looking good in Lafayette, Indiana, with the trailer market strengthening, execution holding up, and conditions improving in other markets such as tank trailers and truck bodies,” said Stifel Transportation Equipment Analyst Michael J. Baudendistel in a note to investors. “We were not surprised to see the company increase delivery guidance, given order activity in November and December which set monthly records (up 16% and 30% y/y, respectively). Still, with the industry building well above replacement demand levels since 2014, we believe there is more risk to the downside than upside beyond 2019.”