With a gross profit margin of 15.5% and operating margin of 8.9%, Wabash National Corporation (NYSE:WNC) achieved the second-strongest second quarter in company history, surpassed only by last year. Wabash also updated its full-year guidance for trailer shipments to 53,000 to 56,000 new trailers.

Net income for the second quarter of 2017 was $22.9 million, or $0.36 per diluted share, compared to second quarter 2016 net income of $35.5 million, or $0.53 per diluted share. Second quarter 2017 non-GAAP adjusted earnings decreased $13.4 million over the prior year period to $23.2 million, or $0.37 per diluted share.

Non-GAAP adjusted earnings for the second quarter of 2017 includes charges related to the early extinguishment of debt in connection with the company’s repurchase of a portion of its outstanding convertible senior notes, one-time executive severance costs and losses on closure of former facilities. Non-GAAP adjusted earnings for the second quarter of 2016 included a non-recurring charge in connection with the Company’s segment realignment.

Net sales for the second quarter of 2017 was $436 million, a decrease of 8% as compared to the second quarter of 2016. Operating income decreased 34% to $38.7 million, due to lower trailer demand, compared to operating income of $58.9 million for the second quarter of 2016.

Operating EBITDA, a non-GAAP measure that excludes the effects of certain recurring and non-recurring items, for the second quarter of 2017 was $49.5 million, a decrease of $23.3 million, or 32%, compared to Operating EBITDA for the prior year period. On a trailing twelve month basis, net sales totaled $1.7 billion, generating Operating EBITDA of $211.8 million, or 12.3% of net sales. The continued solid operating performance is attributable to the strong demand environment and operational improvements within the Commercial Trailer Products segment, as well as the sustained benefits from the company’s growth and diversification strategies.

“While pleased to have delivered another solid quarter overall from a historical perspective, we recognize that we can do even better,” said Dick Giromini, chief executive officer. “The Commercial Trailer Products team successfully achieved targets in cost management and execution, which is reflected in the segment’s continued delivery of strong margins and operating performance. We continue efforts to drive ongoing productivity improvements throughout the enterprise, accelerating actions to optimize the cost structure and performance of the Diversified Products segment while developing new opportunities to grow our top line and margins.

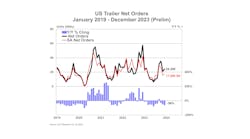

“Backlog totaling $762 million as of June 30, 2017, remains seasonally and historically strong, supporting our long-standing belief that trailer fleet age, regulatory compliance requirements, and customer profitability support a continued favorable demand environment. Based on all these factors, we are updating our full-year guidance for trailer shipments to 53,000 to 56,000 new trailers, and adjusting our earnings guidance range to $1.44 to $1.50 per diluted share.”

Commercial Trailer Products’ net sales for the second quarter were $348 million, a decrease of $34 million, or 9%, as compared to the prior year. Gross profit margin for the second quarter decreased 340 basis points as compared to the prior year period but generally in line with expectations. The year-over-year declines in net sales and gross profit margin were primarily due to lower new trailer shipments and increases in commodity costs. Operating income decreased $15.0 million, or 26%, from the second quarter of last year to $42.2 million, or 12.1% of net sales.

Diversified Products’ net sales for the second quarter decreased $2 million, or 2%, as compared to the prior year period primarily due to reduced pricing within our liquid tank trailer business. Gross profit and gross profit margin as compared to the prior year period decreased $5.7 million and 580 basis points, respectively, as continued softness within the chemical and energy end markets for tank trailers and increases in commodity costs negatively impacted this segment. Operating income for the second quarter of 2017 was $5.1 million, or 5.6% of net sales, a decrease of $5.2 million compared to the same period last year.